Question: Please help please i will give good rating please Atrium Bhd. is a medium-sized manufacturing company that plans to increase capacity by purchasing new machinery

Please help please i will give good rating please

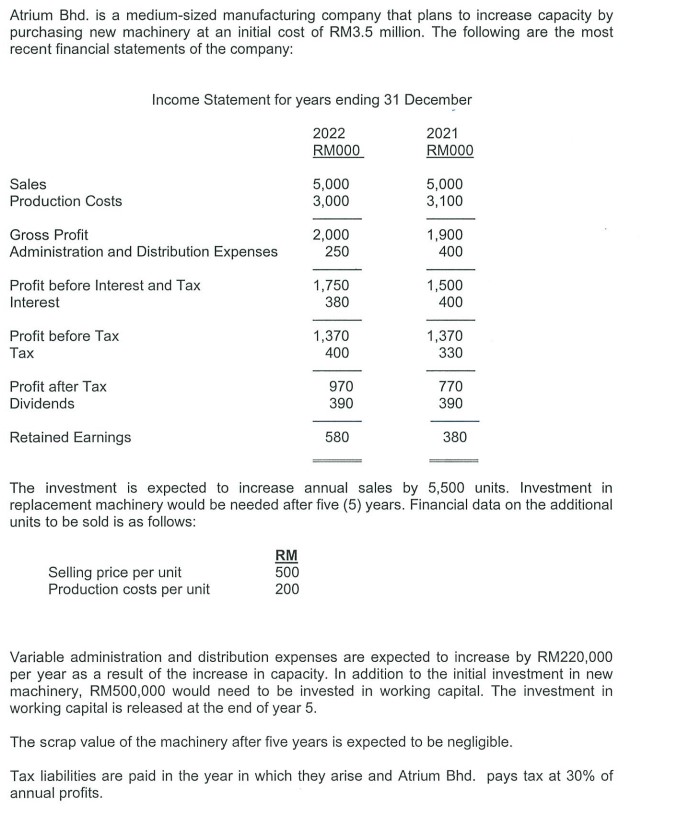

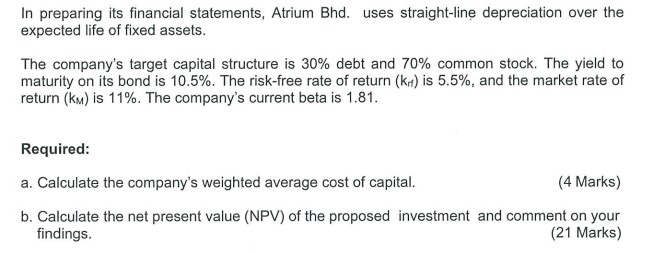

Atrium Bhd. is a medium-sized manufacturing company that plans to increase capacity by purchasing new machinery at an initial cost of RM3.5 million. The following are the most recent financial statements of the company: Income Statement for years ending 31 December The investment is expected to increase annual sales by 5,500 units. Investment in replacement machinery would be needed after five (5) years. Financial data on the additional units to be sold is as follows: Variable administration and distribution expenses are expected to increase by RM220,000 per year as a result of the increase in capacity. In addition to the initial investment in new machinery, RM500,000 would need to be invested in working capital. The investment in working capital is released at the end of year 5. The scrap value of the machinery after five years is expected to be negligible. Tax liabilities are paid in the year in which they arise and Atrium Bhd. pays tax at \30 of annual profits. In preparing its financial statements, Atrium Bhd. uses straight-line depreciation over the expected life of fixed assets. The company's target capital structure is \30 debt and \70 common stock. The yield to maturity on its bond is \10.5. The risk-free rate of return \\( \\left(\\mathrm{k}_{\\mathrm{rf}}\ ight) \\) is \5.5, and the market rate of return \\( \\left(\\mathrm{k}_{M}\ ight) \\) is \11. The company's current beta is 1.81 . Required: a. Calculate the company's weighted average cost of capital. (4 Marks) b. Calculate the net present value (NPV) of the proposed investment and comment on your findings. (21 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts