Question: Please help!! Please show work 7) If a corporation has an average tax rate of 32%, the approximate, annual, after-tax cost of debt for a

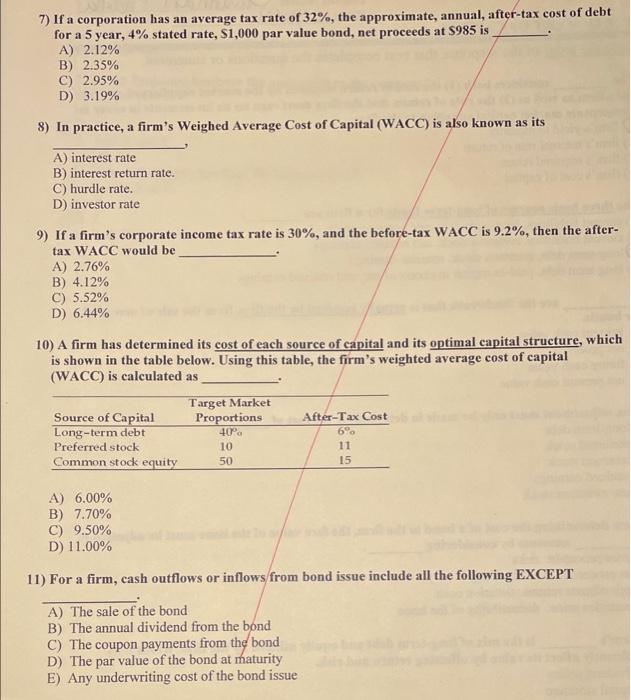

7) If a corporation has an average tax rate of 32%, the approximate, annual, after-tax cost of debt for a 5 year, 4% stated rate, $1,000 par value bond, net proceeds at $985 is A) 2.12% B) 2.35% C) 2.95% D) 3.19% 8) In practice, a firm's Weighed Average Cost of Capital (WACC) is also known as its A) interest rate B) interest return rate. C) hurdle rate. D) investor rate 9) If a firm's corporate income tax rate is 30%, and the before-tax WACC is 9.2%, then the after- tax WACC would be A) 2.76% B) 4.12% C) 5.52% D) 6.44% 10) A firm has determined its cost of each source of capital and its optimal capital structure, which is shown in the table below. Using this table, the firm's weighted average cost of capital (WACC) is calculated as Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions 40 10 50 After-Tax Cost 6% 11 15 A) 6.00% B) 7.70% C) 9.50% D) 11.00% 11) For a firm, cash outflows or inflows from bond issue include all the following EXCEPT A) The sale of the bond B) The annual dividend from the bond C) The coupon payments from the bond D) The par value of the bond at maturity E) Any underwriting cost of the bond issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts