Question: please help on these 5 questions Cullumber Potions, Inc, a pharmaceutical company, bought a machine at a cost of $2 million five years ago that

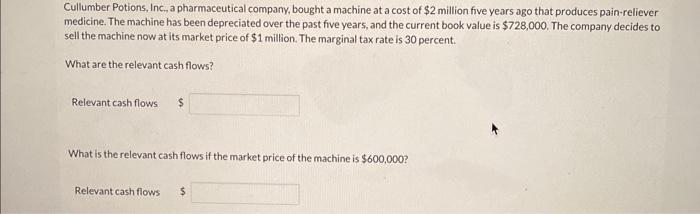

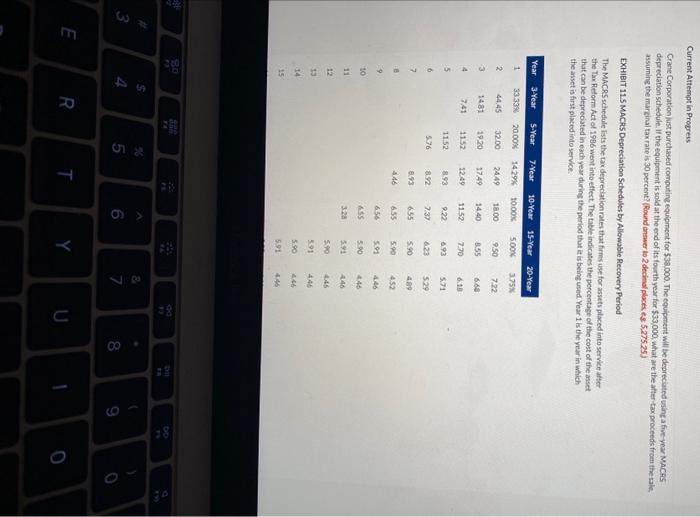

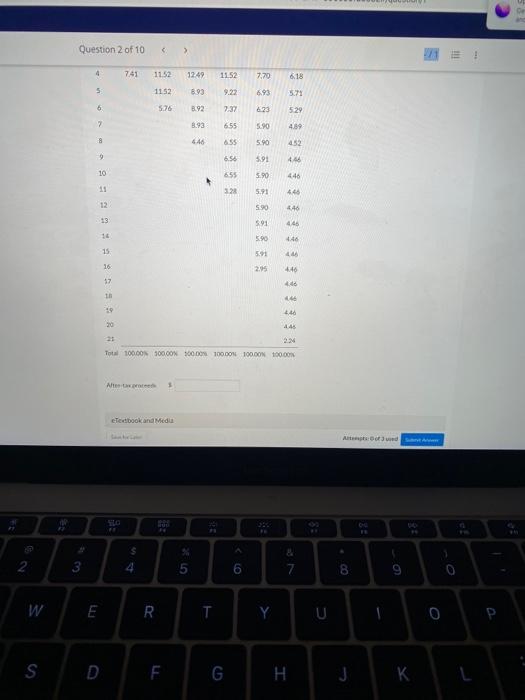

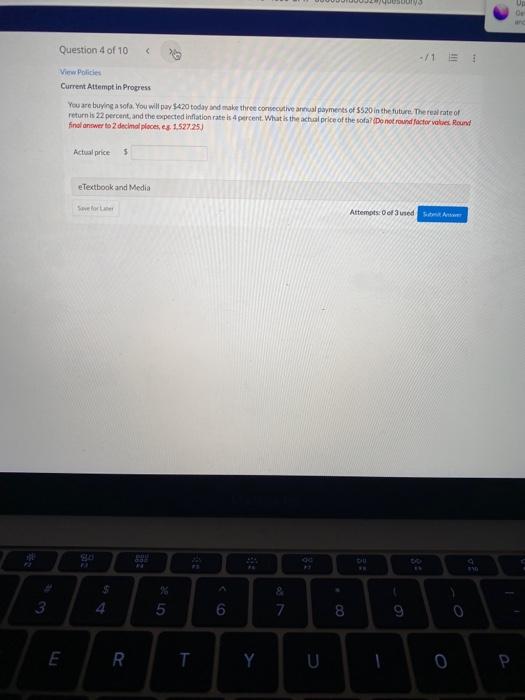

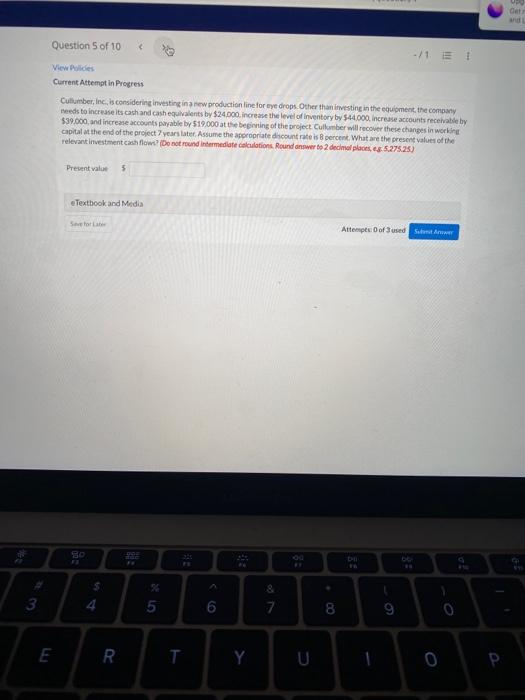

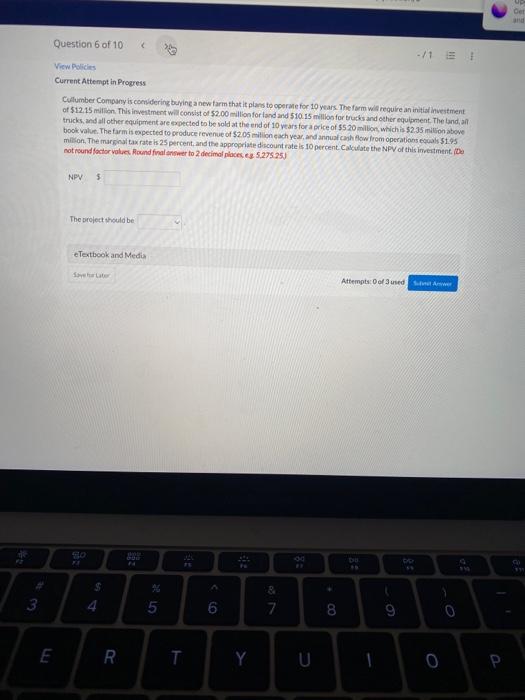

Cullumber Potions, Inc, a pharmaceutical company, bought a machine at a cost of $2 million five years ago that produces pain-reliever medicine. The machine has been depreciated over the past five years, and the current book value is $728,000. The company decides to sell the machine now at its market price of $1 million. The marginal tax rate is 30 percent. What are the relevant cash flows? Relevant cashflows $ What is the relevant cash flows if the market price of the machine is $600,000 ? Relevant cashflows $ Current Attempt in Progress Crane Corporation wist purchased computing equipment for 538.000. The equipment will be depreciated using a five year Mach 15 depreciation sthedule. If the equipment is sold at the end of its fourth year for $33,000 what are the after tax proceeds from the tale. assuming the marsinal tax rate is 30 percent? (Round dnswer to 2 decinol placts es 5.275.25. EXHIBIT 11.5 MACA5 Depreciation Schedules by Allewable Recovery Period The MACRS schedule Fsts the tax depreciation rates that firmes use for assets placed into service alter the Tax fitform Act of 1986 went into etfect. The table indicates the percentage of the cost of the anset that can be deprociated in each year durins the perlod thut it is being used Year 1 is the year in waich the anset is first placed into service. Question 2 of 10 Nhes tavivitett 3 eTentoookana Mitda You are buying a sefa. You will pay\$420 today and twake three conseouthe antival payments of $520 in she future. The real rate of return is 22 percent and the expected inflation rate is 4 percent. What is the achal price of the cofa? po not round foctor vativec Pound find antewer to 2 decimal ploces, es, 1.527.25) Astual price Culamber, Inc, is considerine investing ina rew production line for eye drops. Other than itivesting in the equpment, the company Heeds to increase its cash and cash equivalents by $24.00, increase the level of inventory by $44000 increase accounts receiratbe by $39.000, and increase accounts payable by 519,000 at the beeirning of the project. Culkstber will recoute there chanses in workirit Capital at the end of the project 7 years later, Assume the afperopriate dicount rate is 8 percent. What are the present valuet of thet relevant iffestment cash floes? (bo not round indermedlate celtulotions Round antwer bo 2 decher places, es.5.275.25) Present value -Textbook and Mrsila Cullumber Company is coesidering berine anew farm that it plass to ooerale for 10 years. The form wial require an initiaf invest ment of 512.15 milisen. This inventment will consist of 52.00-illion for land and 510.15 milibo for trucks and cether equipment. The land, an trucks, and all other equipment are sxpected to be sold at the end of 10 vears for a frice of 5520 miliont, which is 52.35 mision above book valut. The farm is mpected to croduce revenue of $2.05 wili on each year, and annuaf canh Pow frem operations equals 51.95 milison. The margif tax rate is 25 percent, and the appropriate diccount rate is 10 percent. Cakdate the NpV of this inreitment. (De. not round foctor valued Round fival stswer to 2 decimal places, 2.5,27525 ) NPe 5 The project thould be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts