Question: Please help : Present Value of the Terminal Value Although there are two different ways of deriving terminal value, either method must be discounted back

Please help :

Present Value of the Terminal Value Although there are two different ways of deriving terminal value, either method must be discounted back to the valuation date.

Open the attached Excel file and go to the worksheet labeled: 2-PV of Terminal

Using the perpetuity growth rate, calculate the present value of the terminal value.

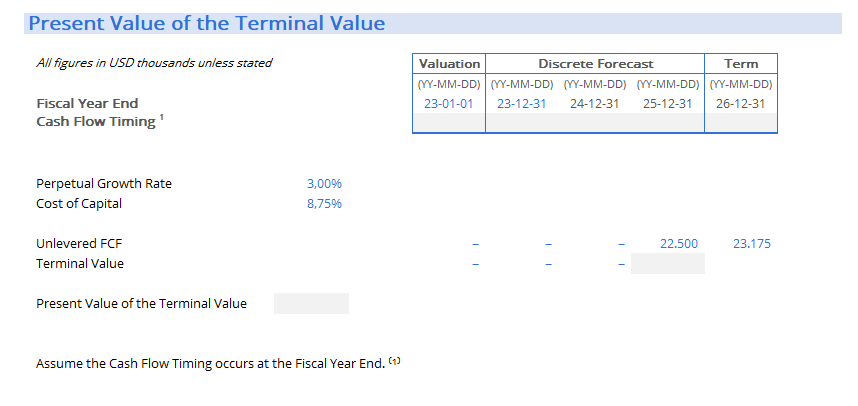

Present Value of the Terminal Value Although there are two different ways of deriving terminal value, either method must be discounted back to the valuation date. - Open the attached Excel file and go to the worksheet labeled: 2-PV of Terminal Using the perpetuity growth rate, calculate the present value of the terminal value. $313,375 $304,247 $313,590 $312,281 Present Value of the Terminal Value A// figures in USD thousands unless stated Fiscal Year End Cash Flow Timing 1 Assume the Cash Flow Timing occurs at the Fiscal Year End. (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts