Question: PLEASE HELP!! please help with the budget report income statement (question 1), controllable overhead variance (question 2), and question 3 please!! 1) Antuan Company uses

PLEASE HELP!! please help with the budget report income statement (question 1), controllable overhead variance (question 2), and question 3 please!!

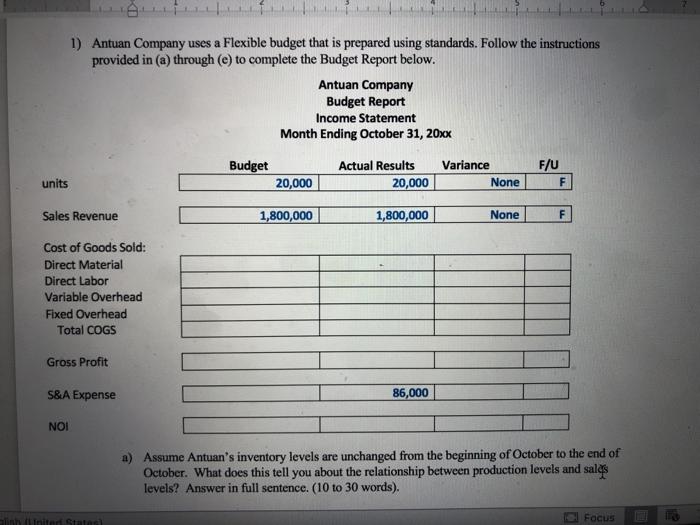

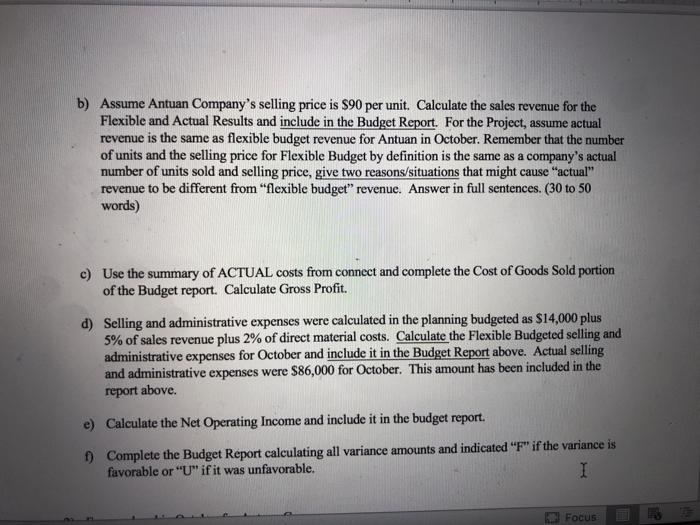

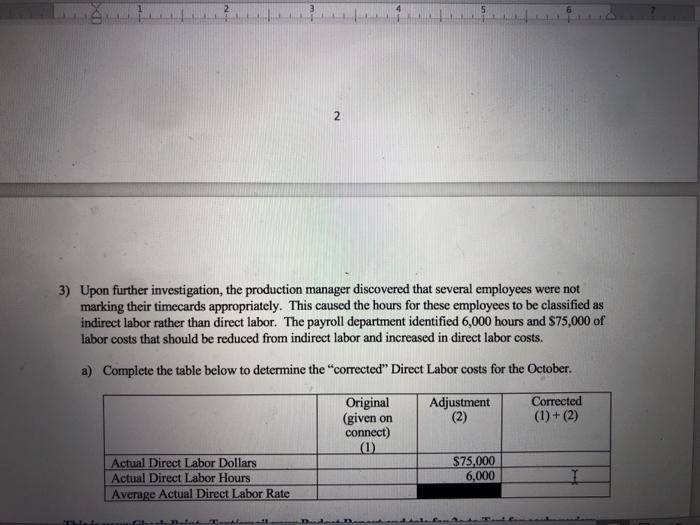

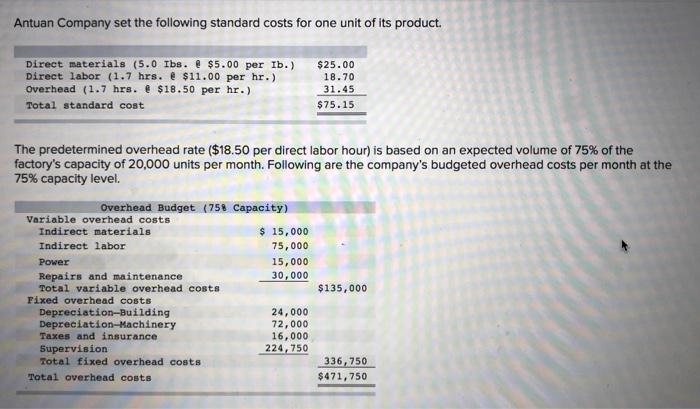

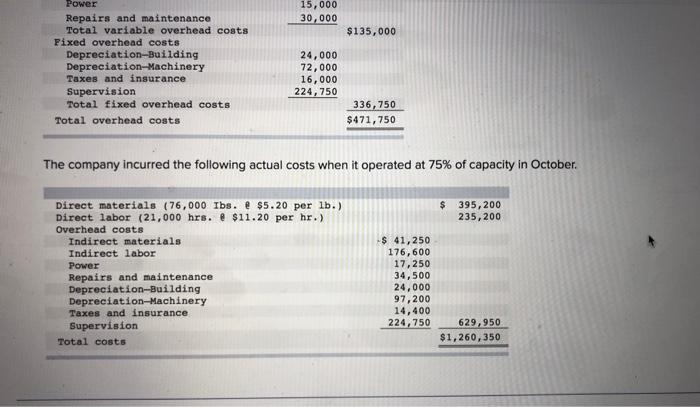

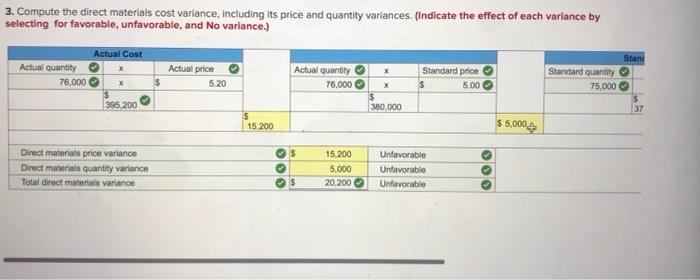

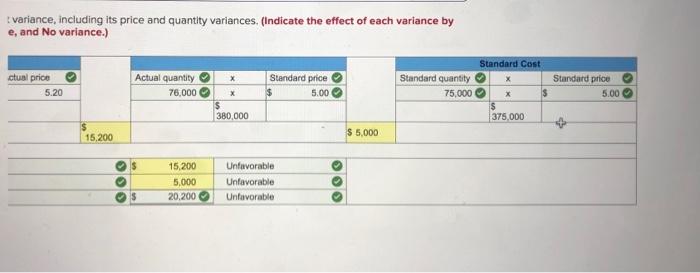

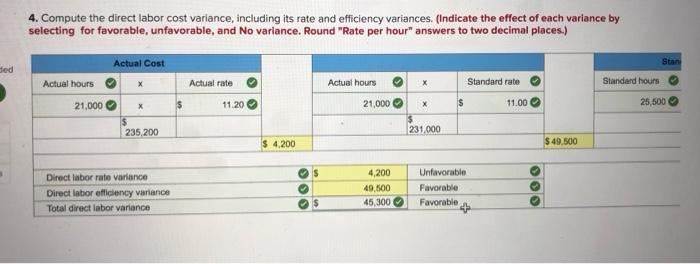

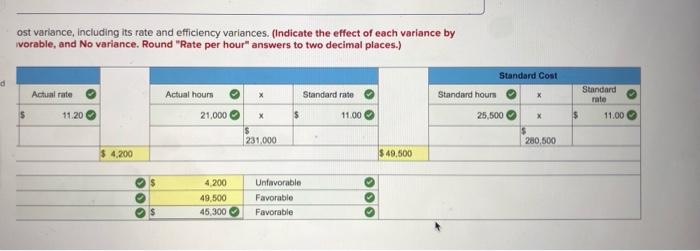

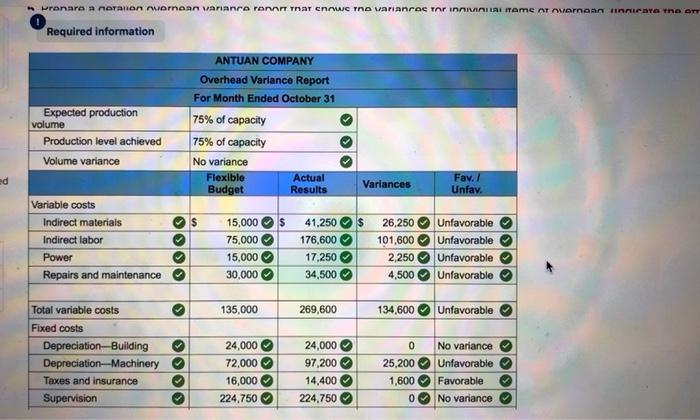

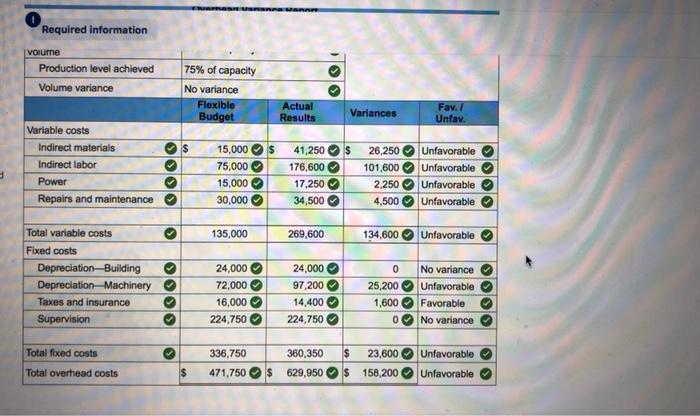

PLEASE HELP!! please help with the budget report income statement (question 1), controllable overhead variance (question 2), and question 3 please!!1) Antuan Company uses a Flexible budget that is prepared using standards. Follow the instructions provided in (a) through (e) to complete the Budget Report below. Antuan Company Budget Report Income Statement Month Ending October 31, 20xx Budget Actual Results 20,000 Variance None F/U F units 20,000 Sales Revenue 1,800,000 1,800,000 None F Cost of Goods Sold: Direct Material Direct Labor Variable Overhead Fixed Overhead Total COGS Gross Profit S&A Expense 86,000 NOI a) Assume Antuan's inventory levels are unchanged from the beginning of October to the end of October. What does this tell you about the relationship between production levels and sales levels? Answer in full sentence. (10 to 30 words). Focus b) Assume Antuan Company's selling price is $90 per unit. Calculate the sales revenue for the Flexible and Actual Results and include in the Budget Report. For the Project, assume actual revenue is the same as flexible budget revenue for Antuan in October. Remember that the number of units and the selling price for Flexible Budget by definition is the same as a company's actual number of units sold and selling price, give two reasons/situations that might cause "actual" revenue to be different from "flexible budget" revenue. Answer in full sentences. (30 to 50 words) c) Use the summary of ACTUAL costs from connect and complete the Cost of Goods Sold portion of the Budget report. Calculate Gross Profit d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report. 1) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. I Focus report above. e) Calculate the Net Operating Income and include it in the budget report. f) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. 2) For overhead in October for Antuan Company: a) Calculate the controllable overhead variance using the table below. Indicate whether the variance is favorable or unfavorable in the pale blue cell. Controllable Overhead Variance Total actual overhead costs Total flexible budget amount Controllable overhead variance b) Does Antuan Company have any volume variance for overhead? Why or Why not? c) Review your overhead variance report in Question 14 of the connect assignment. What cost item is the biggest contributor to the controllable overhead variance calculated in (a)? Review the labor variance analysis performed in Question 13 of connect. How might the Labor Efficiency Variance and the controllable overhead variance be related? Explain in 30 to 50 words. I Antuan Company set the following standard costs for one unit of its product. Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (1.7 hrs. @ $11.00 per hr.) Overhead (1.7 hrs. & $18.50 per hr.) Total standard cost $25.00 18.70 31.45 $75.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (758 Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Repairs and maintenance 30,000 Total variable overhead costs $135,000 Fixed overhead costs Depreciation-Building 24,000 Depreciation-Machinery 72,000 Taxes and insurance 16,000 Supervision 224,750 Total fixed overhead costs 336, 750 Total overhead costs $471,750 15,000 30,000 $135,000 Power Repairs and maintenance Total variable overhead costs Fixed overhead costs Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total fixed overhead costs Total overhead costs 24,000 72,000 16,000 224,750 336,750 $471,750 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 395,200 235, 200 Direct materials (76,000 lbs. e $5.20 per 1b.) Direct labor (21,000 hrs. @ $11.20 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total costs $ 41,250 176,600 17,250 34,500 24,000 97,200 14,400 224,750 629,950 $1,260,350 3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance.) Actual Cost Stank Actual quantity 76,000 Actual price 5.20 X $ Actual quantity 76,000 Standard price 5.00 Standard quantity 75,000 $ 395 200 380,000 37 15200 $5,000.42 $ Direct materials price variance Direct materials quantity variance Total direct materials variance OOO 15 200 5,000 20.200 Unfavorable Unfavorable Unfavorable $ { variance, including its price and quantity variances, (Indicate the effect of each variance by e, and No variance.) ctual price 5.20 Actual quantity 76,000 Standard price $ 5.00 Standard quantity 75,000 Standard Cost X $ $ 375,000 Standard price 5.00 $ 380,000 $ 5.000 15,200 $ 15,200 5,000 20,200 Unfavorable Unfavorable Unfavorable 5 4. Compute the direct labor cost variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance. Round "Rate per hour" answers to two decimal places.) ded Stan Actual Cost Actual rate Actual hours Standard rate Standard hours Actual hours 21,000 11.20 21,000 X s 11.00 25,500 235.200 231,000 $ 4,200 $49,500 $ Direct labor rate variance Direct labor efficiency variance Total direct labor variance 4,200 49,500 45,300 Unfavorable Favorable Favorable OOO $ ost variance, including its rate and efficiency variances. (Indicate the effect of each variance by ivorable, and No variance. Round "Rate per hour" answers to two decimal places.) Standard Cost d Actual rate Standard hours > Standard rate Actual hours 21,000 Standard rate 11.00 5 11.20 X 25,500 X $ 11.00 231.000 280,500 $ 4,200 $ 49,500 $ 4.200 49,500 45,300 Unfavorable Favorable Favorable OO $ NAMAN Required information volume Production level achieved Volume variance 75% of capacity No variance Flexible Budget > Actual Results Variances Fav. / Unfav. $ Variable costs Indirect materials Indirect labor Power Repairs and maintenance 15,000 75,000 15,000 30,000 41,250 $ 176,600 17.250 34,500 26,250 Unfavorable 101.600 Unfavorable 2,250 Unfavorable 4,500 Unfavorable 135,000 269,600 134,600 Unfavorable Total variable costs Fixed costs Depreciation Building Depreciation Machinery Taxes and insurance Supervision 24,000 72,000 16,000 224,750 24,000 97,200 14,400 224,750 0 No variance 25,200 Unfavorable 1,600 Favorable 0 No variance 360,350 $ Total fixed costs Total overhead costs 336.750 471,750 23,600 158,200 Unfavorable Unfavorable $ $ 629,950 $ 1) Antuan Company uses a Flexible budget that is prepared using standards. Follow the instructions provided in (a) through (e) to complete the Budget Report below. Antuan Company Budget Report Income Statement Month Ending October 31, 20xx Budget Actual Results 20,000 Variance None F/U F units 20,000 Sales Revenue 1,800,000 1,800,000 None F Cost of Goods Sold: Direct Material Direct Labor Variable Overhead Fixed Overhead Total COGS Gross Profit S&A Expense 86,000 NOI a) Assume Antuan's inventory levels are unchanged from the beginning of October to the end of October. What does this tell you about the relationship between production levels and sales levels? Answer in full sentence. (10 to 30 words). Focus b) Assume Antuan Company's selling price is $90 per unit. Calculate the sales revenue for the Flexible and Actual Results and include in the Budget Report. For the Project, assume actual revenue is the same as flexible budget revenue for Antuan in October. Remember that the number of units and the selling price for Flexible Budget by definition is the same as a company's actual number of units sold and selling price, give two reasons/situations that might cause "actual" revenue to be different from "flexible budget" revenue. Answer in full sentences. (30 to 50 words) c) Use the summary of ACTUAL costs from connect and complete the Cost of Goods Sold portion of the Budget report. Calculate Gross Profit d) Selling and administrative expenses were calculated in the planning budgeted as $14,000 plus 5% of sales revenue plus 2% of direct material costs. Calculate the Flexible Budgeted selling and administrative expenses for October and include it in the Budget Report above. Actual selling and administrative expenses were $86,000 for October. This amount has been included in the report above. e) Calculate the Net Operating Income and include it in the budget report. 1) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. I Focus report above. e) Calculate the Net Operating Income and include it in the budget report. f) Complete the Budget Report calculating all variance amounts and indicated "F" if the variance is favorable or "U" if it was unfavorable. 2) For overhead in October for Antuan Company: a) Calculate the controllable overhead variance using the table below. Indicate whether the variance is favorable or unfavorable in the pale blue cell. Controllable Overhead Variance Total actual overhead costs Total flexible budget amount Controllable overhead variance b) Does Antuan Company have any volume variance for overhead? Why or Why not? c) Review your overhead variance report in Question 14 of the connect assignment. What cost item is the biggest contributor to the controllable overhead variance calculated in (a)? Review the labor variance analysis performed in Question 13 of connect. How might the Labor Efficiency Variance and the controllable overhead variance be related? Explain in 30 to 50 words. I Antuan Company set the following standard costs for one unit of its product. Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (1.7 hrs. @ $11.00 per hr.) Overhead (1.7 hrs. & $18.50 per hr.) Total standard cost $25.00 18.70 31.45 $75.15 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (758 Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Repairs and maintenance 30,000 Total variable overhead costs $135,000 Fixed overhead costs Depreciation-Building 24,000 Depreciation-Machinery 72,000 Taxes and insurance 16,000 Supervision 224,750 Total fixed overhead costs 336, 750 Total overhead costs $471,750 15,000 30,000 $135,000 Power Repairs and maintenance Total variable overhead costs Fixed overhead costs Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total fixed overhead costs Total overhead costs 24,000 72,000 16,000 224,750 336,750 $471,750 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 395,200 235, 200 Direct materials (76,000 lbs. e $5.20 per 1b.) Direct labor (21,000 hrs. @ $11.20 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation-Building Depreciation Machinery Taxes and insurance Supervision Total costs $ 41,250 176,600 17,250 34,500 24,000 97,200 14,400 224,750 629,950 $1,260,350 3. Compute the direct materials cost variance, including its price and quantity variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance.) Actual Cost Stank Actual quantity 76,000 Actual price 5.20 X $ Actual quantity 76,000 Standard price 5.00 Standard quantity 75,000 $ 395 200 380,000 37 15200 $5,000.42 $ Direct materials price variance Direct materials quantity variance Total direct materials variance OOO 15 200 5,000 20.200 Unfavorable Unfavorable Unfavorable $ { variance, including its price and quantity variances, (Indicate the effect of each variance by e, and No variance.) ctual price 5.20 Actual quantity 76,000 Standard price $ 5.00 Standard quantity 75,000 Standard Cost X $ $ 375,000 Standard price 5.00 $ 380,000 $ 5.000 15,200 $ 15,200 5,000 20,200 Unfavorable Unfavorable Unfavorable 5 4. Compute the direct labor cost variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and No variance. Round "Rate per hour" answers to two decimal places.) ded Stan Actual Cost Actual rate Actual hours Standard rate Standard hours Actual hours 21,000 11.20 21,000 X s 11.00 25,500 235.200 231,000 $ 4,200 $49,500 $ Direct labor rate variance Direct labor efficiency variance Total direct labor variance 4,200 49,500 45,300 Unfavorable Favorable Favorable OOO $ ost variance, including its rate and efficiency variances. (Indicate the effect of each variance by ivorable, and No variance. Round "Rate per hour" answers to two decimal places.) Standard Cost d Actual rate Standard hours > Standard rate Actual hours 21,000 Standard rate 11.00 5 11.20 X 25,500 X $ 11.00 231.000 280,500 $ 4,200 $ 49,500 $ 4.200 49,500 45,300 Unfavorable Favorable Favorable OO $ NAMAN Required information volume Production level achieved Volume variance 75% of capacity No variance Flexible Budget > Actual Results Variances Fav. / Unfav. $ Variable costs Indirect materials Indirect labor Power Repairs and maintenance 15,000 75,000 15,000 30,000 41,250 $ 176,600 17.250 34,500 26,250 Unfavorable 101.600 Unfavorable 2,250 Unfavorable 4,500 Unfavorable 135,000 269,600 134,600 Unfavorable Total variable costs Fixed costs Depreciation Building Depreciation Machinery Taxes and insurance Supervision 24,000 72,000 16,000 224,750 24,000 97,200 14,400 224,750 0 No variance 25,200 Unfavorable 1,600 Favorable 0 No variance 360,350 $ Total fixed costs Total overhead costs 336.750 471,750 23,600 158,200 Unfavorable Unfavorable $ $ 629,950 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts