Question: Please help on the bottom part. Thank You. Exercise 7-11 The following information pertains to Lance Company. 1. 2. 3. 4. Cash balance per bank,

Please help on the bottom part. Thank You.

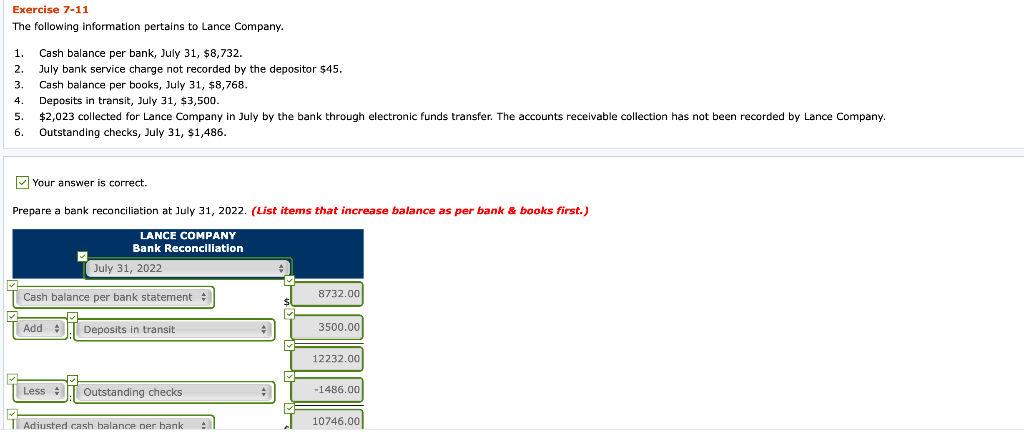

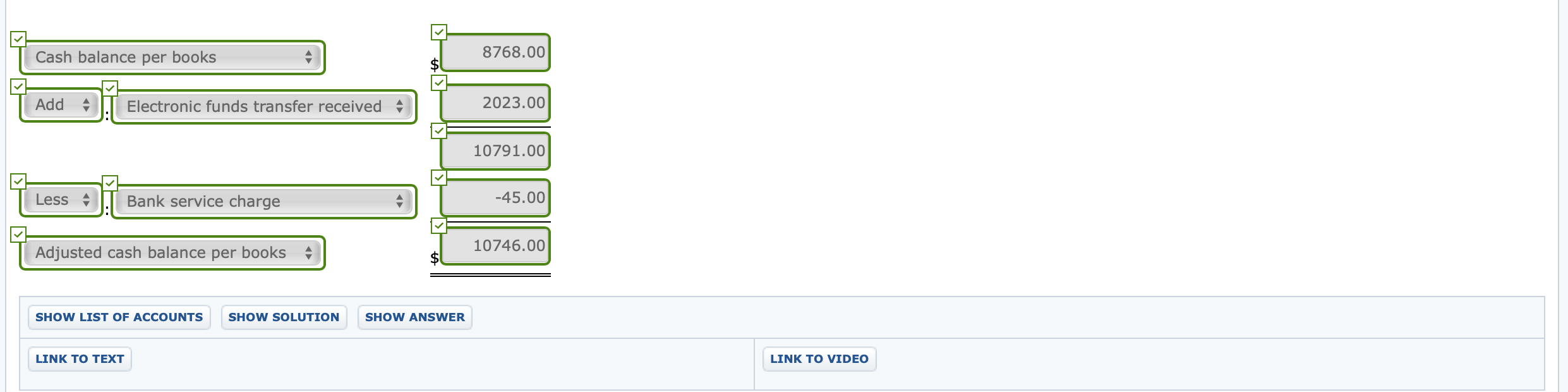

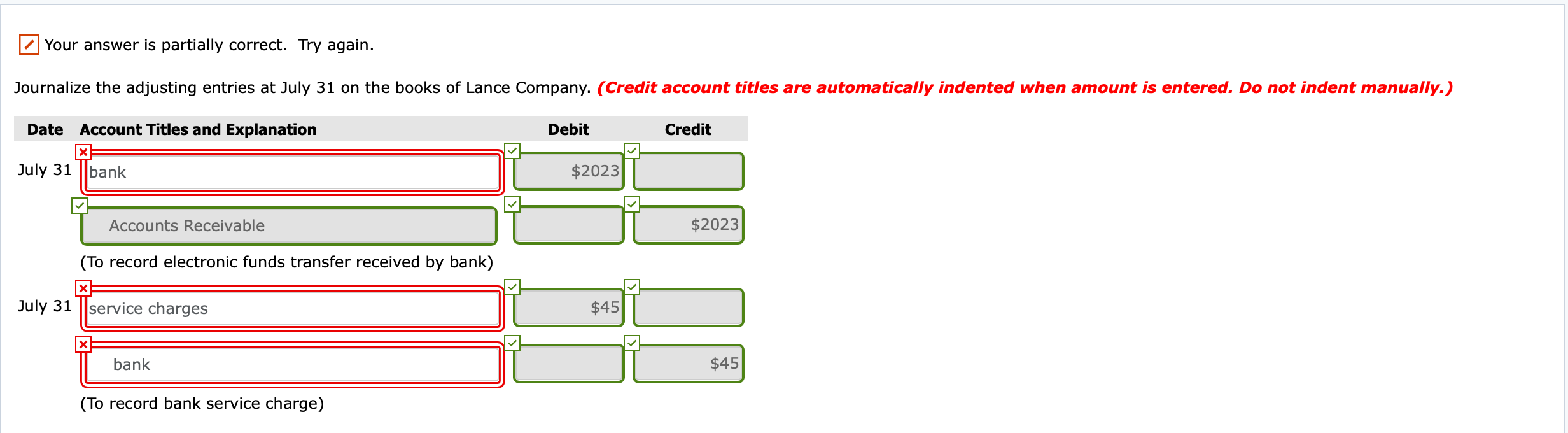

Exercise 7-11 The following information pertains to Lance Company. 1. 2. 3. 4. Cash balance per bank, July 31, $8,732. July bank service charge not recorded by the depositor $45. Cash balance per books, July 31, $8,768. Deposits in transit, July 31, $3,500. $2,023 collected for Lance Company in July by the bank through electronic funds transfer. The accounts receivable collection has not been recorded by Lance Company. Outstanding checks, July 31, $1,486. 5. 6 Your answer is correct. Prepare bank reconciliation at July 31, 2022. (List items that increase balance as per bank & books first.) LANCE COMPANY Bank Reconciliation July 31, 2022 Cash balance per bank statement 8732.00 Add Deposits in transit 3500.000 12232.00 Less Outstanding checks -1486.00 Adiusted cash balance per bank 10746.00 Cash balance per books 8768.00 Add A Electronic funds transfer received 2023.00 10791.00 Less Bank service charge -45.00 10746.00 Adjusted cash balance per books SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO VIDEO Your answer is partially correct. Try again. Journalize the adjusting entries at July 31 on the books of Lance Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit x July 31 bank $2023 Accounts Receivable $2023 (To record electronic funds transfer received by bank) X July 31 || service charges $45 X bank $45 (To record bank service charge)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts