Question: Please help out! B 9 20 21 22 Question 2 (4 Marks) When Mr. Happy Golightly, president and chief executive of Miles Inc., first saw

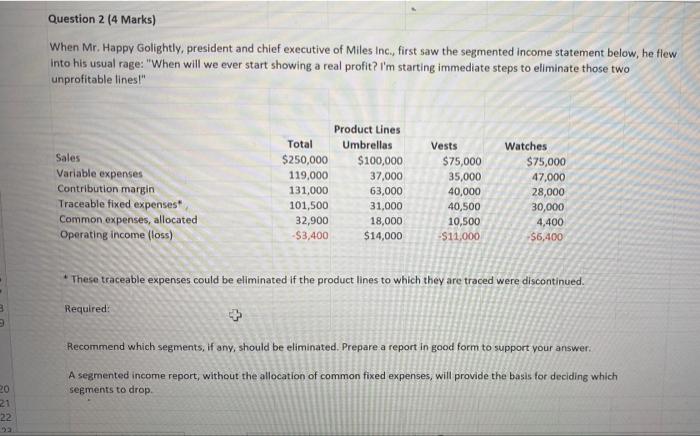

B 9 20 21 22 Question 2 (4 Marks) When Mr. Happy Golightly, president and chief executive of Miles Inc., first saw the segmented income statement below, he flew into his usual rage: "When will we ever start showing a real profit? I'm starting immediate steps to eliminate those two unprofitable lines!" Sales Variable expenses Contribution margin Traceable fixed expenses Common expenses, allocated i Operating income (loss) Total $250,000 119,000 131,000 101,500 32,900 -$3,400 Product Lines Umbrellas $100,000 37,000 63,000 31,000 18,000 $14,000 Vests $75,000 35,000 40,000 40,500 10,500 -$11,000 Watches $75,000 47,000 28,000 30,000 4,400 $6,400 These traceable expenses could be eliminated if the product lines to which they are traced were discontinued. Required: Recommend which segments, if any, should be eliminated. Prepare a report in good form to support your answer. A segmented income report, without the allocation of common fixed expenses, will provide the basis for deciding which segments to drop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts