Question: PLEASE HELP ON THESE QUESTIONS FROM GLOBAL CSR. Think about what Trevio and Nelson said about the role of government regulation in protecting investors and

PLEASE HELP ON THESE QUESTIONS FROM GLOBAL CSR.

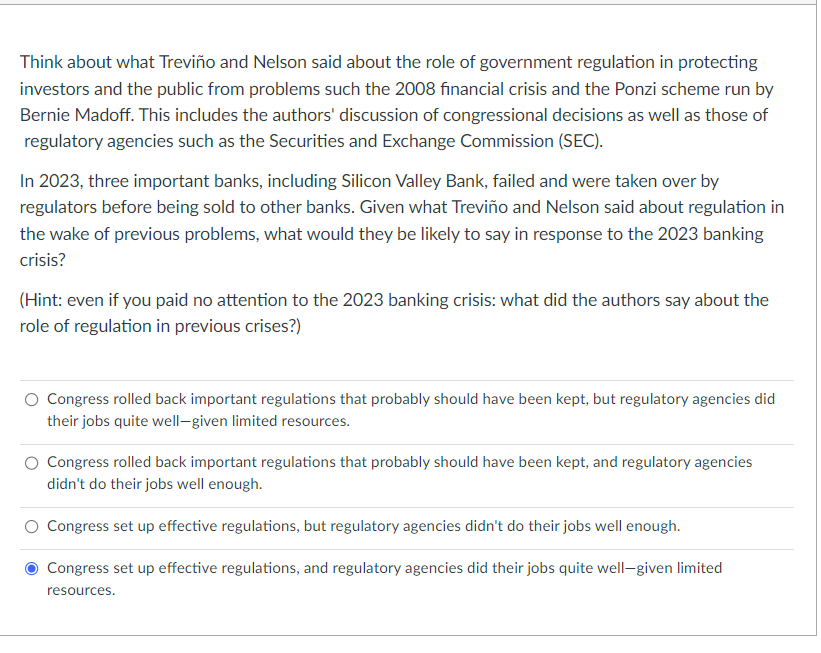

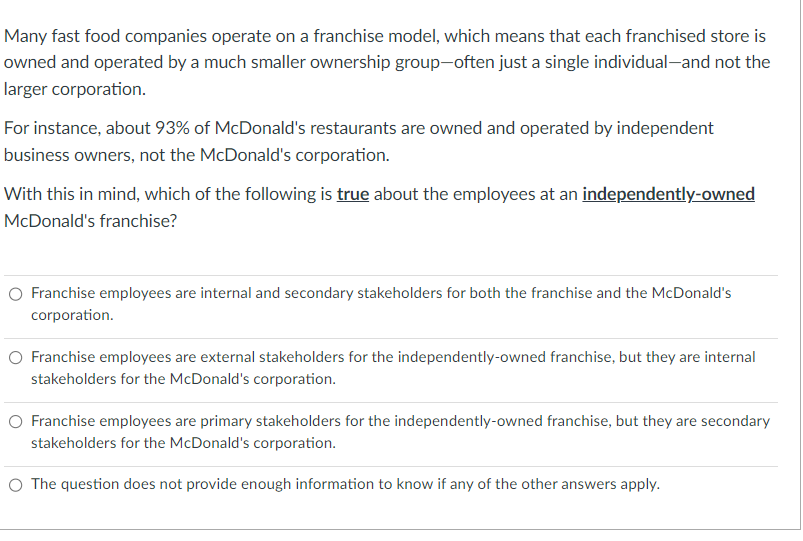

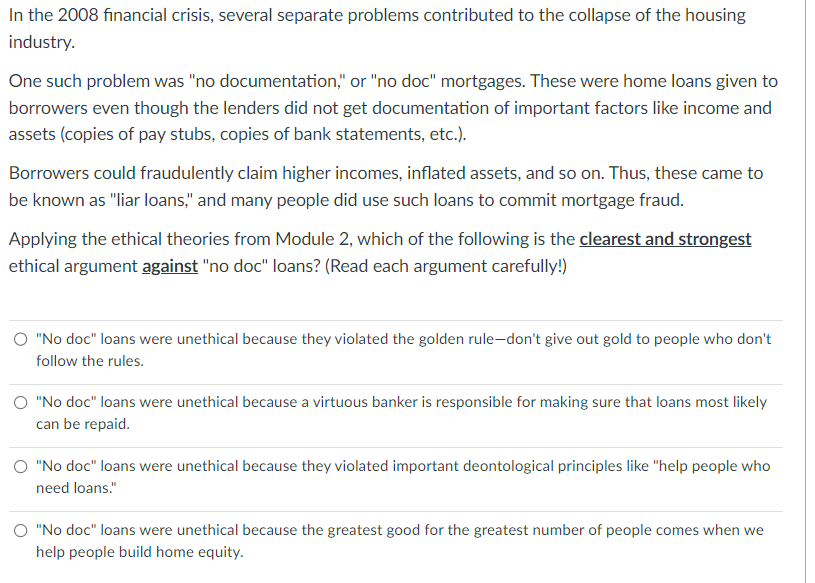

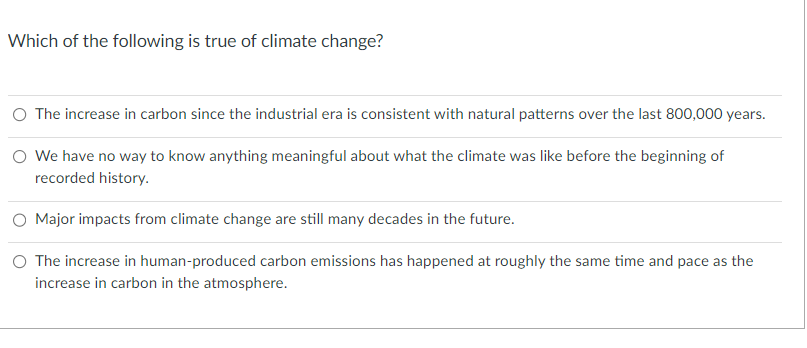

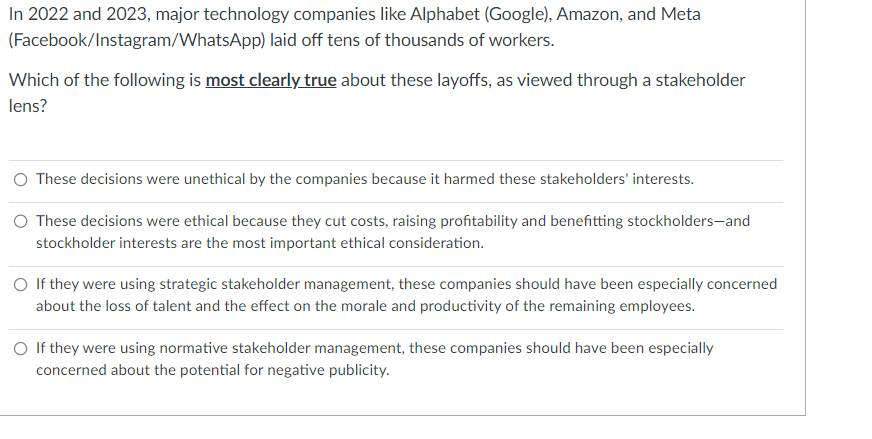

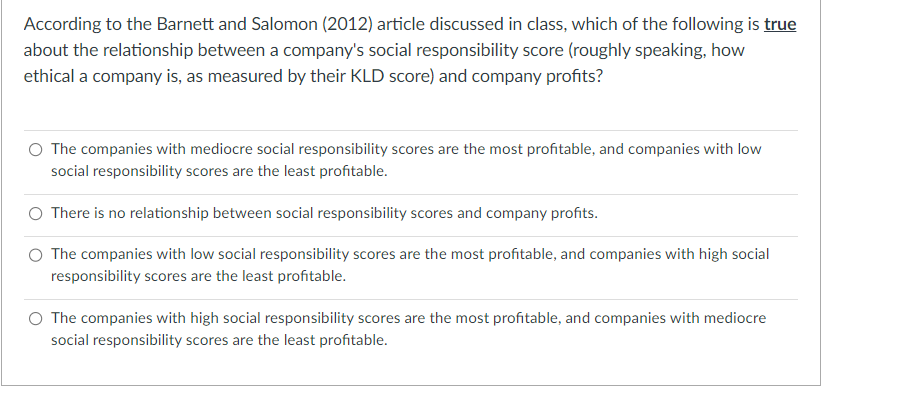

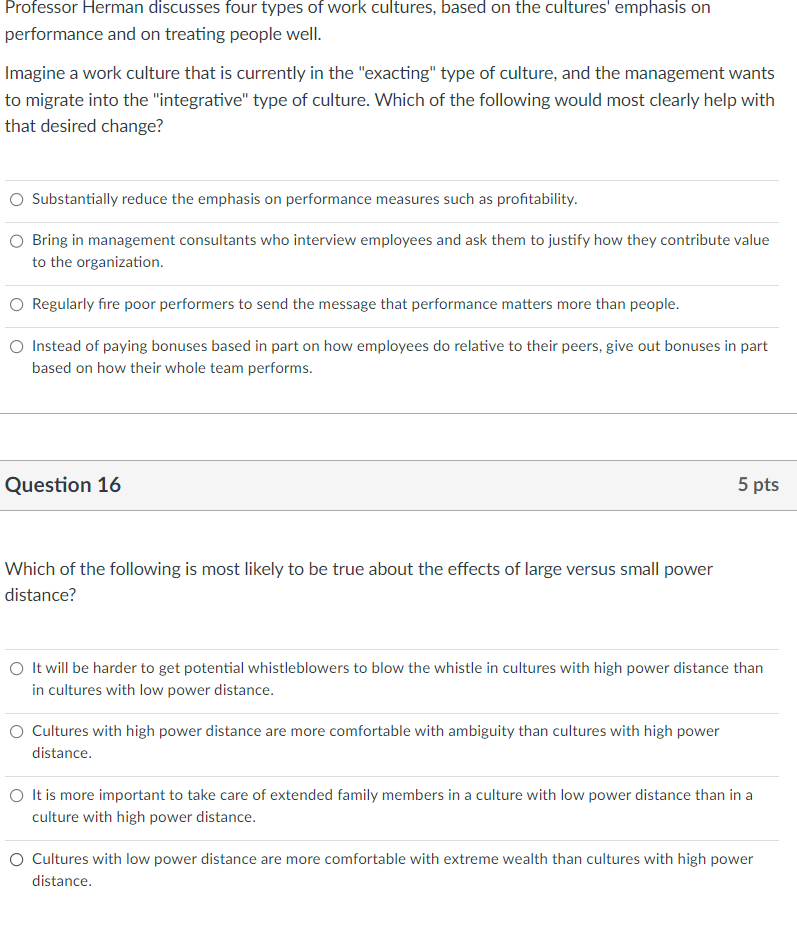

Think about what Trevio and Nelson said about the role of government regulation in protecting investors and the public from problems such the 2008 financial crisis and the Ponzi scheme run by Bernie Madoff. This includes the authors' discussion of congressional decisions as well as those of regulatory agencies such as the Securities and Exchange Commission (SEC). In 2023, three important banks, including Silicon Valley Bank, failed and were taken over by regulators before being sold to other banks. Given what Trevio and Nelson said about regulation in the wake of previous problems, what would they be likely to say in response to the 2023 banking crisis? (Hint: even if you paid no attention to the 2023 banking crisis: what did the authors say about the role of regulation in previous crises?) Congress rolled back important regulations that probably should have been kept, but regulatory agencies did their jobs quite well-given limited resources. Congress rolled back important regulations that probably should have been kept, and regulatory agencies didn't do their jobs well enough. Congress set up effective regulations, but regulatory agencies didn't do their jobs well enough. Congress set up effective regulations, and regulatory agencies did their jobs quite well-given limited resources. Many fast food companies operate on a franchise model, which means that each franchised store is owned and operated by a much smaller ownership group-often just a single individual-and not the larger corporation. For instance, about 93% of McDonald's restaurants are owned and operated by independent business owners, not the McDonald's corporation. With this in mind, which of the following is true about the employees at an independently-owned McDonald's franchise? Franchise employees are internal and secondary stakeholders for both the franchise and the McDonald's corporation. Franchise employees are external stakeholders for the independently-owned franchise, but they are internal stakeholders for the McDonald's corporation. Franchise employees are primary stakeholders for the independently-owned franchise, but they are secondary stakeholders for the McDonald's corporation. The question does not provide enough information to know if any of the other answers apply. In the 2008 financial crisis, several separate problems contributed to the collapse of the housing industry. One such problem was "no documentation," or "no doc" mortgages. These were home loans given to borrowers even though the lenders did not get documentation of important factors like income and assets (copies of pay stubs, copies of bank statements, etc.). Borrowers could fraudulently claim higher incomes, inflated assets, and so on. Thus, these came to be known as "liar loans," and many people did use such loans to commit mortgage fraud. Applying the ethical theories from Module 2, which of the following is the clearest and strongest ethical argument against "no doc" loans? (Read each argument carefully!) "No doc" loans were unethical because they violated the golden rule-don't give out gold to people who don't follow the rules. "No doc" loans were unethical because a virtuous banker is responsible for making sure that loans most likely can be repaid. "No doc" loans were unethical because they violated important deontological principles like "help people who need loans." "No doc" loans were unethical because the greatest good for the greatest number of people comes when we help people build home equity. Which of the following is true of climate change? The increase in carbon since the industrial era is consistent with natural patterns over the last 800,000 years. We have no way to know anything meaningful about what the climate was like before the beginning of recorded history. Major impacts from climate change are still many decades in the future. The increase in human-produced carbon emissions has happened at roughly the same time and pace as the increase in carbon in the atmosphere. In 2022 and 2023, major technology companies like Alphabet (Google), Amazon, and Meta (Facebook/Instagram/WhatsApp) laid off tens of thousands of workers. Which of the following is most clearly true about these layoffs, as viewed through a stakeholder lens? These decisions were unethical by the companies because it harmed these stakeholders' interests. These decisions were ethical because they cut costs, raising profitability and benefitting stockholders-and stockholder interests are the most important ethical consideration. If they were using strategic stakeholder management, these companies should have been especially concerned about the loss of talent and the effect on the morale and productivity of the remaining employees. If they were using normative stakeholder management, these companies should have been especially concerned about the potential for negative publicity. According to the Barnett and Salomon (2012) article discussed in class, which of the following is true about the relationship between a company's social responsibility score (roughly speaking, how ethical a company is, as measured by their KLD score) and company profits? The companies with mediocre social responsibility scores are the most profitable, and companies with low social responsibility scores are the least profitable. There is no relationship between social responsibility scores and company profits. The companies with low social responsibility scores are the most profitable, and companies with high social responsibility scores are the least profitable. The companies with high social responsibility scores are the most profitable, and companies with mediocre social responsibility scores are the least profitable. Professor Herman discusses four types of work cultures, based on the cultures' emphasis on performance and on treating people well. Imagine a work culture that is currently in the "exacting" type of culture, and the management wants to migrate into the "integrative" type of culture. Which of the following would most clearly help with that desired change? Substantially reduce the emphasis on performance measures such as profitability. Bring in management consultants who interview employees and ask them to justify how they contribute value to the organization. Regularly fire poor performers to send the message that performance matters more than people. Instead of paying bonuses based in part on how employees do relative to their peers, give out bonuses in part based on how their whole team performs. Question 16 5 pts Which of the following is most likely to be true about the effects of large versus small power distance? It will be harder to get potential whistleblowers to blow the whistle in cultures with high power distance than in cultures with low power distance. Cultures with high power distance are more comfortable with ambiguity than cultures with high power distance. It is more important to take care of extended family members in a culture with low power distance than in a culture with high power distance. Cultures with low power distance are more comfortable with extreme wealth than cultures with high power distance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts