Question: Please help on this question. It is about the taxable income. 5. Membre Corp. Is a Canadian controlled private corporation that Is not associated with

Please help on this question. It is about the taxable income.

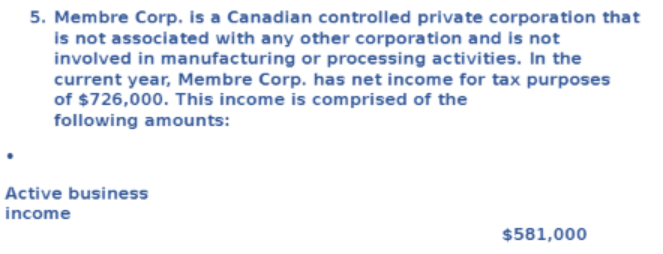

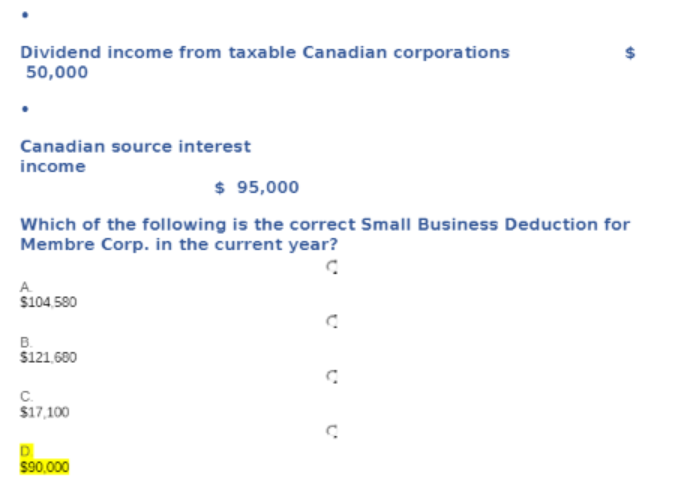

5. Membre Corp. Is a Canadian controlled private corporation that Is not associated with any other corporation and is not involved in manufacturing or processing activities. In the current year, Membre Corp. has net income for tax purposes of $726,000. This income is comprised of the following amounts: Active business income $581,000Dividend income from taxable Canadian corporations 50,000 Canadian source interest income $ 95,000 Which of the following is the correct Small Business Deduction for Membre Corp. in the current year? A $104 580 B $121.680 C. $17,100 D $90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts