Question: Please help! Please explain how you got your solution! I would really appreciate it! Zooming in helps in case you can't see the numbers! amortized

Please help! Please explain how you got your solution! I would really appreciate it! Zooming in helps in case you can't see the numbers!

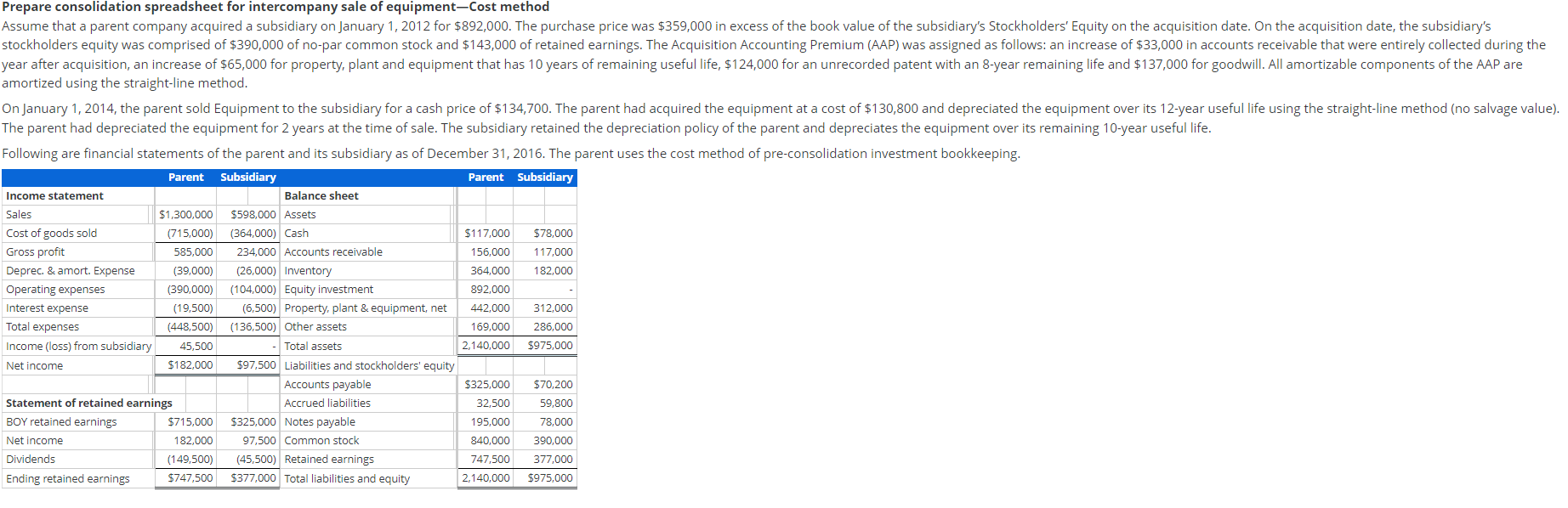

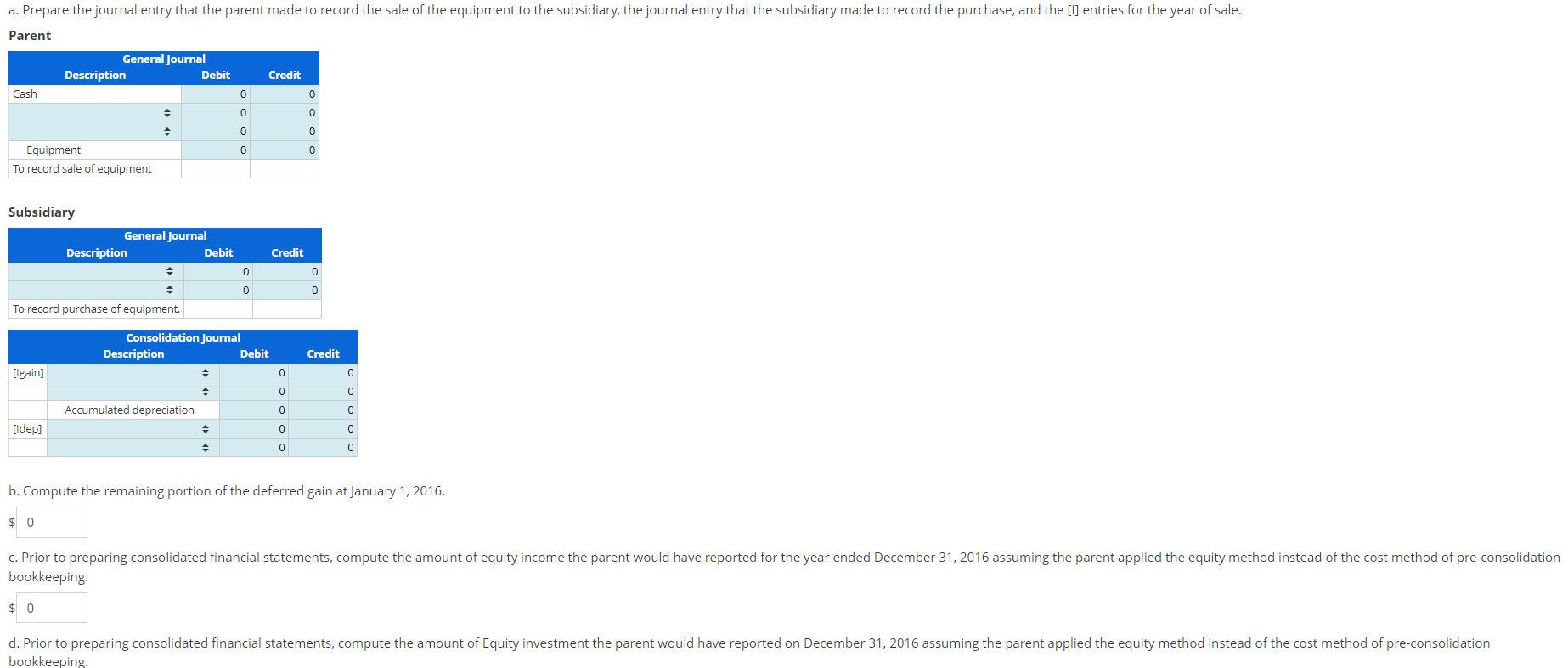

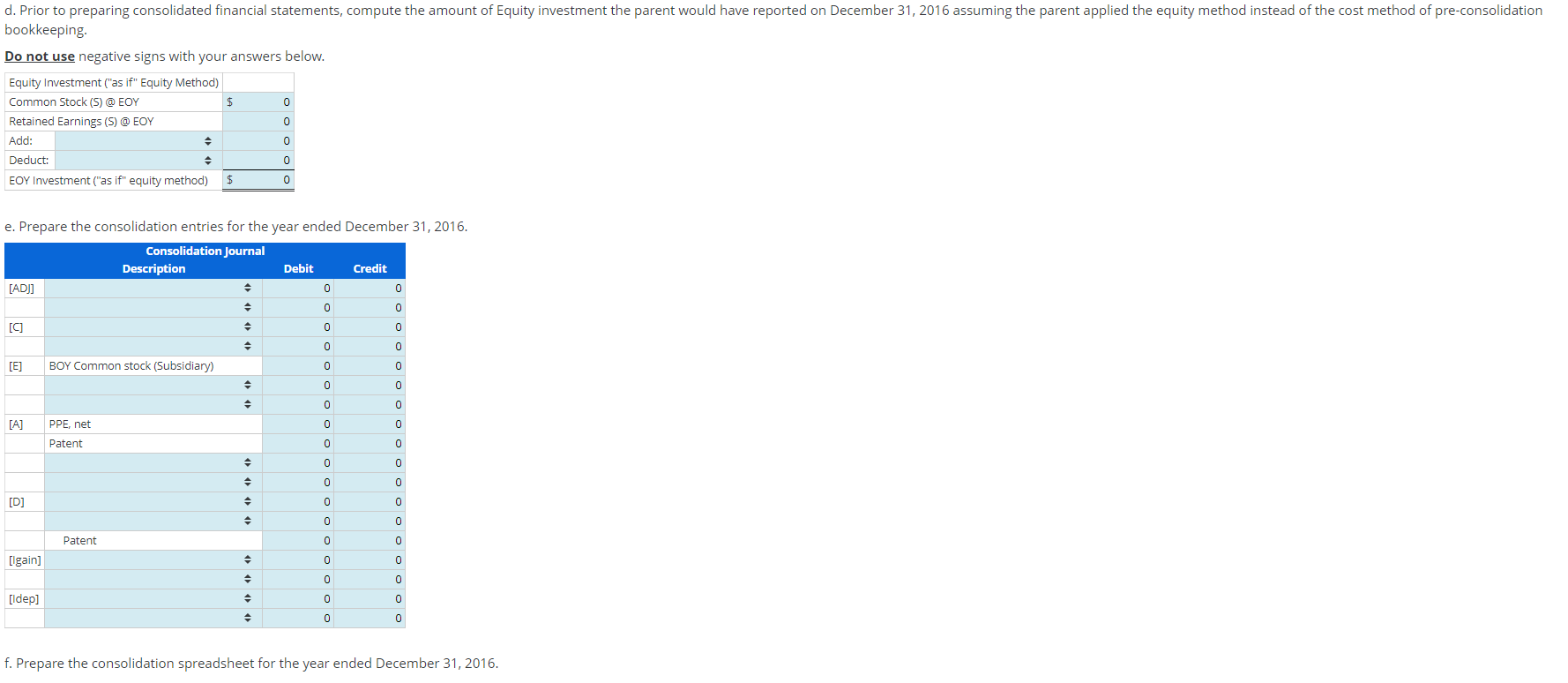

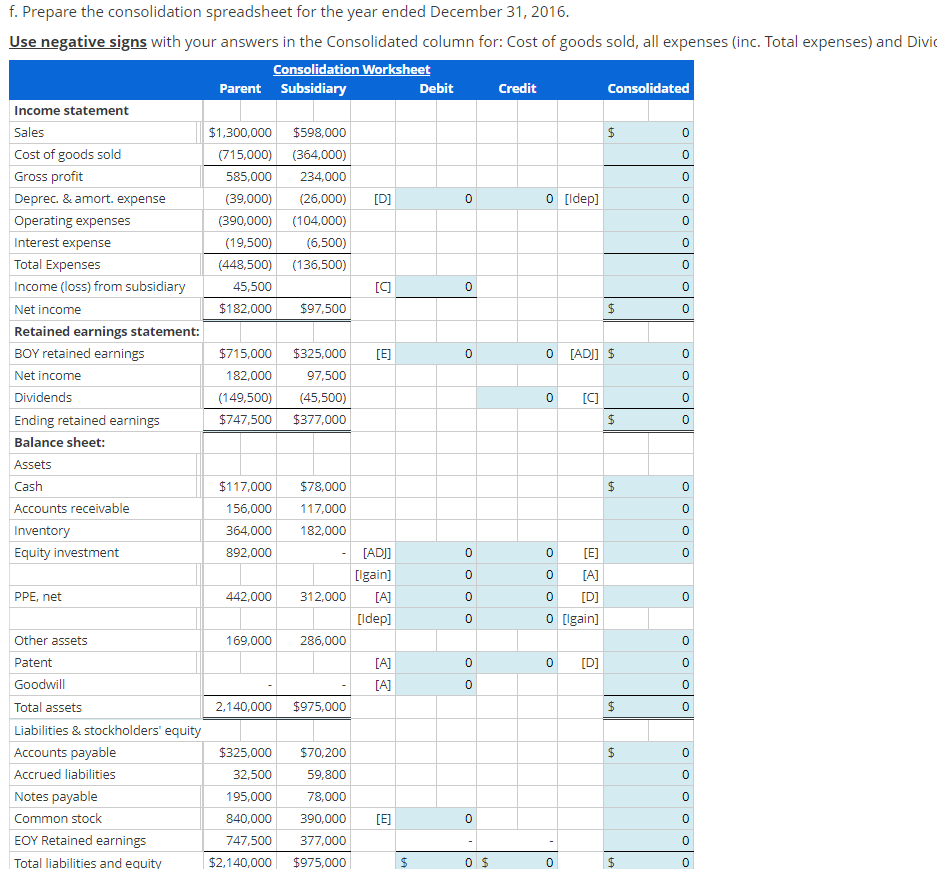

amortized using the straight-line method. The parent had depreciated the equipment for 2 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciates the equipment over its remaining 10 -year useful life. Following are financial statements of the parent and its subsidiary as of December 31,2016 . The parent uses the cost method of pre-consolidation investment bookkeeping. Subsidiary b. Compute the remaining portion of the deferred gain at January 1, 2016. bookkeeping. bookkeeping. e. Prepare the consolidation entries for the year ended December 31, 2016. f. Prepare the consolidation spreadsheet for the year ended December 31, 2016. ses (inc. Total expenses) and Divi amortized using the straight-line method. The parent had depreciated the equipment for 2 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciates the equipment over its remaining 10 -year useful life. Following are financial statements of the parent and its subsidiary as of December 31,2016 . The parent uses the cost method of pre-consolidation investment bookkeeping. Subsidiary b. Compute the remaining portion of the deferred gain at January 1, 2016. bookkeeping. bookkeeping. e. Prepare the consolidation entries for the year ended December 31, 2016. f. Prepare the consolidation spreadsheet for the year ended December 31, 2016. ses (inc. Total expenses) and Divi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts