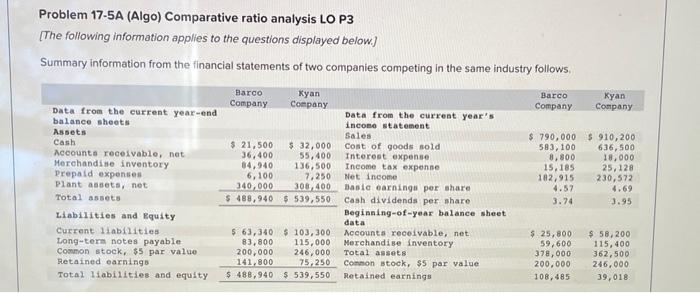

Question: Please help! Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements

![information applies to the questions displayed below.] Summary information from the financial](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eaedbf37621_31866eaedbec6abe.jpg)

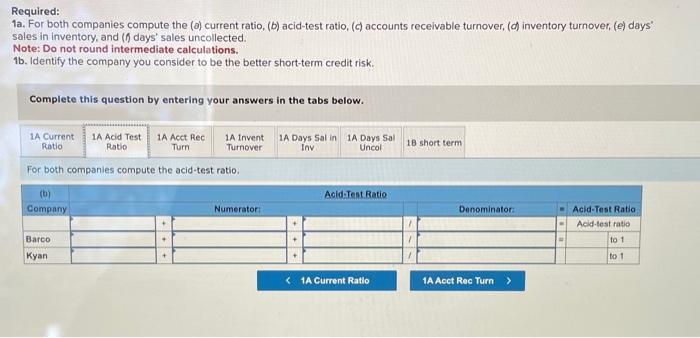

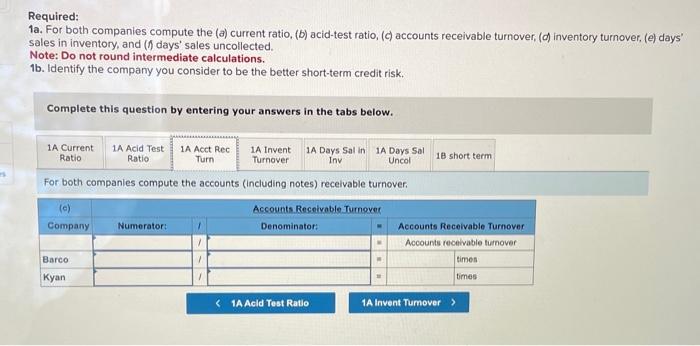

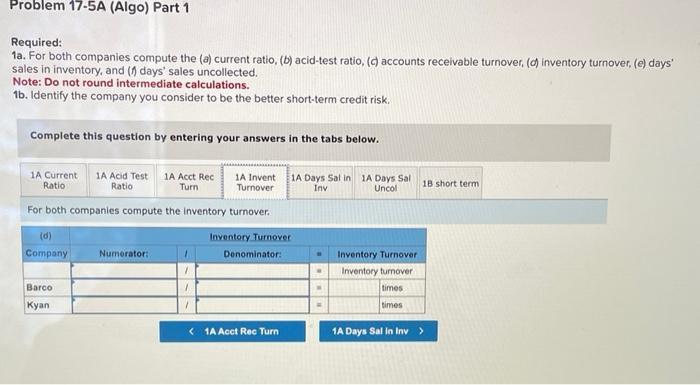

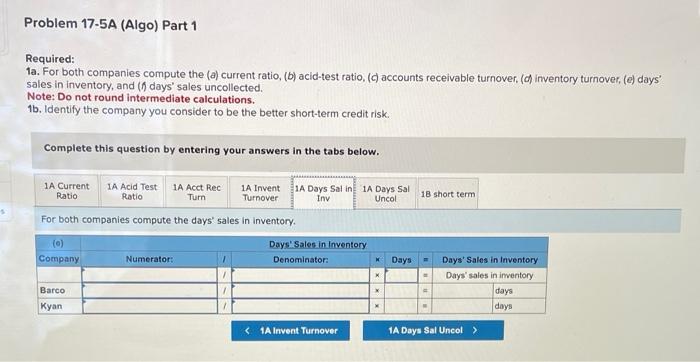

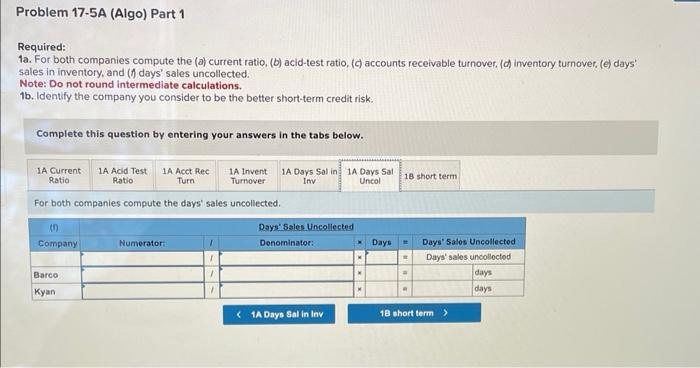

Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows, Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required: la. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) inventory turnover, (e) days: sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( ( days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) recelvable turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, ( ( ) inventory turnover, (e) days' sales in inventory, and (I) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (c) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts