Question: Please help Part A. The following information is available for Entity Y : Instructions 1. Use the above information to prepare a multiple-step income statement

Please help

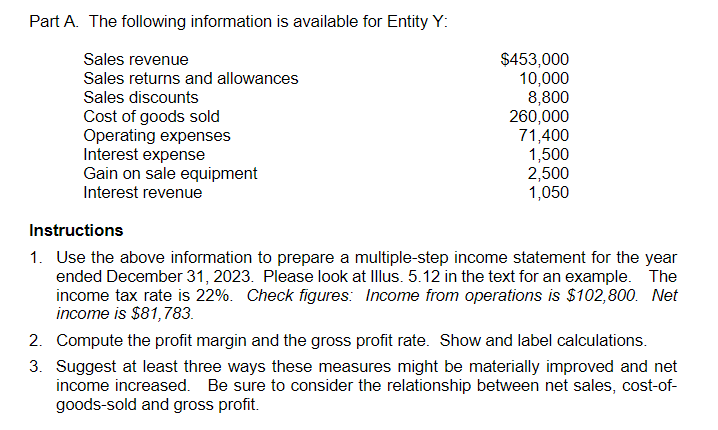

Part A. The following information is available for Entity Y : Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2023. Please look at Illus. 5.12 in the text for an example. The income tax rate is 22%. Check figures: Income from operations is $102,800. Net income is $81,783. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-ofgoods-sold and gross profit. Part A. The following information is available for Entity Y : Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2023. Please look at Illus. 5.12 in the text for an example. The income tax rate is 22%. Check figures: Income from operations is $102,800. Net income is $81,783. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-ofgoods-sold and gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts