Question: please help! P6-1 Present Value and Multiple Cash Flows (LO1] Seaborn Co. has identified an investment project with the following cash flows. Year NM+ Cash

![please help! P6-1 Present Value and Multiple Cash Flows (LO1] Seaborn](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eca01f3e215_51866eca01e66abe.jpg)

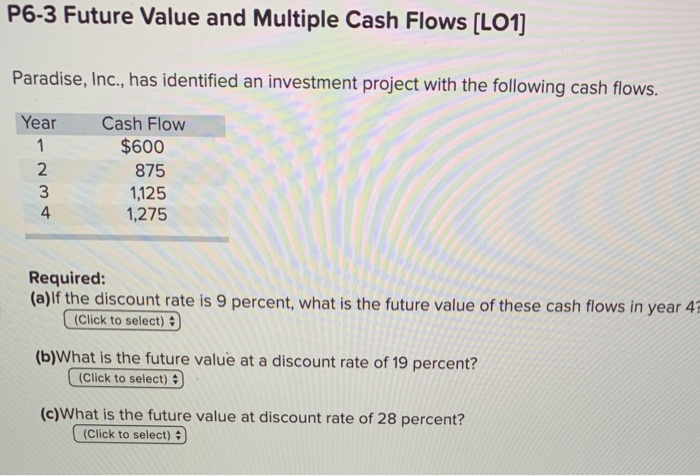

P6-1 Present Value and Multiple Cash Flows (LO1] Seaborn Co. has identified an investment project with the following cash flows. Year NM+ Cash Flow $800 1,010 1,270 1,170 Required: (a) If the discount rate is 11 percent, what is the present value of these cash flows? (Click to select) (b) What is the present value at 17 percent? (Click to select) (c) What is the present value at 28 percent? (Click to select) P6-3 Future Value and Multiple Cash Flows [LO1] Paradise, Inc., has identified an investment project with the following cash flows. Year n Cash Flow $600 875 1,125 1,275 + Required: (a)If the discount rate is 9 percent, what is the future value of these cash flows in year 41 (Click to select) :) (b)What is the future value at a discount rate of 19 percent? (Click to select) (c)What is the future value at discount rate of 28 percent? (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts