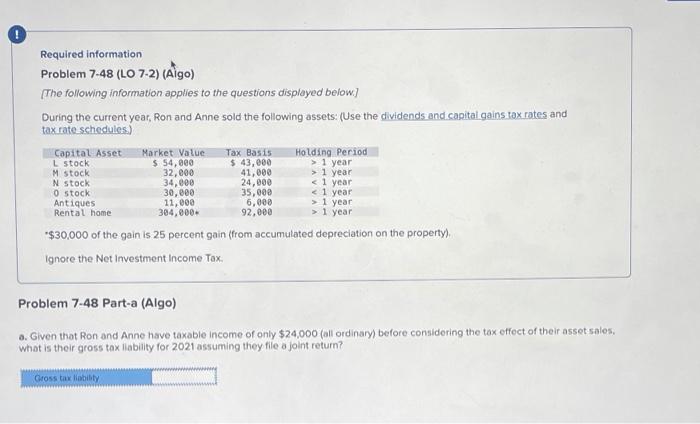

Question: PLEASE HELP O Required information Problem 7-48 (LO 7-2) (Algo) (The following information applies to the questions displayed below.) During the current year, Ron and

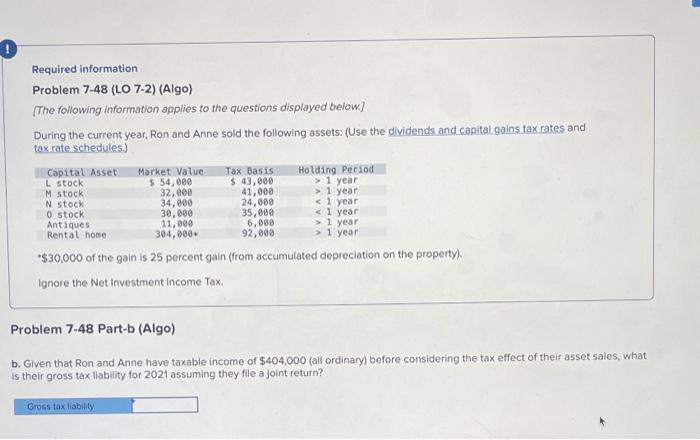

O Required information Problem 7-48 (LO 7-2) (Algo) (The following information applies to the questions displayed below.) During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) Capital Asset Market Value Tax Basis Holding Period L stock $ 54,800 $ 43,000 > 1 year M Stock 32,000 41,000 > 1 year N stock 34,800 24,000 1 year Rental home 304,000 92,000 > 1 year $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property) Ignore the Net Investment Income Tax 11,000 Problem 7-48 Part-a (Algo) 0. Given that Ron and Anne have taxable income of only $24,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2021 assuming they file a joint return? Gross tax liability Required information Problem 7-48 (LO 7-2) (Algo) [The following information applies to the questions displayed below.) During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules) Capital Asset Market value Tax Basis Holding Period L stock $ 54,000 $ 43,000 > 1 year M stock 32,000 41,000 > 1 year N stock 34,000 24,000 1 year Rental home 304,000 92,000 > 1 year *$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax Problem 7-48 Part-b (Algo) b. Given that Ron and Anne have taxable income of $404,000 (all ordinary before considering the tax effect of their asset sales, what is their gross tax liability for 2021 assuming they file a joint return? Gross tax liability O Required information Problem 7-48 (LO 7-2) (Algo) (The following information applies to the questions displayed below.) During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) Capital Asset Market Value Tax Basis Holding Period L stock $ 54,800 $ 43,000 > 1 year M Stock 32,000 41,000 > 1 year N stock 34,800 24,000 1 year Rental home 304,000 92,000 > 1 year $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property) Ignore the Net Investment Income Tax 11,000 Problem 7-48 Part-a (Algo) 0. Given that Ron and Anne have taxable income of only $24,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2021 assuming they file a joint return? Gross tax liability Required information Problem 7-48 (LO 7-2) (Algo) [The following information applies to the questions displayed below.) During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules) Capital Asset Market value Tax Basis Holding Period L stock $ 54,000 $ 43,000 > 1 year M stock 32,000 41,000 > 1 year N stock 34,000 24,000 1 year Rental home 304,000 92,000 > 1 year *$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax Problem 7-48 Part-b (Algo) b. Given that Ron and Anne have taxable income of $404,000 (all ordinary before considering the tax effect of their asset sales, what is their gross tax liability for 2021 assuming they file a joint return? Gross tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts