Question: PLEASE HELP! Prepare a statement of cash flows using the indirect method. Presented here are the financial statements of Blossom Company. Additional data: 1. Depreciation

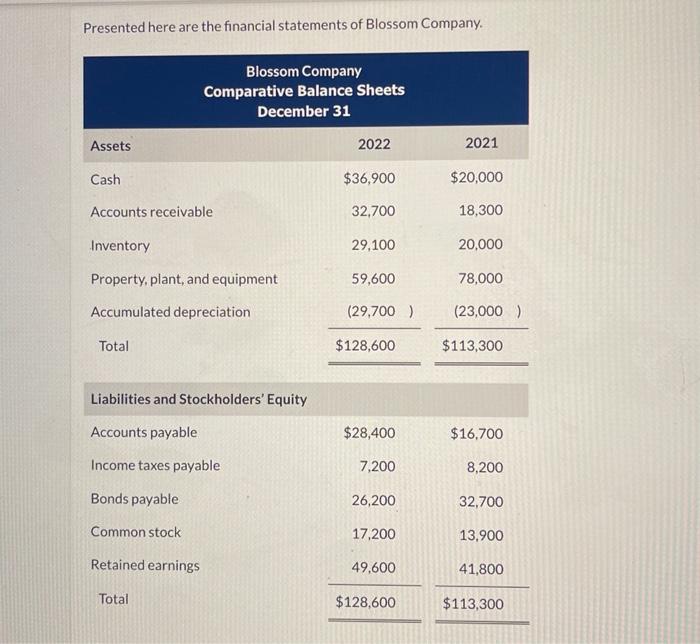

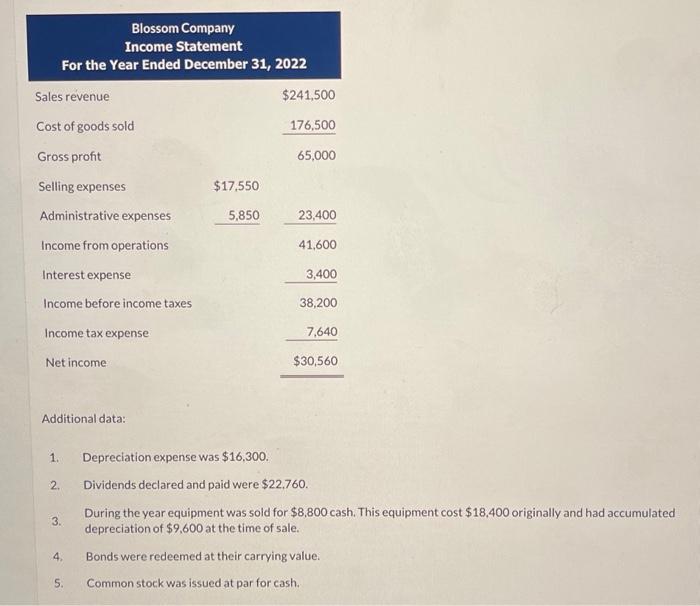

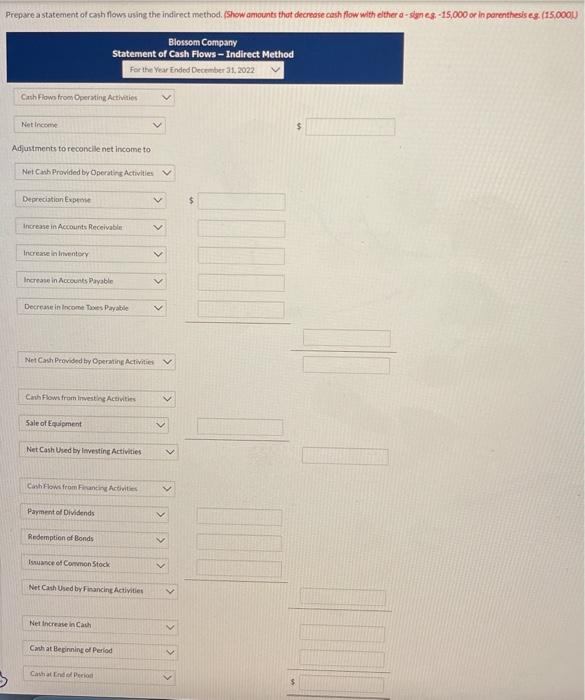

Presented here are the financial statements of Blossom Company. Additional data: 1. Depreciation expense was $16,300. 2. Dividends declared and paid were $22,760. 3. During the year equipment was sold for $8,800cash. This equipment cost $18,400 originally and had accumulated depreciation of $9,600 at the time of sale. 4. Bonds were redeemed at their carrying value. 5. Common stock was issued at par for cash. Preparea statement of cash flows using the indirect method. iShow amounts thot decrease cash flow with elther a-slan eg, - 15,000 or in parentheds eg. (15,000U Blossom Company Statement of Cash Flows - Indirect Method For the Vear Ended Decenter 31, 2022. Cash Flown from Dperating Actineties Net lincente 5 Adjustments to reconclile net income to Net Cahh Provided by Operatios Activities Deprecistian Experte 5 Insease in Accounts Receivable Increxie in liventery Increase in hcocuots payablo Decrease in locome Taots Paydble Net Cash Provided by Opermine Activitie Cahh Flowi framinvesting Aceivits 5ale of Eqigment Net Cash Uhed by ievestine Activities CashFlewi from Financing Recthities Papment of Divisends Redemption ot Bonds Iswumce of Coninon Stock Net Caih Used by Financinc Actiyitien Net increase incach Cachiat Bepinning of Period Casthat Inded Preioil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts