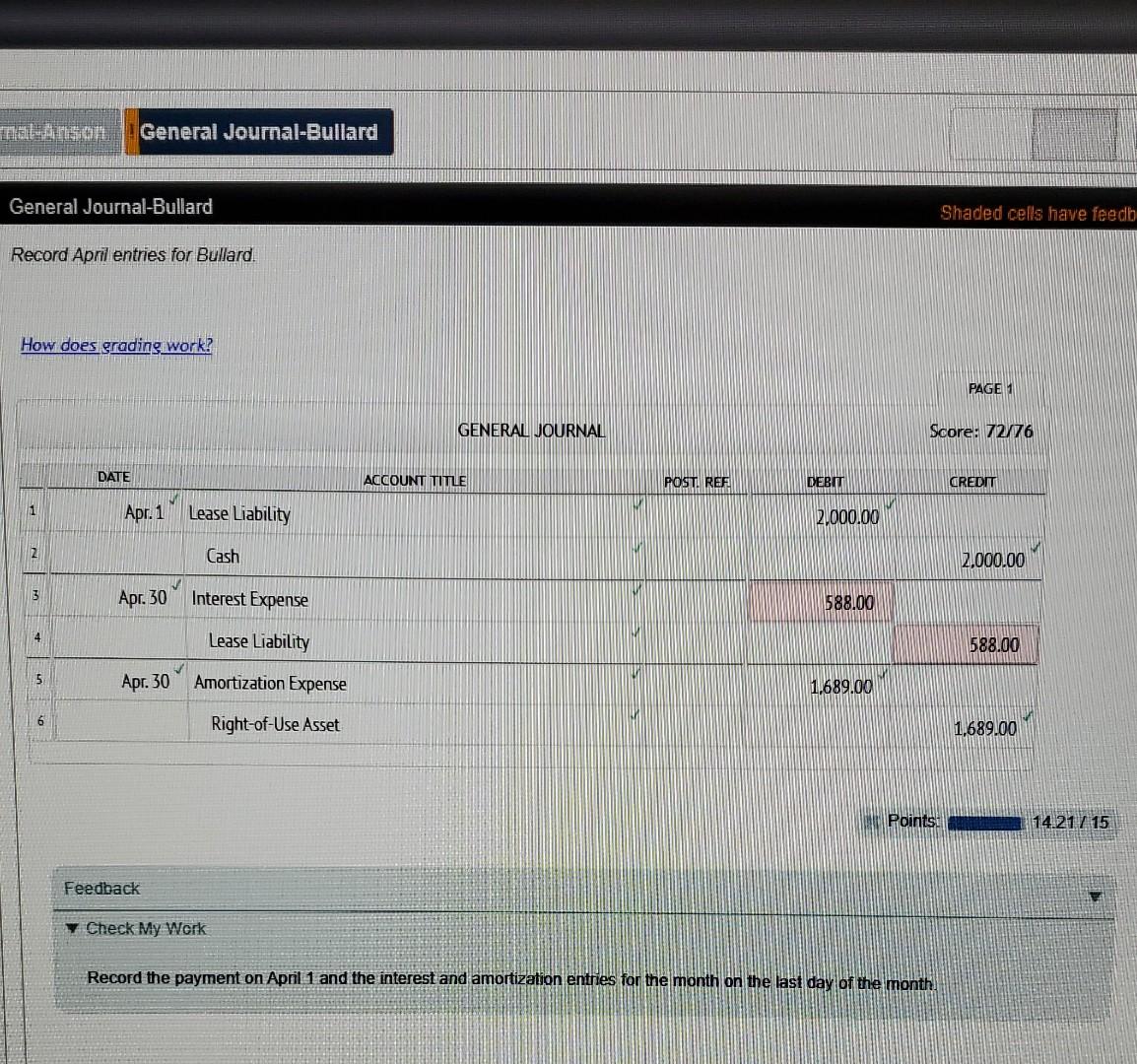

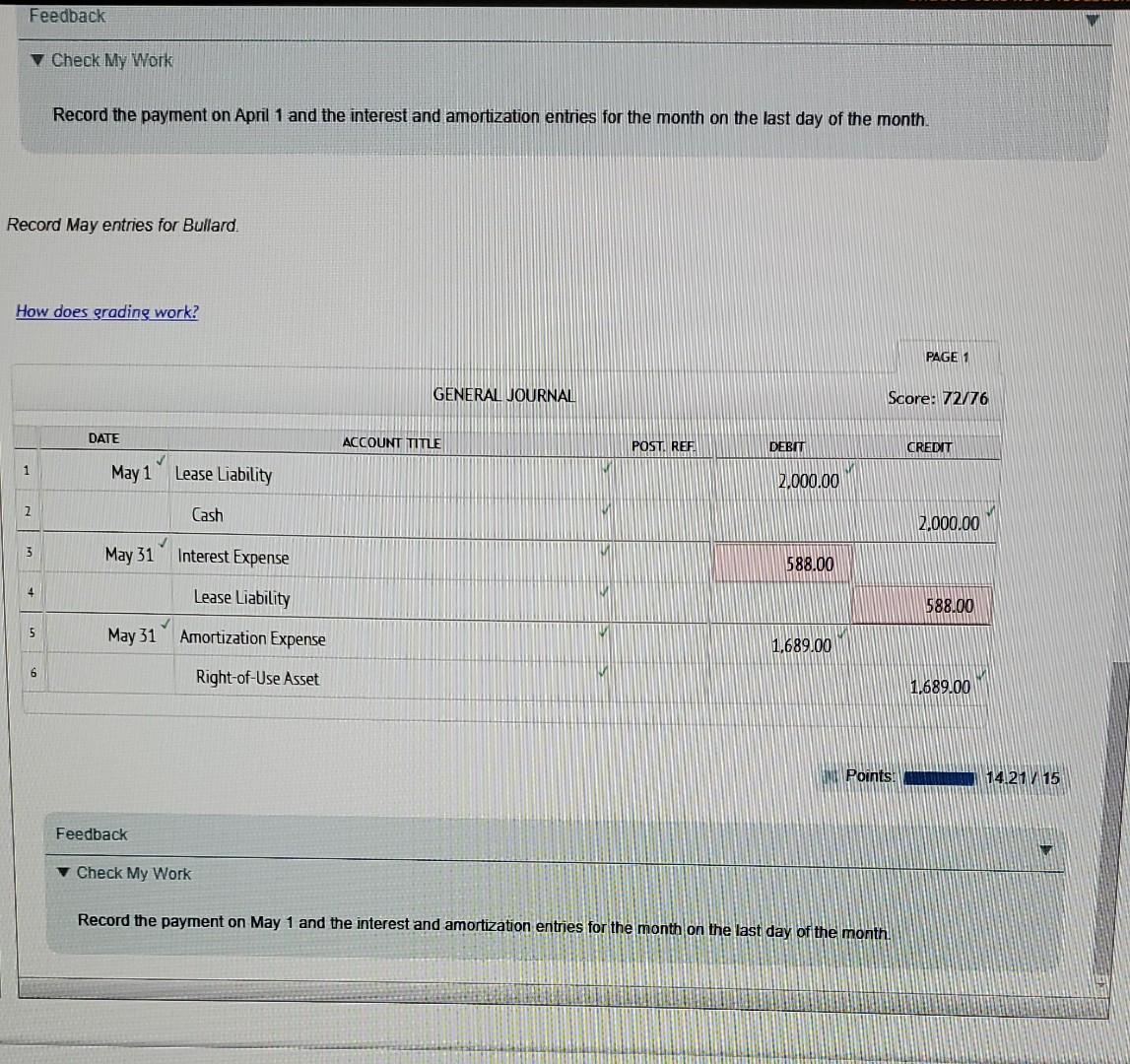

Question: Please help, only need the interest expense and lease liability amounts that are in red. Thank you! Required: 1. Record the lease (including the initial

Please help, only need the interest expense and lease liability amounts that are in red. Thank you!

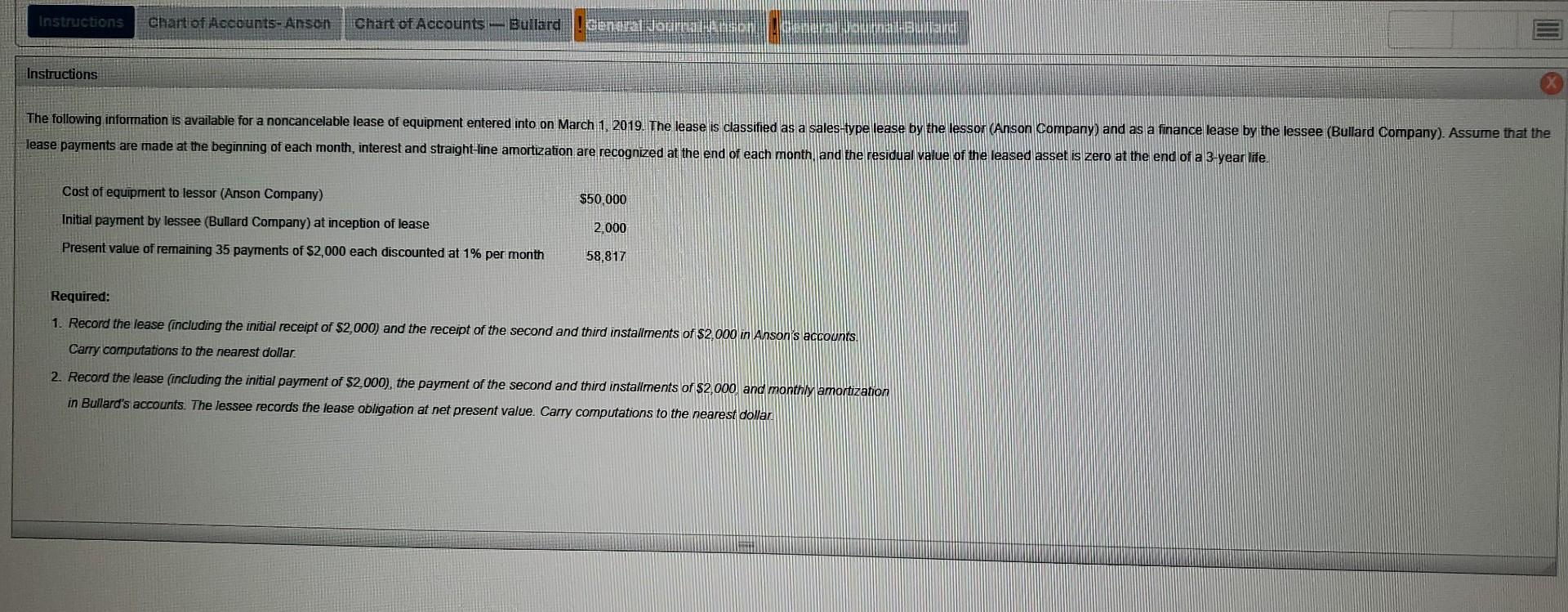

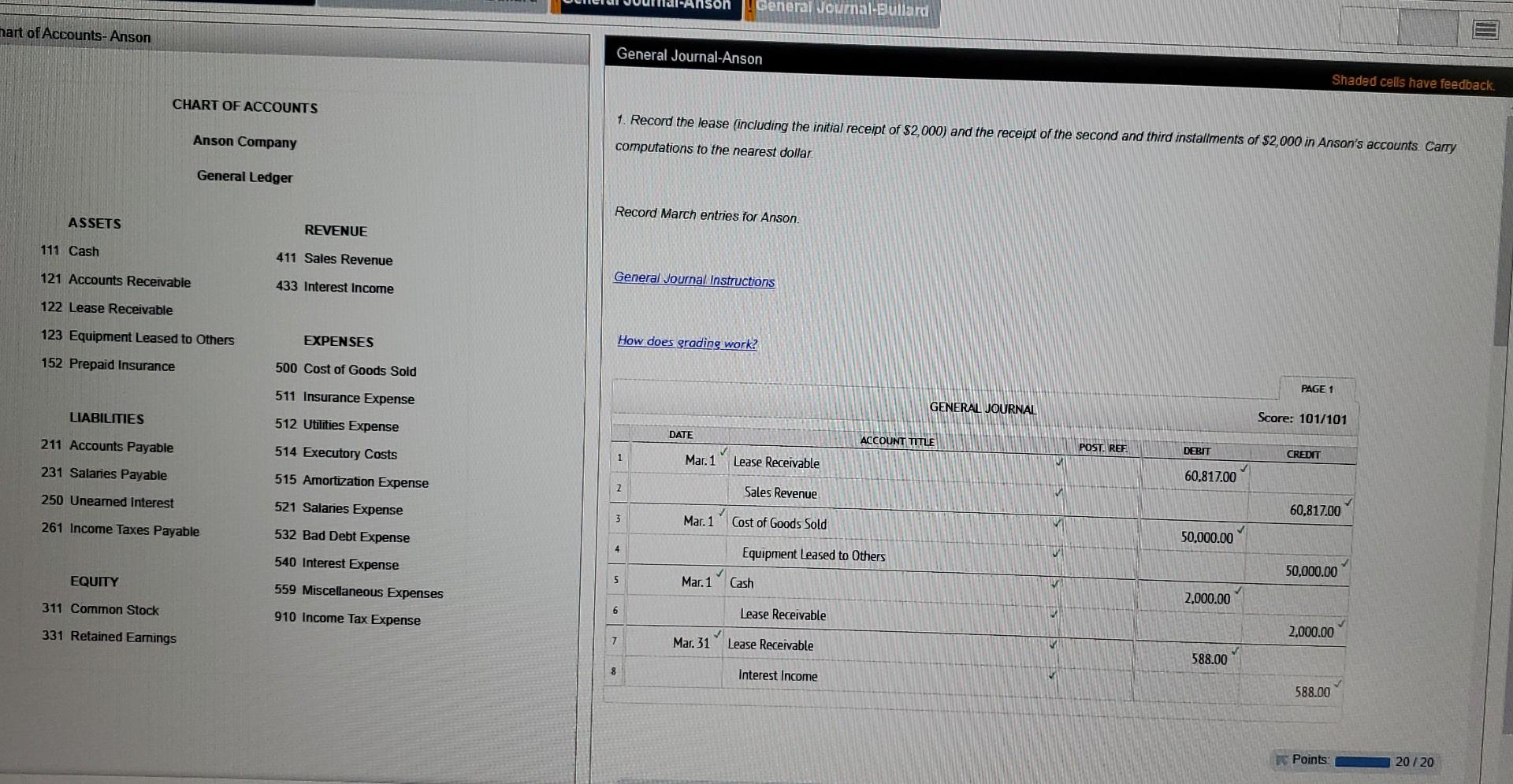

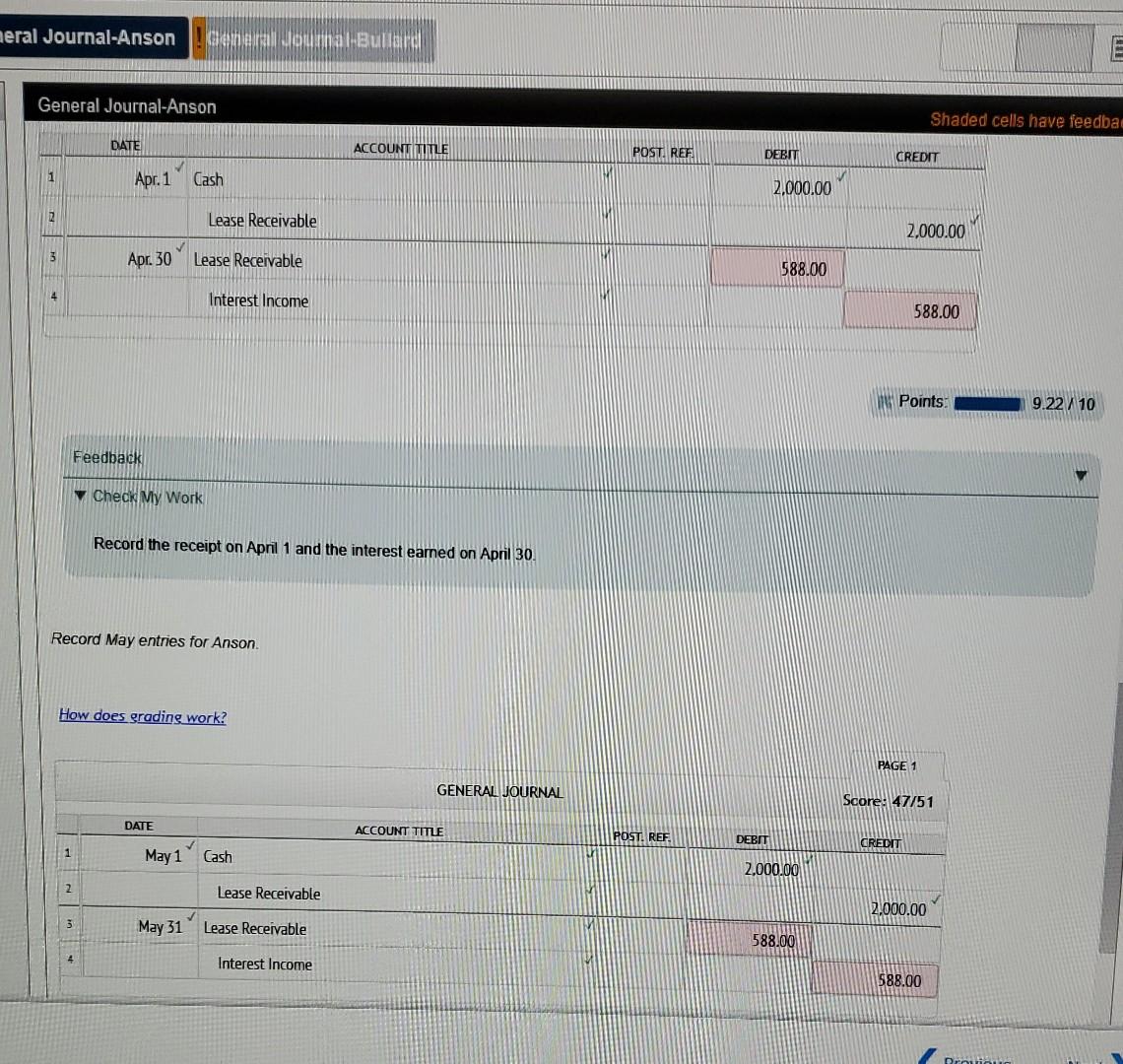

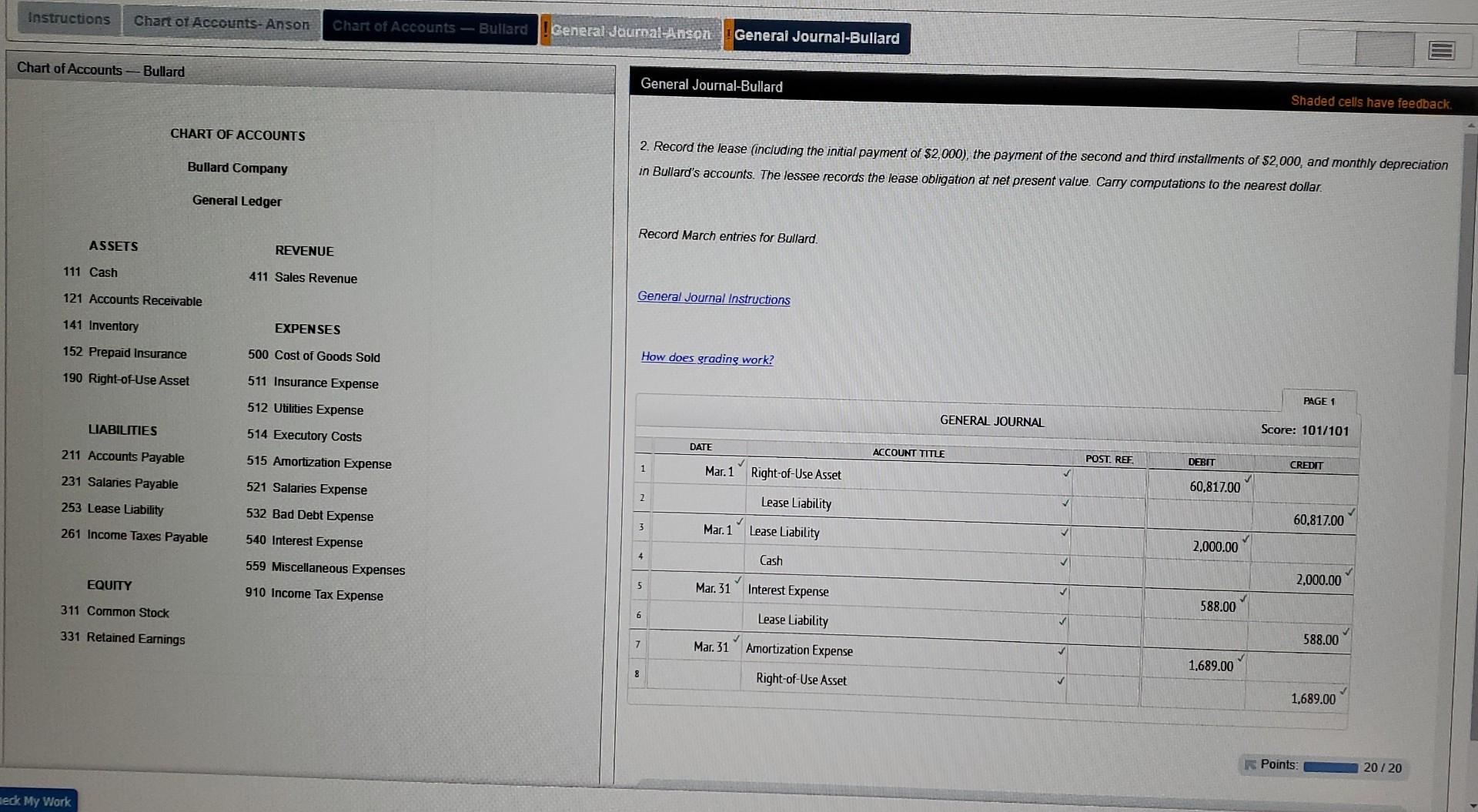

Required: 1. Record the lease (including the initial receipt of $2,000 ) and the receipt of the second and third installments of $2,000 in Ansonis accounts Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of $2,000 ), the payment of the second and third installments of $2,000 and monthly amortization in Bullard's accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar. CHART OF ACCOUNTS Anson Company 1. Record the lease (including the initial receipt of $2,000 ) and the receipt of the second and third installments of $2,000 in Anson's accounts. Cany computations to the nearest dollar. General Ledger Record March entries for Anson. General Journal Instructions How does grading work? Record May entries for Anson. How does grading work? CHART OF ACCOUNTS Bullard Company 2. Record the lease (including the initial payment of $2,000 ), the payment of the second and third installments of $2,000, and monthly depreciation in Bullard's accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar. General Ledger Record March entries for Bullard. General Joumal Instructions How does grading work? Record April entries for Bullard. How does grading work? GENERAL JOURNAL Record the payment on April 1 and the interest and amortization entries for the month on the last day of the month. Record May entries for Bullard. Required: 1. Record the lease (including the initial receipt of $2,000 ) and the receipt of the second and third installments of $2,000 in Ansonis accounts Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of $2,000 ), the payment of the second and third installments of $2,000 and monthly amortization in Bullard's accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar. CHART OF ACCOUNTS Anson Company 1. Record the lease (including the initial receipt of $2,000 ) and the receipt of the second and third installments of $2,000 in Anson's accounts. Cany computations to the nearest dollar. General Ledger Record March entries for Anson. General Journal Instructions How does grading work? Record May entries for Anson. How does grading work? CHART OF ACCOUNTS Bullard Company 2. Record the lease (including the initial payment of $2,000 ), the payment of the second and third installments of $2,000, and monthly depreciation in Bullard's accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar. General Ledger Record March entries for Bullard. General Joumal Instructions How does grading work? Record April entries for Bullard. How does grading work? GENERAL JOURNAL Record the payment on April 1 and the interest and amortization entries for the month on the last day of the month. Record May entries for Bullard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts