Question: please help on section d-2 and d-4, thank you! Colton Enterprises experienced the following events for Year 1, the first year of operation: 1. Acquired

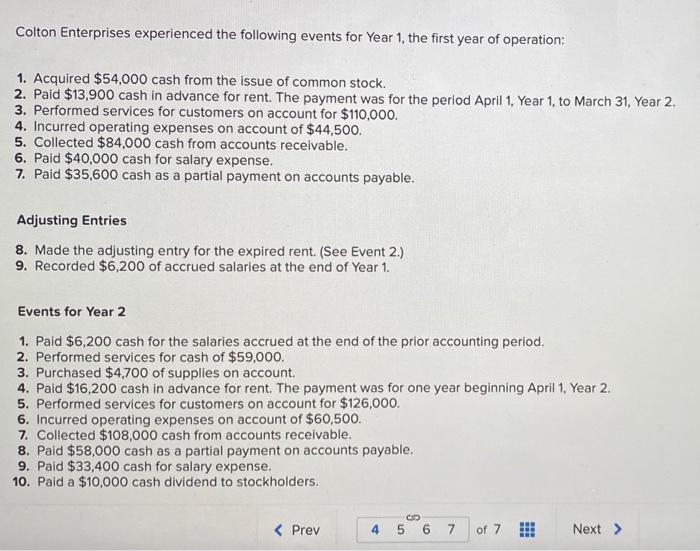

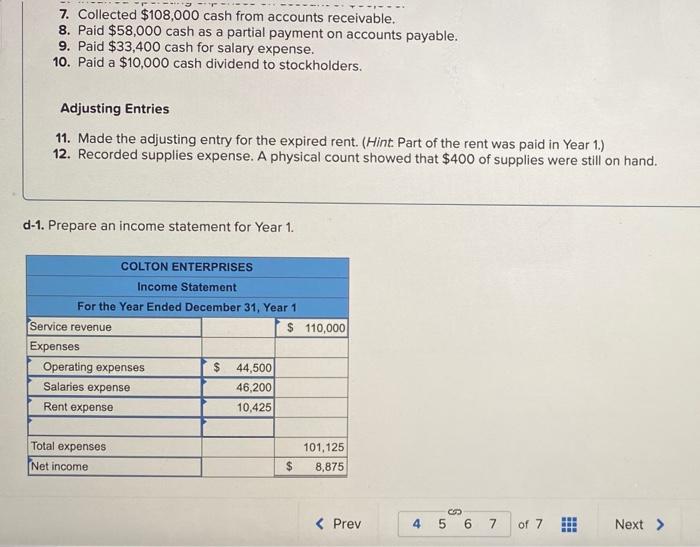

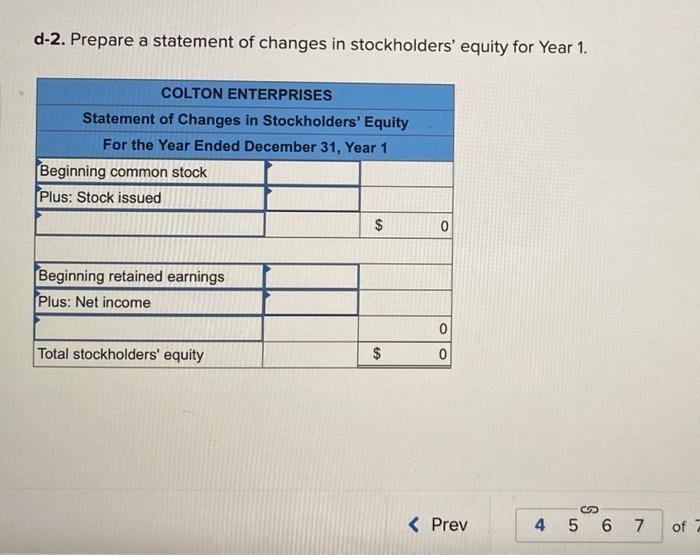

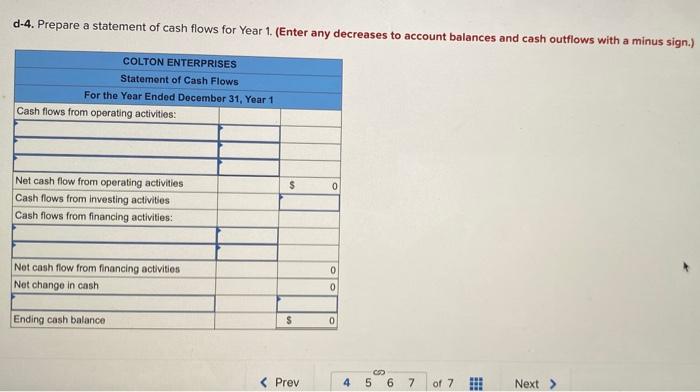

Colton Enterprises experienced the following events for Year 1, the first year of operation: 1. Acquired $54,000 cash from the issue of common stock. 2. Pald $13,900 cash in advance for rent. The payment was for the period April 1, Year 1 to March 31, Year 2. 3. Performed services for customers on account for $110,000. 4. Incurred operating expenses on account of $44,500. 5. Collected $84,000 cash from accounts receivable. 6. Paid $40,000 cash for salary expense. 7. Paid $35,600 cash as a partial payment on accounts payable. Adjusting Entries 8. Made the adjusting entry for the expired rent. (See Event 2.) 9. Recorded $6,200 of accrued salaries at the end of Year 1. Events for Year 2 1. Paid $6,200 cash for the salaries accrued at the end of the prior accounting period. 2. Performed services for cash of $59,000. 3. Purchased $4,700 of supplies on account. 4. Paid $16,200 cash in advance for rent. The payment was for one year beginning April 1. Year 2. 5. Performed services for customers on account for $126,000. 6. Incurred operating expenses on account of $60,500. 7. Collected $108,000 cash from accounts receivable. 8. Paid $58,000 cash as a partial payment on accounts payable. 9. Paid $33,400 cash for salary expense. 10. Paid a $10,000 cash dividend to stockholders. 7. Collected $108,000 cash from accounts receivable. 8. Paid $58,000 cash as a partial payment on accounts payable. 9. Paid $33,400 cash for salary expense. 10. Paid a $10,000 cash dividend to stockholders. Adjusting Entries 11. Made the adjusting entry for the expired rent. (Hint Part of the rent was paid in Year 1.) 12. Recorded supplies expense. A physical count showed that $400 of supplies were still on hand. d-1. Prepare an income statement for Year 1. COLTON ENTERPRISES Income Statement For the Year Ended December 31, Year 1 Service revenue $ 110,000 Expenses Operating expenses $ 44,500 Salaries expense 46,200 Rent expense 10,425 Total expenses 101,125 8,875 Net income $ d-2. Prepare a statement of changes in stockholders' equity for Year 1. COLTON ENTERPRISES Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 Beginning common stock Plus: Stock issued $ 0 Beginning retained earnings Plus: Net income 0 Total stockholders' equity $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts