Question: please help out, i really appreciate it. 10-22 Coleman Technologies Inc. Cost of Capital A. (1) What sources of capital should be included when you

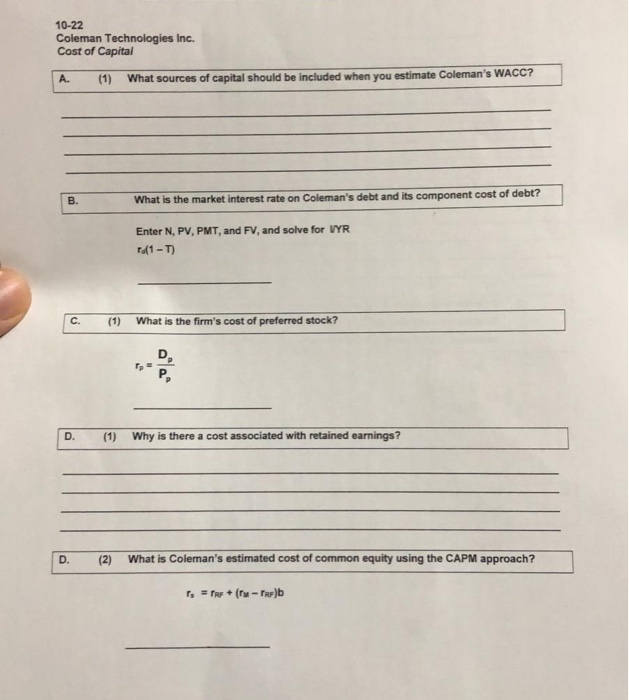

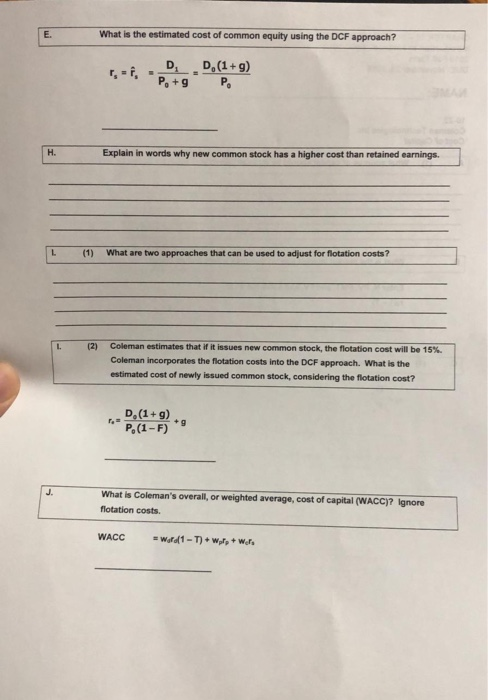

10-22 Coleman Technologies Inc. Cost of Capital A. (1) What sources of capital should be included when you estimate Coleman's WACC? What is the market interest rate on Coleman's debt and its component cost of debt? Enter N, PV, PMT, and FV, and solve for VYR To(1 -T) C. (1) What is the firm's cost of preferred stock? D. (1) Why is there a cost associated with retained earnings? D. (2) What is Coleman's estimated cost of common equity using the CAPM approach? = + (rup) What is the estimated cost of common equity using the DCF approach? 5, D. (1+9) P, +9 Explain in words why new common stock has a higher cost than retained earnings. L (1) What are two approaches that can be used to adjust for flotation costs? L. (2) Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost? D.(1-9) . P.(1-F) What is Coleman's overall, or weighted average cost of capital (WACC)? Ignore flotation costs. WACC - Wordf1-T) + W., + Wire 10-22 Coleman Technologies Inc. Cost of Capital A. (1) What sources of capital should be included when you estimate Coleman's WACC? What is the market interest rate on Coleman's debt and its component cost of debt? Enter N, PV, PMT, and FV, and solve for VYR To(1 -T) C. (1) What is the firm's cost of preferred stock? D. (1) Why is there a cost associated with retained earnings? D. (2) What is Coleman's estimated cost of common equity using the CAPM approach? = + (rup) What is the estimated cost of common equity using the DCF approach? 5, D. (1+9) P, +9 Explain in words why new common stock has a higher cost than retained earnings. L (1) What are two approaches that can be used to adjust for flotation costs? L. (2) Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost? D.(1-9) . P.(1-F) What is Coleman's overall, or weighted average cost of capital (WACC)? Ignore flotation costs. WACC - Wordf1-T) + W., + Wire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts