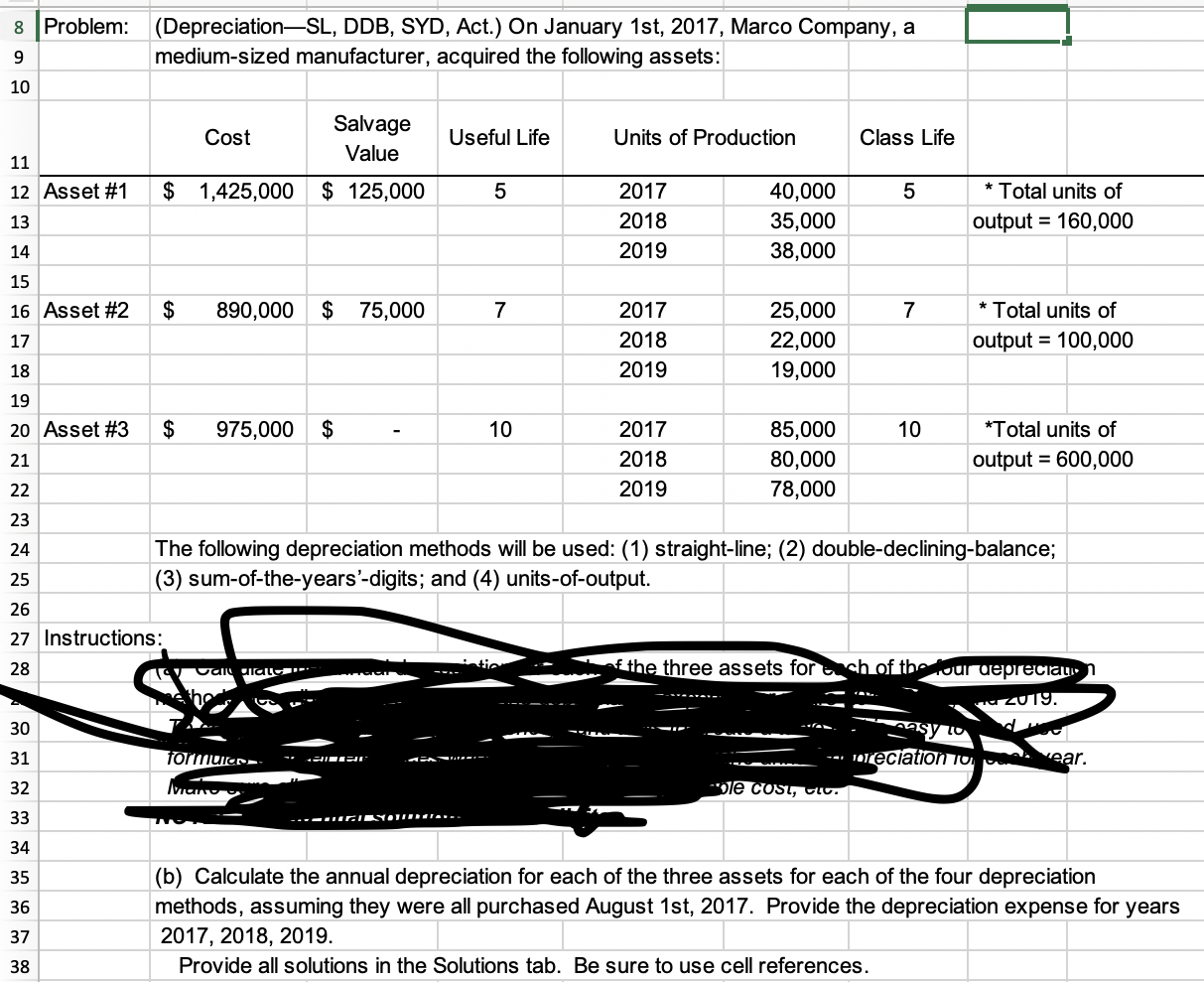

Question: Please help on part b 8 Problem: (DepreciationSL, DDB, SYD, Act.) On January 1st, 2017, Marco Company, a 9 medium-sized manufacturer, acquired the following assets:

Please help on part b

Please help on part b

8 Problem: (DepreciationSL, DDB, SYD, Act.) On January 1st, 2017, Marco Company, a 9 medium-sized manufacturer, acquired the following assets: 10 Cost Salvage Value Useful Life Units of Production Class Life 11 12 Asset #1 $ 1,425,000 $ 125,000 5 5 2017 2018 2019 13 40,000 35,000 38,000 * Total units of output = 160,000 14 15 16 Asset #2 $ 890,000 $ 75,000 7 2017 25,000 7 * Total units of 17 2018 22,000 output = 100,000 18 2019 19,000 19 20 Asset #3 $ 975,000 $ 10 2017 85,000 10 *Total units of 21 2018 80,000 output = 000 22 2019 78,000 23 24 The following depreciation methods will be used: (1) straight-line; (2) double-declining-balance; (3) sum-of-the-years'-digits; and (4) units-of-output. 26 27 Instructions: -f the three assets for ach of the tour depreciau 25 28 vull piate- vuzu19. 30 y lo leciation 10 31 formulier 2. avear. 32 le cost, I. 33 -.-P.LOISONIIIa... 34 35 36 (b) Calculate the annual depreciation for each of the three assets for each of the four depreciation methods, assuming they were all purchased August 1st, 2017. Provide the depreciation expense for years 2017, 2018, 2019. Provide all solutions in the Solutions tab. Be sure to use cell references. 37 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts