Question: please help PART 2: Assume that S is not dissolved and that P acquired all of the outstanding common stock of S for $600,000 cash

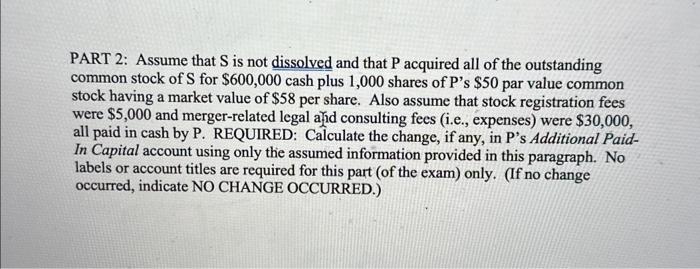

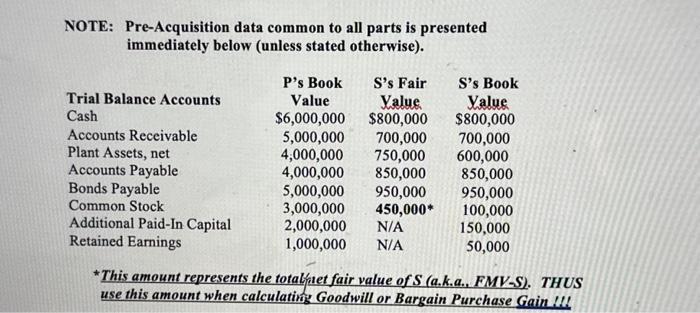

PART 2: Assume that S is not dissolved and that P acquired all of the outstanding common stock of S for $600,000 cash plus 1,000 shares of P's $50 par value common stock having a market value of $58 per share. Also assume that stock registration fees were $5,000 and merger-related legal ahd consulting fees (i.e., expenses) were $30,000, all paid in cash by P. REQUIRED: Calculate the change, if any, in P's Additional PaidIn Capital account using only the assumed information provided in this paragraph. No labels or account titles are required for this part (of the exam) only. (If no change occurred, indicate NO CHANGE OCCURRED.) NOTE: Pre-Acquisition data common to all parts is presented immediately below (unless stated otherwise). *This amount represents the totalfat fair value of S (a.k.a., FMV-S). THUS use this amount when calculating Goodwill or Bargain Purchase Gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts