Question: please help on B The dollar-value LIFO method was adopted by Coronado Corp. on January 1,2020 . Its inventory on that date was $279,100. On

please help on B

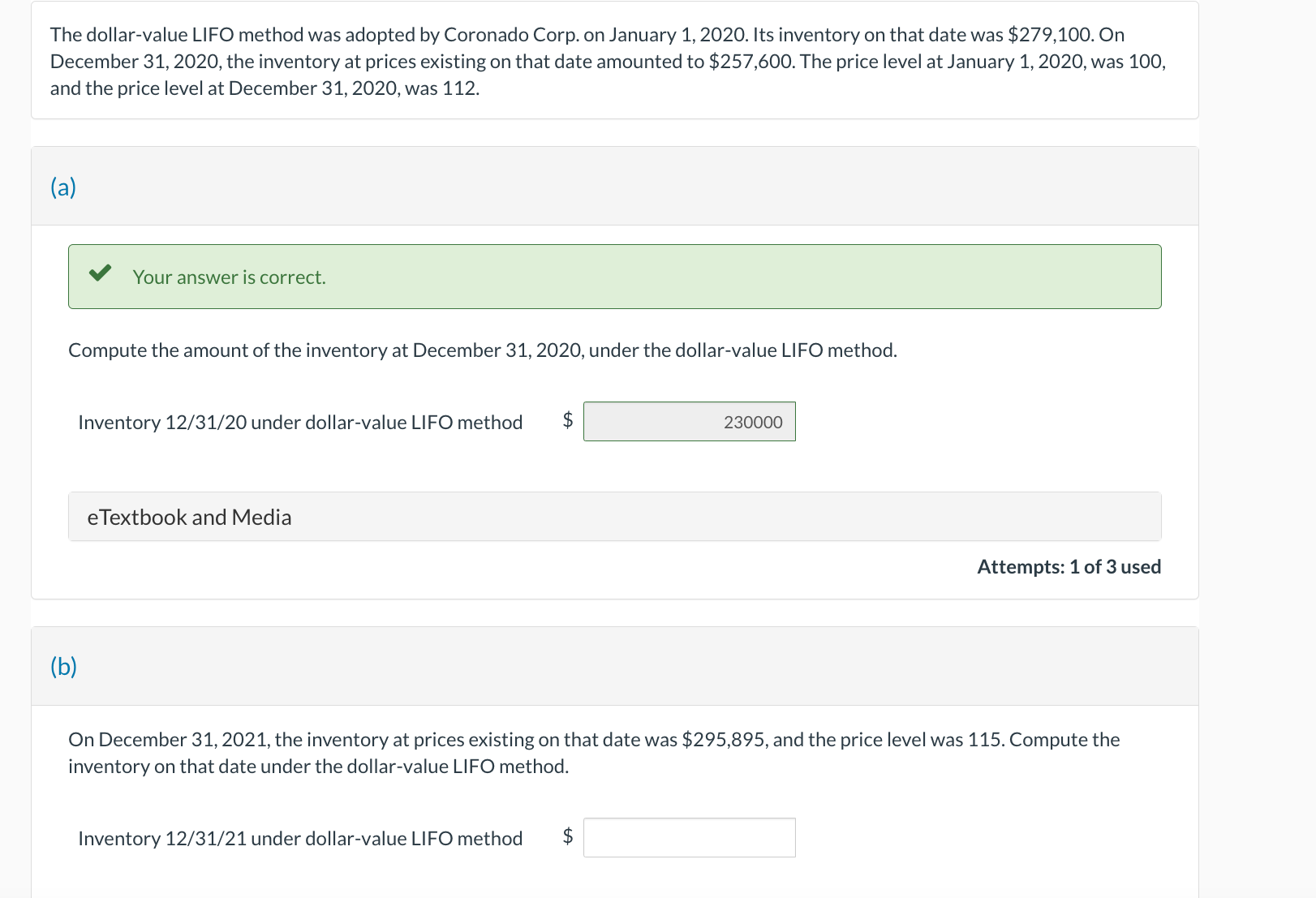

The dollar-value LIFO method was adopted by Coronado Corp. on January 1,2020 . Its inventory on that date was $279,100. On December 31,2020 , the inventory at prices existing on that date amounted to $257,600. The price level at January 1,2020 , was 100 , and the price level at December 31, 2020, was 112. (a) Your answer is correct. Compute the amount of the inventory at December 31, 2020, under the dollar-value LIFO method. Inventory 12/31/20 under dollar-value LIFO method \$ eTextbook and Media Attempts: 1 of 3 used (b) On December 31, 2021, the inventory at prices existing on that date was $295,895, and the price level was 115 . Compute the inventory on that date under the dollar-value LIFO method. Inventory 12/31/21 under dollar-value LIFO method $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts