Question: Please help.. Please show work. Thank you value: 10.00 points Durham Company uses a job-order costing system. The following transactions took place last year a.

Please help.. Please show work. Thank you

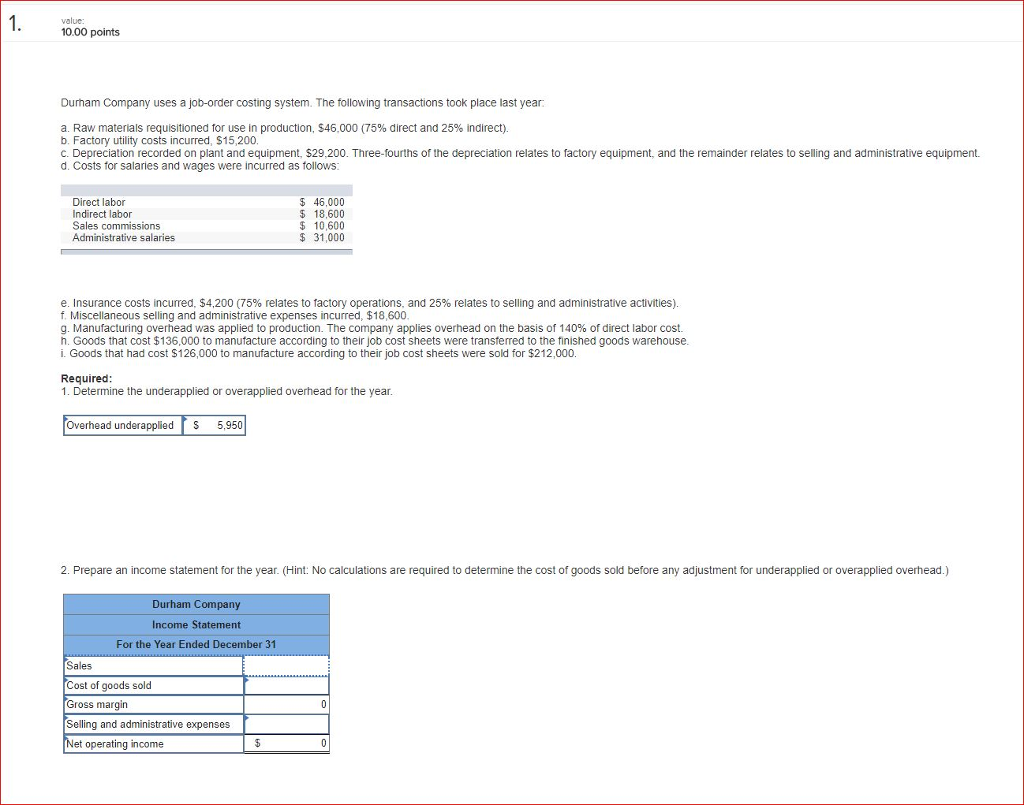

value: 10.00 points Durham Company uses a job-order costing system. The following transactions took place last year a. Raw materials requisitioned for use in production, $46.000 (75% direct and 25% indirect). b. Factory utility costs incurred, S15,200 C. Depreciation recorded on plant and equipment, $29,200. Three-fourths of the depreciation relates to factory equipment, and the remainder relates to selling and administrative equipment. d. Costs for salaries and wages were incurred as follows Direct labor Indirect labor Sales commissions Administrative salaries $ 46,000 18,600 $10,600 $31,000 e. Insurance costs incurred, $4,200 (75% relates to factory operations, and 25% relates to selling and administrative activities). f. Miscellaneous selling and administrative expenses incurred, $18,600 g. Manufacturing overhead was applied to production. The company applies overhead on the basis of 140% of direct labor cost. h. Goods that cost $136,000 to manufacture according to their job cost sheets were transterred to the finished goods warehouse. i. Goods that had cost $126,000 to manufacture according to their job cost sheets were sold for $212,000. Required 1. Determine the underapplied or overapplied overhead for the year Overhead underapplied $ 5.950 2. Prepare an income statement for the year. (Hint: No calculations are required to determine the cost of goods sold before any adjustment for underapplied or overapplied overhead.) Durham Company Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses et operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts