Question: Please help please please please asap help help ABC Inc. is expected to pay a dividend of D1 = $1.80 per share at the end

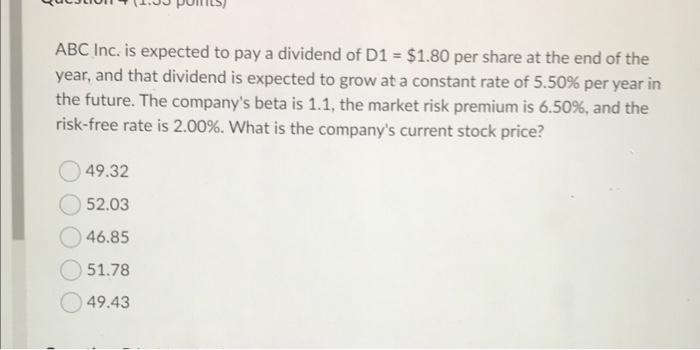

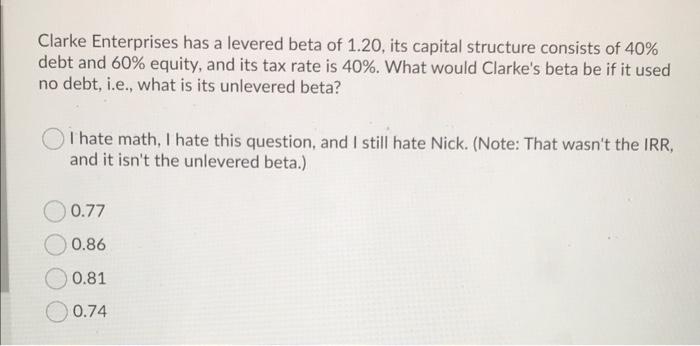

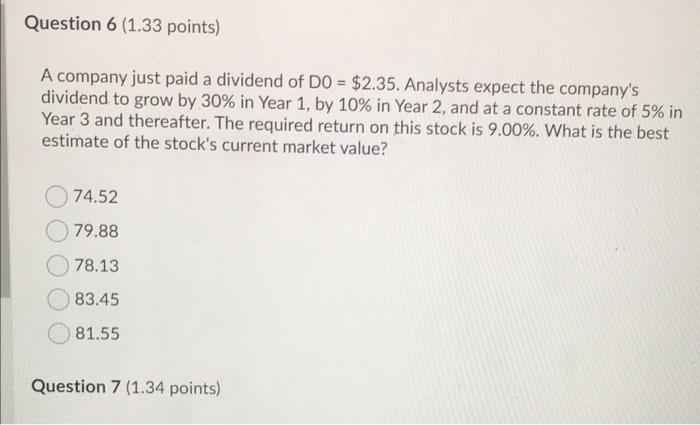

ABC Inc. is expected to pay a dividend of D1 = $1.80 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.50% per year in the future. The company's beta is 1.1, the market risk premium is 6.50%, and the risk-free rate is 2.00%. What is the company's current stock price? 49.32 52.03 46.85 51.78 49.43 Clarke Enterprises has a levered beta of 1.20, its capital structure consists of 40% debt and 60% equity, and its tax rate is 40%. What would Clarke's beta be if it used no debt, i.e., what is its unlevered beta? Thate math, I hate this question, and I still hate Nick. (Note: That wasn't the IRR, and it isn't the unlevered beta.) 0.77 0.86 0.81 0.74 Question 6 (1.33 points) A company just paid a dividend of DO = $2.35. Analysts expect the company's dividend to grow by 30% in Year 1, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The required return on this stock is 9.00%. What is the best estimate of the stock's current market value? 74.52 79.88 78.13 83.45 81.55 Question 7 (1.34 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts