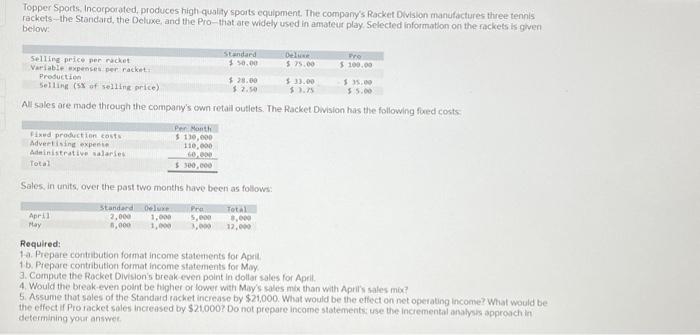

Question: PLEASE HELP!! Prepare contribution format income statements for April. (Round Total percent answers to 1 . decimal olace) Topper Sports, Incorporated, produces high-quality sports equipment,

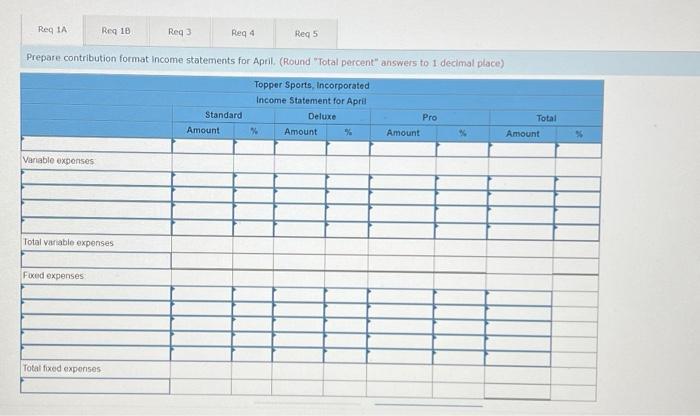

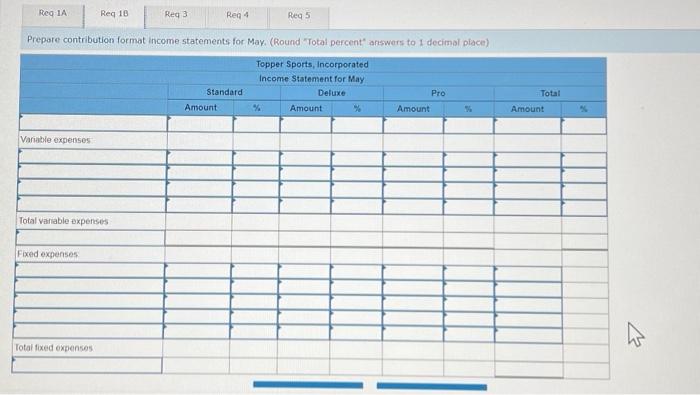

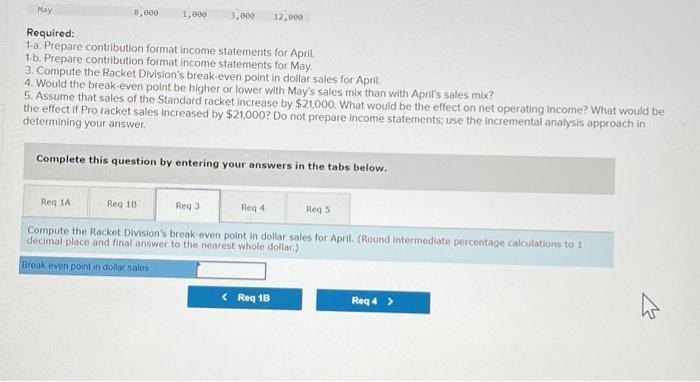

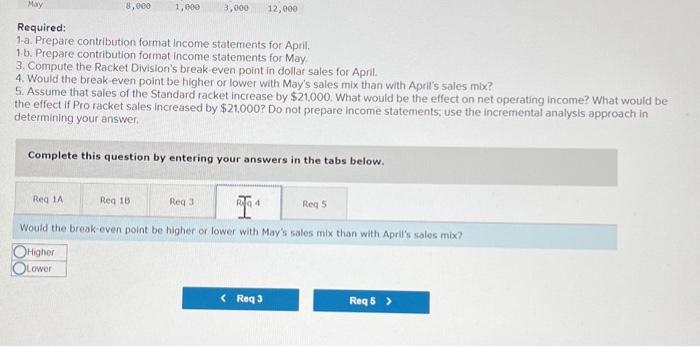

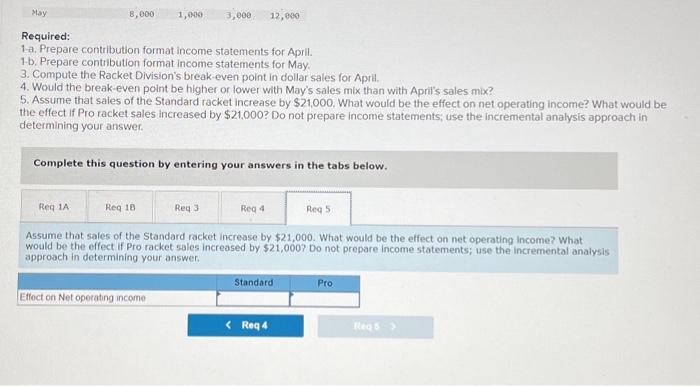

Prepare contribution format income statements for April. (Round "Total percent" answers to 1 . decimal olace) Topper Sports, Incorporated, produces high-quality sports equipment, The company's Racket Division manufactures three tennis rackets - the Standard, the Deluxe, and the Pro-that are widely vised in amateir play. Selected information on the nackets is ghen below: Al sales are made through the company's own retail outlets. The Racket Division has the following fried costs: Sales, in units, over the past two months have been as follows: Required: 1. Prepare contribution format income staternents for Aprit. 1b. Prepare contribution format income statements for Moy. 3. Compute the Rocket Divison's break-even point in dollar sales for Aprit. 4. Would the break-even point be higher or fower with May's sales mik than with Aprills sales miec? 5. Assume that sales of the Standard racket increase by $21,000. What woutd be the effect on net operating income? What would be the effectif Pro sacket soles increased by \$21,000? Do not prepare incorpe statements: use the incremental analysh approach in determining your answer. 1-a. Prepare contribution format income statements for April. 1.b. Prepare contribution format income statements for May. 3. Compute the Racket Division's break-even point in dollat sales for April. 4. Would the break-even point be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $21,000. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $21,000 ? Do not prepare income statements, use the incremental analysis approach in determining your answer. Complete this question by entering your answers in the tabs below. Would the break-even point be higher or lower with May's sales mix than with April's sales mix? Prepare contribution format income statements for May. (Round "Total percent" answors to 1 decimal place) 1.a. Prepare contribution format income statements for April, 1-b. Prepare contribution format income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Would the break-even point be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $21,000. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $21,000 ? Do not prepare income statements; use the incremental analysis approach in determining your answer. Complete this question by entering your answers in the tabs below. Compute the Racket Division's break-even point in dollor sales for April. (Round intermediate percentage calculations to 1 decimal place and final onswer. to the nearest whole dollar.) Required: 1.a. Prepare contribution format income statements for April. 1.b. Prepare contribution format income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Would the break-even point be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $21,000. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $21,000 ? Do not prepare income statements; use the incremental analysis approach in determining your answer. Complete this question by entering your answers in the tabs below. Assume that sales of the Standard racket increase by $21,000. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by \$21,000? Do not prepare income statements; use the incremental analysis approach in determining your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts