Question: Please help On July 1,202, a fire destroyed the entire inventory of Circle Clothes, a retail store. The accounting records that were saved showed that

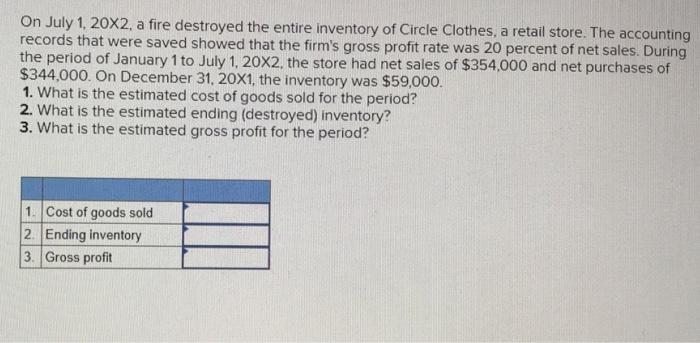

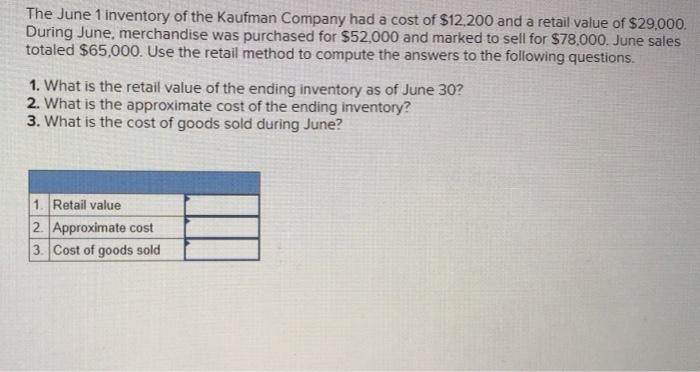

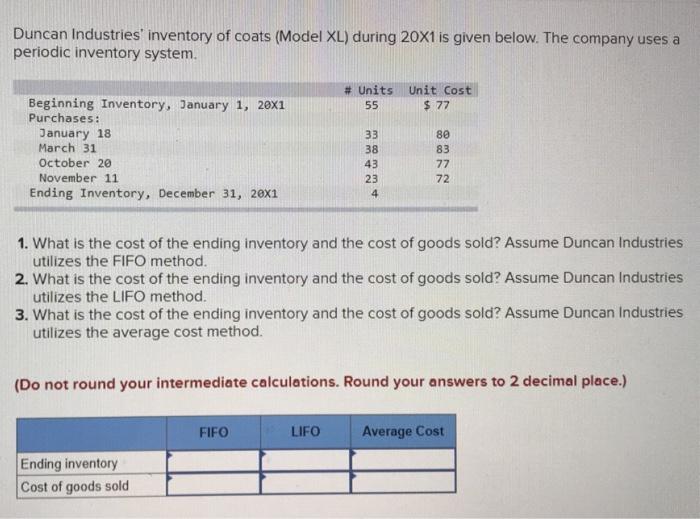

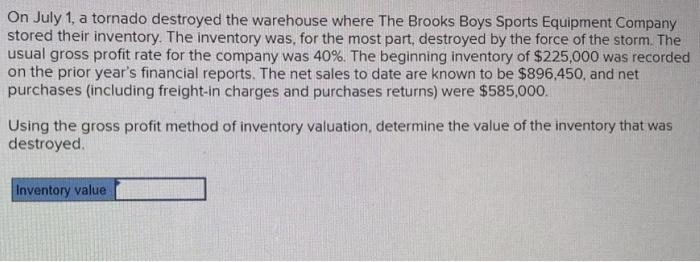

On July 1,202, a fire destroyed the entire inventory of Circle Clothes, a retail store. The accounting records that were saved showed that the firm's gross profit rate was 20 percent of net sales. During the period of January 1 to July 1,202, the store had net sales of $354,000 and net purchases of $344,000. On December 31,201, the inventory was $59,000. 1. What is the estimated cost of goods sold for the period? 2. What is the estimated ending (destroyed) inventory? 3. What is the estimated gross profit for the period? The June 1 inventory of the Kaufman Company had a cost of $12,200 and a retail value of $29,000. During June, merchandise was purchased for $52,000 and marked to sell for $78,000. June sales totaled $65,000. Use the retail method to compute the answers to the following questions. 1. What is the retail value of the ending inventory as of June 30 ? 2. What is the approximate cost of the ending inventory? 3. What is the cost of goods sold during June? Duncan Industries' inventory of coats (Model XL) during 20X1 is given below. The company uses a periodic inventory system. 1. What is the cost of the ending inventory and the cost of goods sold? Assume Duncan Industries utilizes the FIFO method. 2. What is the cost of the ending inventory and the cost of goods sold? Assume Duncan Industries utilizes the LIFO method. 3. What is the cost of the ending inventory and the cost of goods sold? Assume Duncan Industries utilizes the average cost method. On July 1, a tornado destroyed the warehouse where The Brooks Boys Sports Equipment Company stored their inventory. The inventory was, for the most part, destroyed by the force of the storm. The usual gross profit rate for the company was 40%. The beginning inventory of $225,000 was recorded on the prior year's financial reports. The net sales to date are known to be $896,450, and net purchases (including freight-in charges and purchases returns) were $585,000. Using the gross profit method of inventory valuation, determine the value of the inventory that was destroyed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts