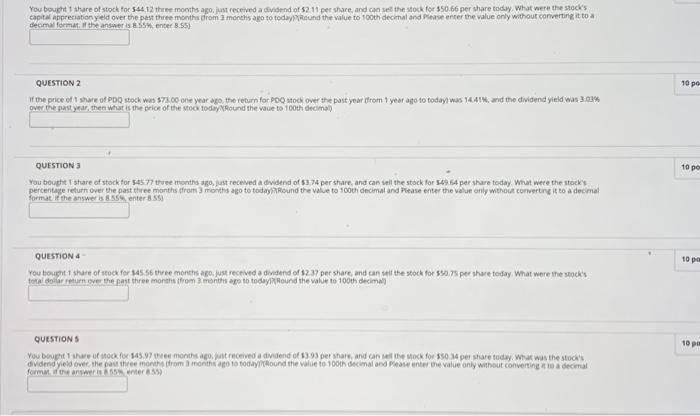

Question: ? Please help on these questions instead You bought 1 thare of stock for 544,12 there month ago, just received a dividend of 32.11 per

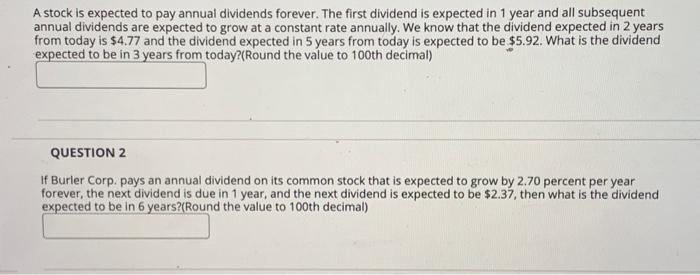

You bought 1 thare of stock for 544,12 there month ago, just received a dividend of 32.11 per share, and can sell the stock for 350.66 per share todyy. What were the stacks. decmal format. If the answer is : 5.5%, enter 8.55 ) QUESTION 2 over the nast vear, then what is the pricr of the stock toden Npound the vaue to 100 th decima? QUESTION 3 You bought 1 share of stock for 54577 thee montha ago, just received a dvidend of 53,74 per share, and can sell the stock for 54964 per share today. What were the stocks. QUESTION 4 - You bought 1 share of atock fer 345 s6 three months aga, just received a dindend of 32.37 per share, and can seif the stock for 350.75 per share today . What were the spock Questions A stock is expected to pay annual dividends forever. The first dividend is expected in 1 year and all subsequent annual dividends are expected to grow at a constant rate annually. We know that the dividend expected in 2 years from today is $4.77 and the dividend expected in 5 years from today is expected to be $5.92. What is the dividend expected to be in 3 vears from today?(Round the value to 100 th decimal) QUESTION 2 If Burler Corp. pays an annual dividend on its common stock that is expected to grow by 2.70 percent per year forever, the next dividend is due in 1 year, and the next dividend is expected to be $2.37, then what is the dividend expected to be in 6 vears?(Round the value to 100 th decimal)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts