Question: Please help Problem 1. Let the bond prices be A(0) = 90 and A(T) = 100 dollars. Let the stock prices be S(0) = 25

Please help

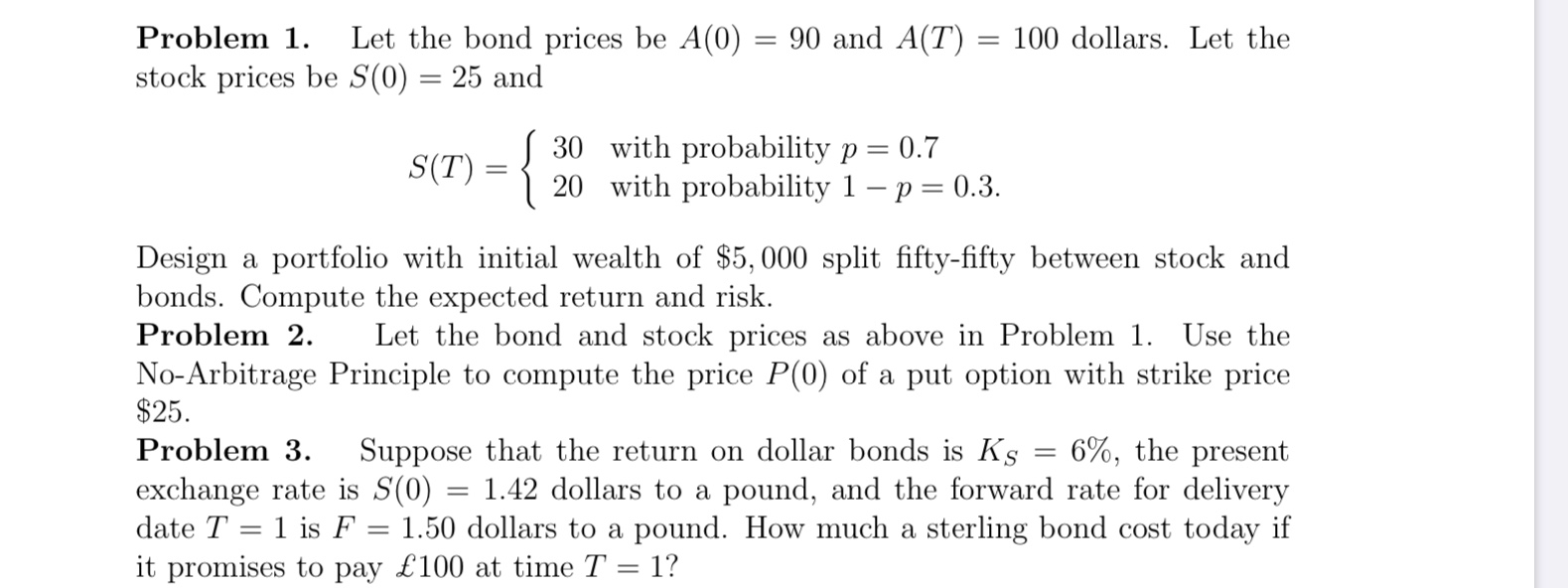

Problem 1. Let the bond prices be A(0) = 90 and A(T) = 100 dollars. Let the stock prices be S(0) = 25 and S(T) = | 30 with probability p= 0.7 | 20 with probability 1 p= 0.3. Design a portfolio with initial wealth of $5,000 split fifty-fifty between stock and bonds. Compute the expected return and risk. Problem 2. Let the bond and stock prices as above in Problem 1. Use the No-Arbitrage Principle to compute the price P(0) of a put option with strike price $25. Problem 3. Suppose that the return on dollar bonds is Ks = 6%, the present exchange rate is S(0) = 1.42 dollars to a pound, and the forward rate for delivery date T = 1 is F = 1.50 dollars to a pound. How much a sterling bond cost today if it promises to pay 100 at time T = 1? Problem 1. Let the bond prices be A(0) = 90 and A(T) = 100 dollars. Let the stock prices be S(0) = 25 and S(T) = | 30 with probability p= 0.7 | 20 with probability 1 p= 0.3. Design a portfolio with initial wealth of $5,000 split fifty-fifty between stock and bonds. Compute the expected return and risk. Problem 2. Let the bond and stock prices as above in Problem 1. Use the No-Arbitrage Principle to compute the price P(0) of a put option with strike price $25. Problem 3. Suppose that the return on dollar bonds is Ks = 6%, the present exchange rate is S(0) = 1.42 dollars to a pound, and the forward rate for delivery date T = 1 is F = 1.50 dollars to a pound. How much a sterling bond cost today if it promises to pay 100 at time T = 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts