Question: Please help please help taxes withheld. Joyce had total AGI in 2021 and 2022 of $51,000 and $53,500, respectively. In 2021 , Joyce also paid

Please help

Please help

please help

please help

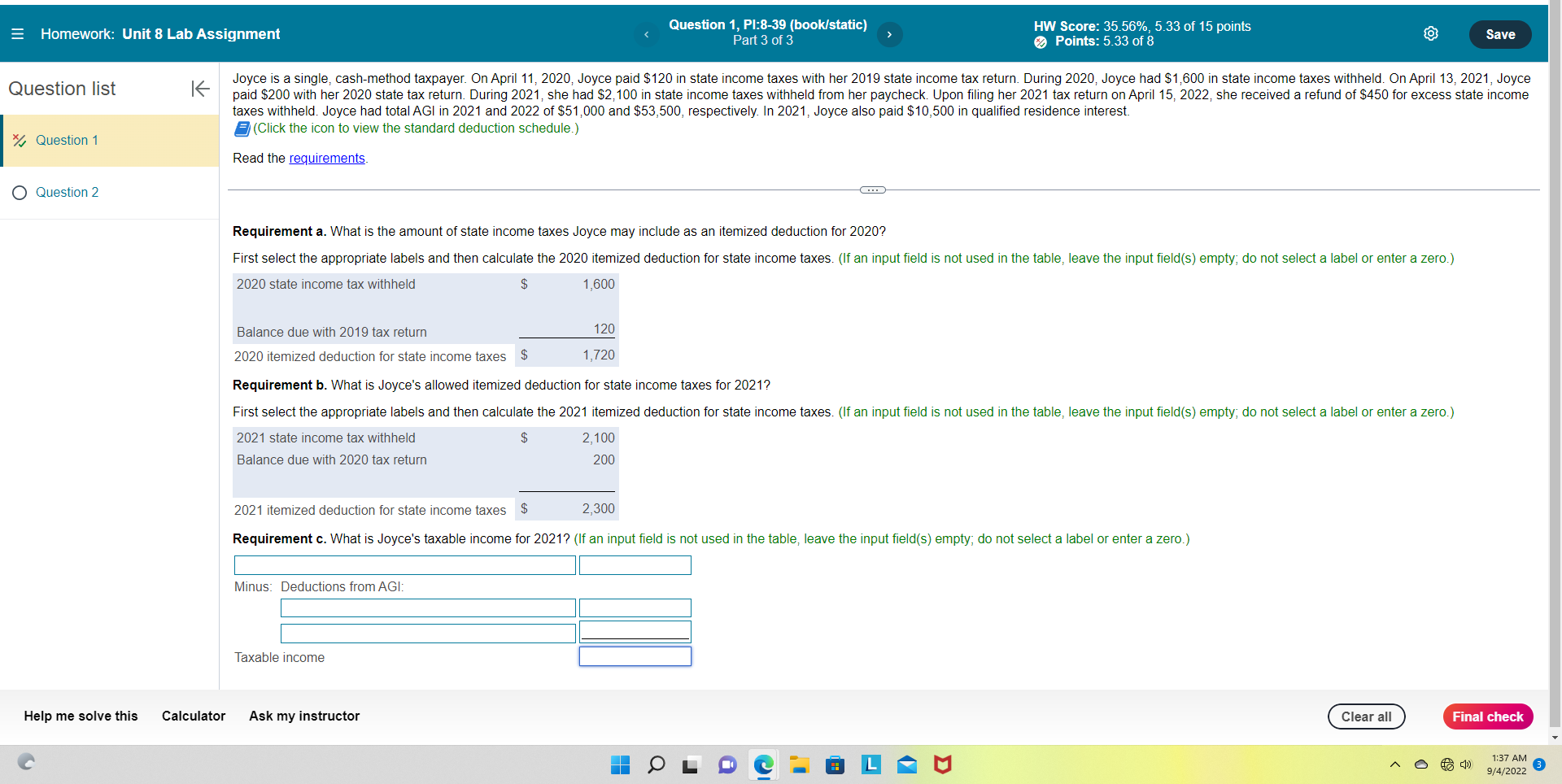

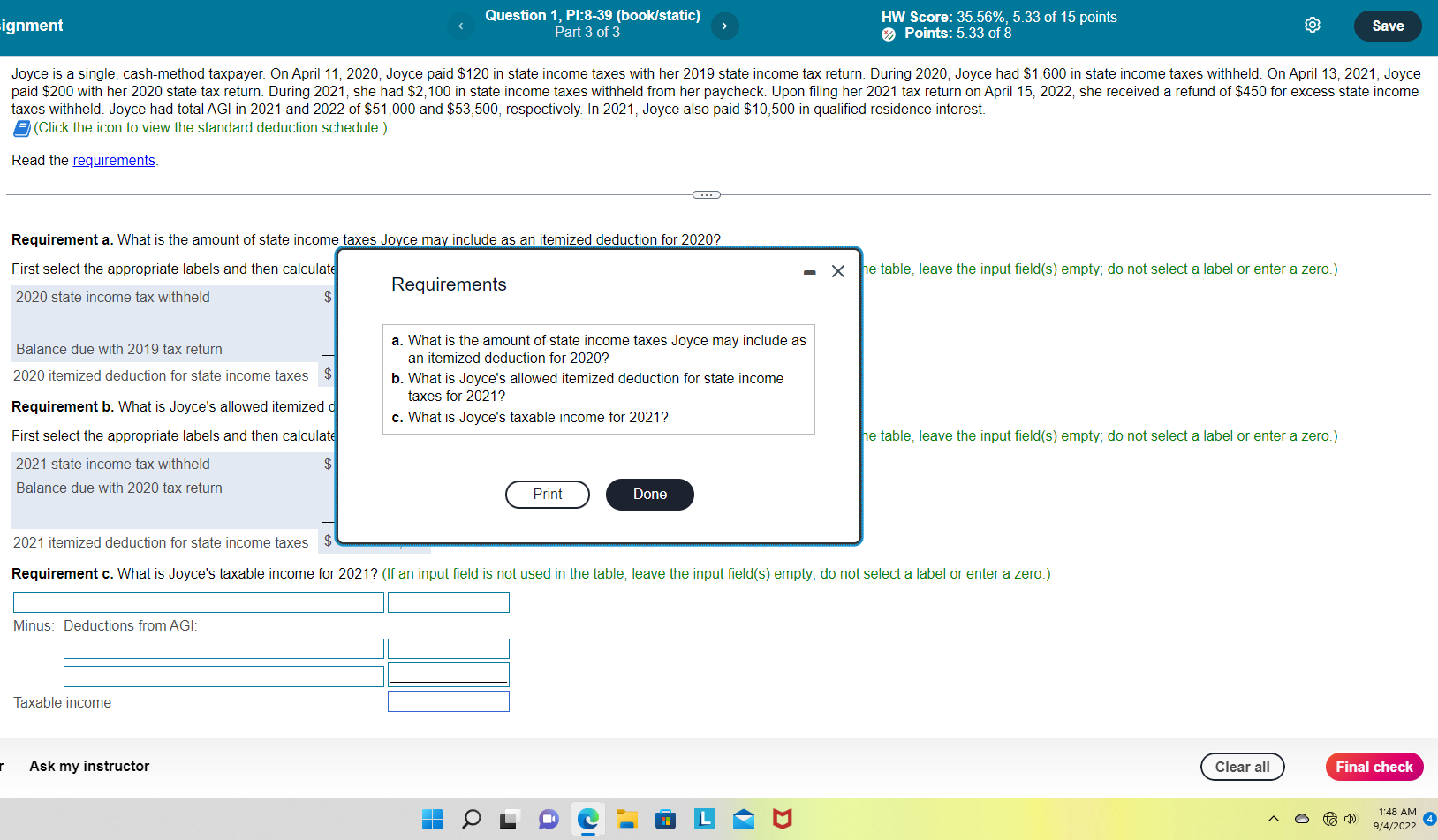

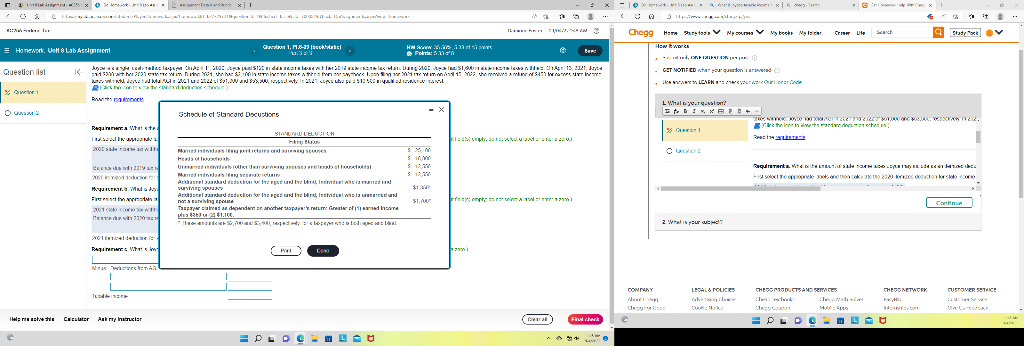

taxes withheld. Joyce had total AGI in 2021 and 2022 of $51,000 and $53,500, respectively. In 2021 , Joyce also paid $10,500 in qualified residence interest. E (Click the icon to view the standard deduction schedule.) Read the requirements. Requirement a. What is the amount of state income taxes Joyce may include as an itemized deduction for 2020? taxes withheld. Joyce had total AGI in 2021 and 2022 of $51,000 and $53,500, respectively. In 2021 , Joyce also paid $10,500 in qualified residence interest. (Click the icon to view the standard deduction schedule.) Read the requirements. Requirement a. What is the amount of state income taxes Joyce may include as an itemized deduction for 2020? First select the appropriate labels and then calculate 2020 state income tax withheld Balance due with 2019 tax return 2020 itemized deduction for state income taxes Requirements Requirement b. What is Joyce's allowed itemized on a. What is the amount of state income taxes Joyce may include as an itemized deduction for 2020? b. What is Joyce's allowed itemized deduction for state income taxes for 2021? c. What is Joyce's taxable income for 2021? he table, leave the input field(s) empty; do not select a label or enter a zero.) re table, leave the input field(s) empty; do not select a label or enter a zero.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts