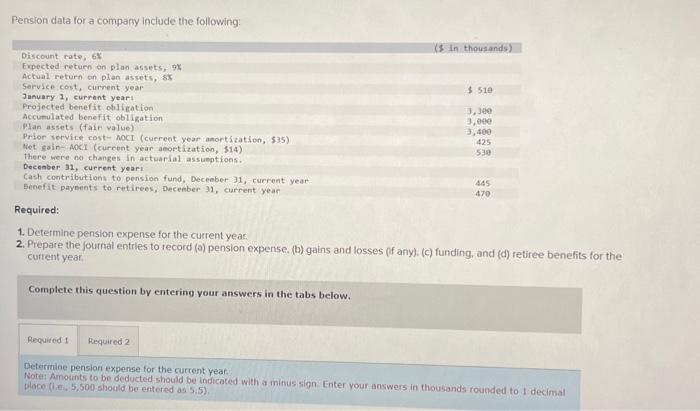

Question: please help Pension data for a company include the following: 1. Determine pension expense for the current yeas 2. Prepare the journal entries to record

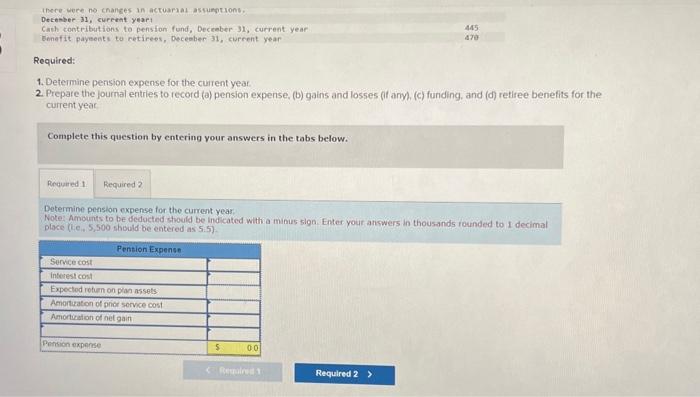

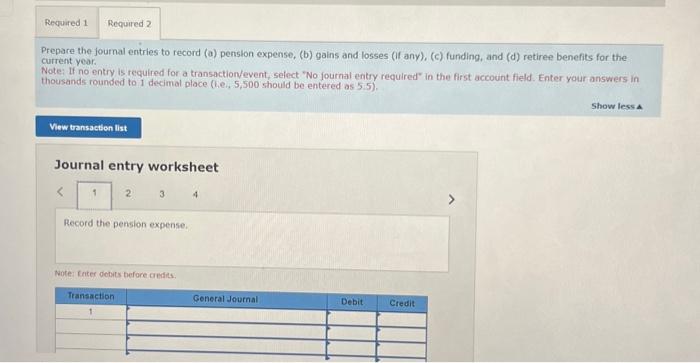

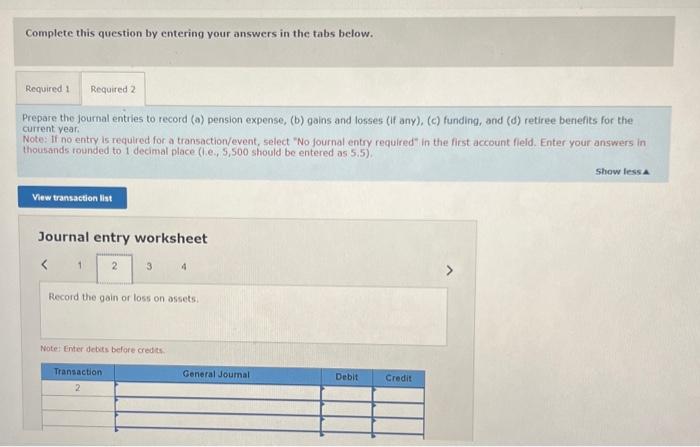

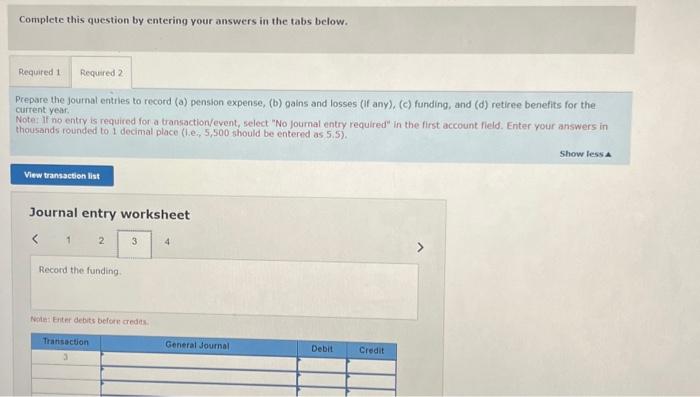

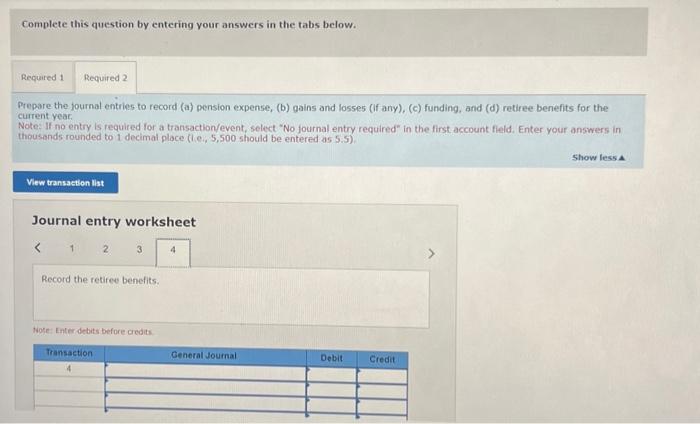

Pension data for a company include the following: 1. Determine pension expense for the current yeas 2. Prepare the journal entries to record (a) pension expense. (b) gains and losses (f any). (c) funding, and (d) retiree benefits for the curtent year. Complete this question by entering your answers in the tabs below. Determine pension expense for the current year Note: Amounts to be oeducted should be indicated with a minus sign Enter your answers in thousiands rounded to 1 decimal place (ie, 5,500 should be entered as 5.5). 1. Determine pension expense for the cuirent year 2. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year Complete this question by entering your answers in the tabs below. Determine pension expense for the current year Note: Amounts to be dedocted stould be indicated with a maus sign. Enter your answers in thousands founded to 1 decimal place (i.e, 5,500 should be entered as 5.5 ). Prepare the journal entries to record (a) penslon expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year. Note: If no entry is required for a transactionvevent, sefect "No fournal entry required" in the first account field. Enter your answers in thousands rounded to 1 decimal place (h.e, 5,500 should be entered as 5.5). Show less A Journal entry worksheet Complete this question by entering your answers in the tabs below. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree beriefits for the current year. Note: If no entry is required for a transaction/event, select "No fournal entry required" in the first account field. Enter your answers in thousands tounded to 1 decimal place ( 1. ., 5,500 should be entered as 5.5). Show less a Journal entry worksheet Complete this question by entering your answers in the tabs below. Prepare the joumal entiles to record (a) pension expense, (b) gains and losses (If any). (c) funding, and (d) retiree benefits for the curtent year. Note: If ho entry is required for a transaction/event, select "No joumal entry required" in the first account field. Enter your answers in thousands rounded to 1 decimal place (i.e, 5,500 should be entered as 5.5 . Show tess 4 Journal entry worksheet 4 Complete this question by entering your answers in the tabs below. Prepare the fournal entries to record (a) pension expense, (b) gains and losses (If any), (c) funding, and (d) retiree beriefits for the current year. Note: If no entry is required for a transaction/event, select "No fournal entry required" in the first account fleld. Enter your answers in thousands rounded to 1 decimal place (1.e, 5,500 should be entered as 5.5). Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts