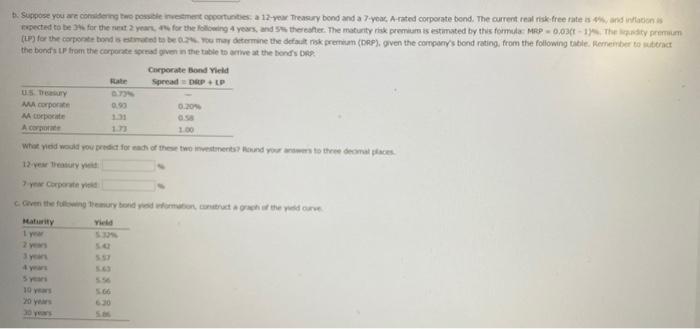

Question: please help. please display formulas. Thank you so much Suppose you are considerablement portes a 12-year Treasury bond and a year, A-rated corporate bond. The

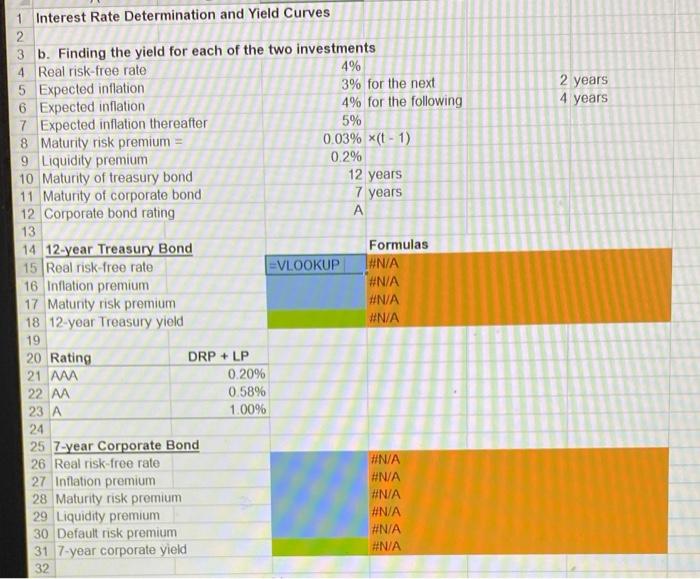

Suppose you are considerablement portes a 12-year Treasury bond and a year, A-rated corporate bond. The current real riske free rates and nations pected to be for the year for the following 4 years, and there. The maturity risk premium is estimated by this formula: MRP -0,031 they promum (LP) for the corporate bond strated to be may determine the default psk premium (ORP), given the company's tond rating from the following table. Norenber to teria the bonds from the corporate in the table to arrive at the bonds Corporate Bond Yield Rate Spread DPP Utry Mi corporate 0.90 0.20 More A 100 What ied would you predict for each of these two investments Hound you to the complaces 12 Treasury y Corporated Con the remury bondyed wormation, contractor the pedicure Yield Maturity Iy 2 Sy 4 5 50 566 6:30 20 20 yrs 2 years 4 years 12 years 1 Interest Rate Determination and Yield Curves 2 3 b. Finding the yield for each of the two investments 4 Real risk-free rate 4% 5 Expected inflation 3% for the next 6 Expected inflation 4% for the following 7 Expected inflation thereafter 5% 8 Maturity risk premium = 0.03% x(t-1) 9 Liquidity premium 0.2% 10 Maturity of treasury bond 11 Maturity of corporate bond 7 years 12 Corporate bond rating 13 14 12-year Treasury Bond Formulas 15 Real risk-free rate VLOOKUP #N/A 16 Inflation premium #N/A 17 Maturity risk premium #N/A 18 12-year Treasury yield #N/A 19 20 Rating DRP + LP 21 AMMA 0.20% 22 AA 0.58% 23 A 1.00% 24 25 7-year Corporate Bond 26 Real risk-free rate #N/A 27 Inflation premium #N/A 28 Maturity risk premium #N/A 29 Liquidity premium #N/A 30 Default risk premium #N/A 31 7-year corporate yield #N/A 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts