Question: please help on problems 3 and 4. thank you Exercise 3 Matthew Leoni is a graduate of lowa State University (BS Electronical Engineering. 1994; MS

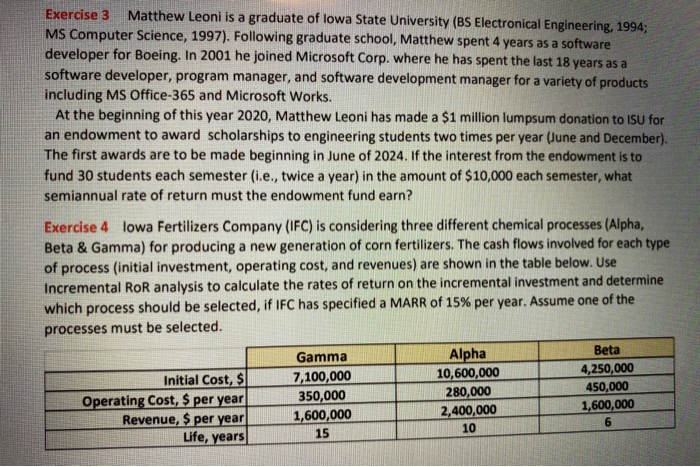

Exercise 3 Matthew Leoni is a graduate of lowa State University (BS Electronical Engineering. 1994; MS Computer Science, 1997). Following graduate school, Matthew spent 4 years as a software developer for Boeing. In 2001 he joined Microsoft Corp. where he has spent the last 18 years as a software developer, program manager, and software development manager for a variety of products including MS Office 365 and Microsoft Works. At the beginning of this year 2020, Matthew Leoni has made a $1 million lumpsum donation to ISU for an endowment to award scholarships to engineering students two times per year (June and December). The first awards are to be made beginning in June of 2024. If the interest from the endowment is to fund 30 students each semester (i.e., twice a year) in the amount of $10,000 each semester, what semiannual rate of return must the endowment fund earn? Exercise 4 lowa Fertilizers Company (IFC) is considering three different chemical processes (Alpha, Beta & Gamma) for producing a new generation of corn fertilizers. The cash flows involved for each type of process (initial investment, operating cost, and revenues) are shown in the table below. Use Incremental RoR analysis to calculate the rates of return on the incremental investment and determine which process should be selected, if IFC has specified a MARR of 15% per year. Assume one of the processes must be selected. Gamma Alpha Beta 7,100,000 Initial Cost, SL 10,600,000 4,250,000 Operating cost, $ per year 350,000 450,000 280,000 1,600,000 Revenue, $ per year 2,400,000 1,600,000 10 15 Life, years Exercise 3 Matthew Leoni is a graduate of lowa State University (BS Electronical Engineering. 1994; MS Computer Science, 1997). Following graduate school, Matthew spent 4 years as a software developer for Boeing. In 2001 he joined Microsoft Corp. where he has spent the last 18 years as a software developer, program manager, and software development manager for a variety of products including MS Office 365 and Microsoft Works. At the beginning of this year 2020, Matthew Leoni has made a $1 million lumpsum donation to ISU for an endowment to award scholarships to engineering students two times per year (June and December). The first awards are to be made beginning in June of 2024. If the interest from the endowment is to fund 30 students each semester (i.e., twice a year) in the amount of $10,000 each semester, what semiannual rate of return must the endowment fund earn? Exercise 4 lowa Fertilizers Company (IFC) is considering three different chemical processes (Alpha, Beta & Gamma) for producing a new generation of corn fertilizers. The cash flows involved for each type of process (initial investment, operating cost, and revenues) are shown in the table below. Use Incremental RoR analysis to calculate the rates of return on the incremental investment and determine which process should be selected, if IFC has specified a MARR of 15% per year. Assume one of the processes must be selected. Gamma Alpha Beta 7,100,000 Initial Cost, SL 10,600,000 4,250,000 Operating cost, $ per year 350,000 450,000 280,000 1,600,000 Revenue, $ per year 2,400,000 1,600,000 10 15 Life, years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts