Question: please help Problem 2 A policy application of the One Input/One Output model and In a perfectly competitive market, twenty firms compete for customers. Ten

please help

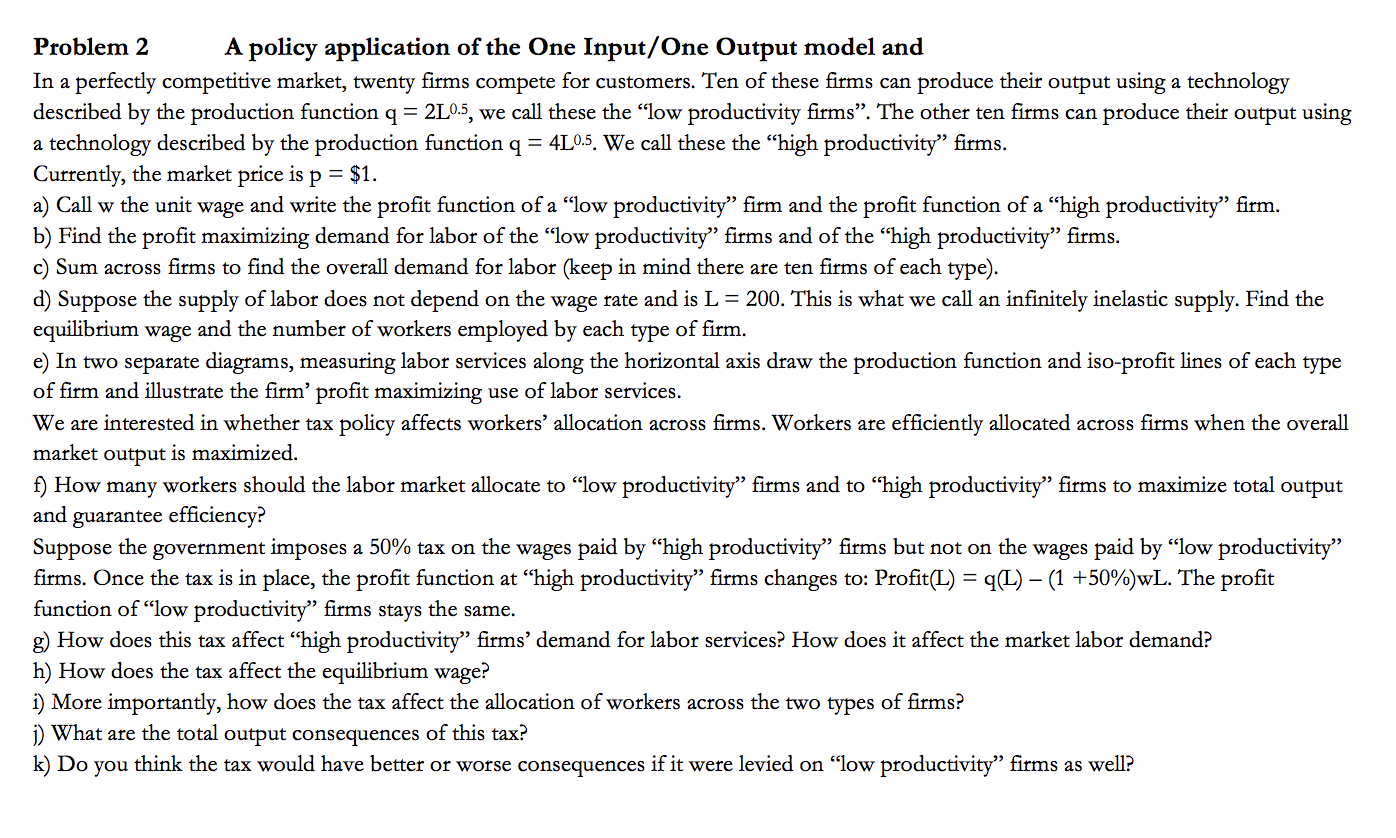

Problem 2 A policy application of the One Input/One Output model and In a perfectly competitive market, twenty firms compete for customers. Ten of these firms can produce their output using a technology described by the production function q = 2105, we call these the "low productivity firms". The other ten firms can produce their output using a technology described by the production function q = 4L05. We call these the "high productivity" firms. Currently, the market price is p = $1. a) Call w the unit wage and write the profit function of a "low productivity" firm and the profit function of a "high productivity" firm. b) Find the profit maximizing demand for labor of the "low productivity" firms and of the "high productivity" firms. c) Sum across firms to find the overall demand for labor (keep in mind there are ten firms of each type). d) Suppose the supply of labor does not depend on the wage rate and is L = 200. This is what we call an infinitely inelastic supply. Find the equilibrium wage and the number of workers employed by each type of firm. e) In two separate diagrams, measuring labor services along the horizontal axis draw the production function and iso-profit lines of each type of firm and illustrate the firm' profit maximizing use of labor services. We are interested in whether tax policy affects workers' allocation across firms. Workers are efficiently allocated across firms when the overall market output is maximized. f) How many workers should the labor market allocate to "low productivity" firms and to "high productivity" firms to maximize total output and guarantee efficiency? Suppose the government imposes a 50% tax on the wages paid by "high productivity" firms but not on the wages paid by "low productivity" firms. Once the tax is in place, the profit function at "high productivity" firms changes to: Profit(L) = q(L) - (1 +50%)wL. The profit function of "low productivity" firms stays the same. g) How does this tax affect "high productivity" firms' demand for labor services? How does it affect the market labor demand? h) How does the tax affect the equilibrium wage? i) More importantly, how does the tax affect the allocation of workers across the two types of firms? j) What are the total output consequences of this tax? k) Do you think the tax would have better or worse consequences if it were levied on "low productivity" firms as well

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts