Question: please help on these two please! A. 1 B. 10 Bautista Corporation reponted pretax book income of $1,000,000. Iacluded in the computation were favorable temporary

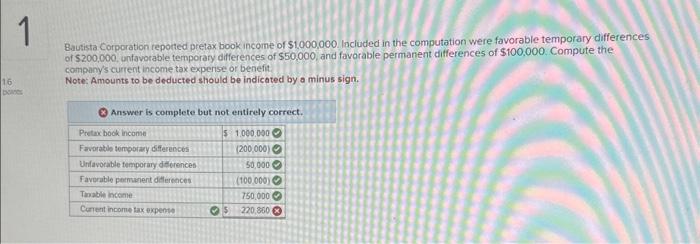

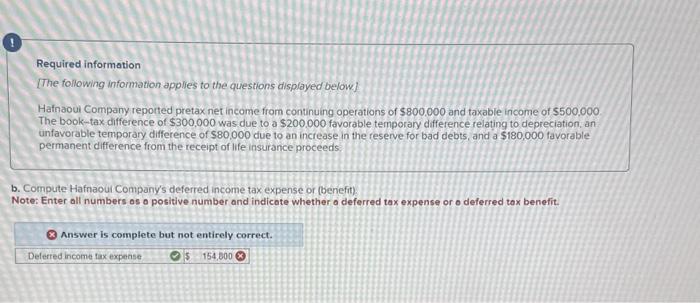

Bautista Corporation reponted pretax book income of $1,000,000. Iacluded in the computation were favorable temporary differences of $200,000, unfavorable temporary differences of $50,000, and favorable permanent differences of $100,000. Compute the company's current income tax expenise or benefit Note: Amounts to be deducted should be indicated by a minus sign. Required information [The following information applies to the questions displayed below] Hafnaoui Company reported pretax net income from continuing operations of $800.000 and taxable income of $500.000 The book-tax difference of $300,000 was due to a $200,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $80,000 due to an increase in the reserve for bad debts, and a $180,000 favorable permanent difference from the receipt of life insurance proceeds b. Compute Hafnaour Company's deferred income tax expense or (benefit). Note: Enter all numbers os o positive number and indicate whether o deferred tax expense or o deferred tox benefit. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts