Question: Please help Problem 2 I don't see any corrections to this problem in this file. You need to recalculate the unrealized gain in the beginning

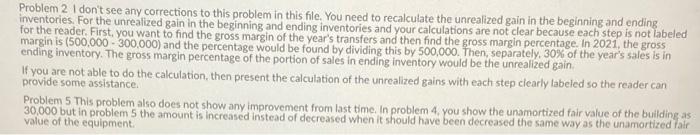

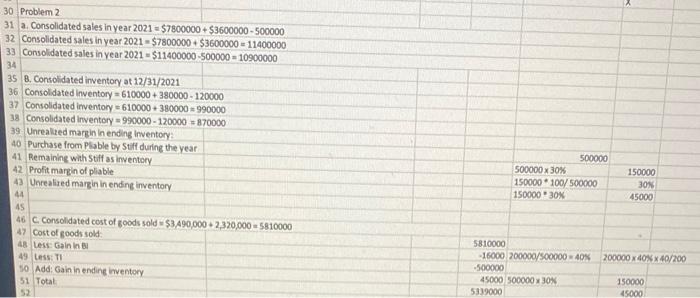

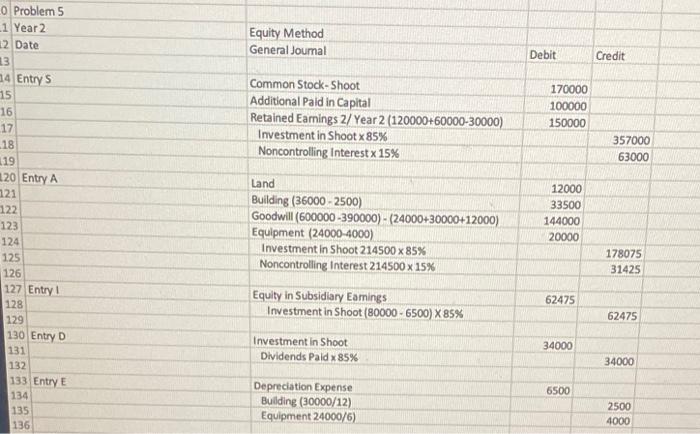

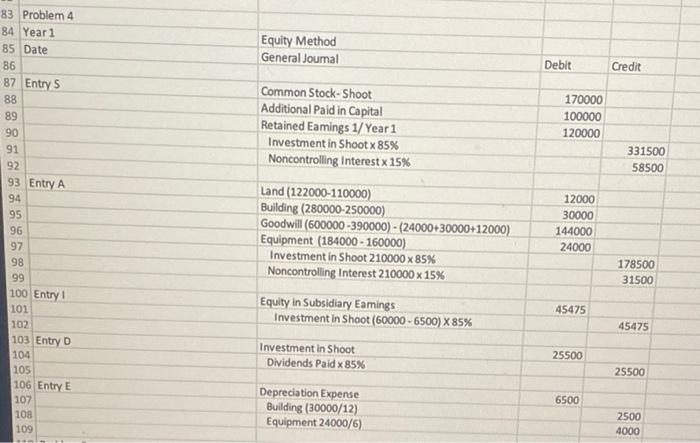

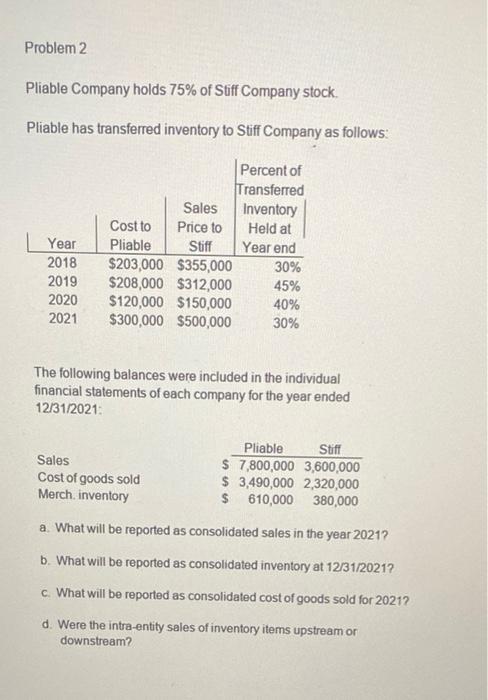

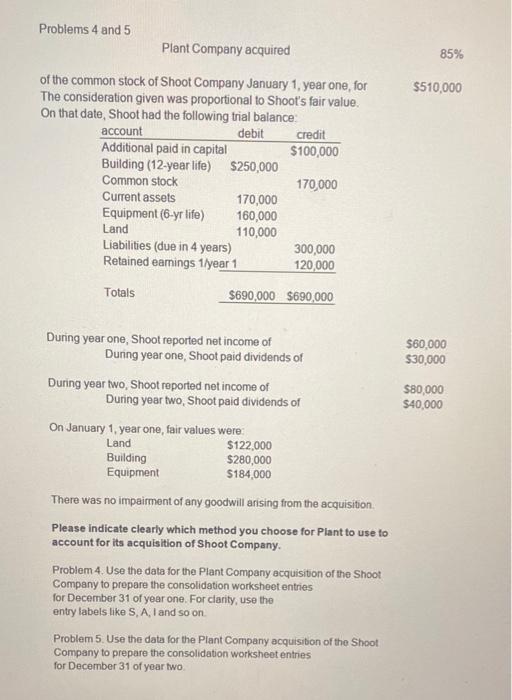

Problem 2 I don't see any corrections to this problem in this file. You need to recalculate the unrealized gain in the beginning and ending inventories. For the unrealized gain in the beginning and ending inventories and your calculations are not clear because each step is not labeled for the reader. First, you want to find the gross margin of the year's transfers and then find the gross margin percentage. In 2021, the gross margin is (500,000 - 300.000) and the percentage would be found by dividing this by 500,000. Then, separately. 30% of the year's sales is in ending inventory. The gross margin percentage of the portion of sales in ending inventory would be the unrealized gain If you are not able to do the calculation, then present the calculation of the unrealized gains with each step clearly labeled so the reader can provide some assistance, Problem 5 This problem also does not show any improvement from last time. In problem 4, you show the unamortized fair value of the building as 30,000 but in problems the amount is increased instead of decreased when it should have been decreased the same way as the unamortized Vair value of the equipment. 30 Problem 2 31 a. Consolidated sales in year 2021 - 57800000 + $3600000-500000 32 Consolidated sales in year 2021 - $7800000 $3600000 = 11400000 33 Consolidated sales in year 2021-$11400000-500000 - 10900000 34 35 B. Consolidated inventory at 12/31/2021 36 Consolidated Inventory - 610000+ 380000 - 120000 37 Consolidated inventory 610000 + 380000 = 990000 38 Consolidated inventory 990000 - 120000 870000 39 Unrealized marginin ending inventory 40 Purchase from Plable by Suff during the year 41 Remaining with Stuff as inventory 42 Profit margin of pliable 4) Unrealized marginin ending inventory 44 45 46 Consolidated cost of goods sold $3,490,000 2,320,000 5810000 47 Cost of goods sold A Less Gain in 49 Less: TI 50 Add: Gain in ending inventory 51 Total 500000 500000 x 30% 150000 100/500000 150000 30% 150000 30% 45000 200000 x 40 x 40/200 5810000 16000 200000/500000 - 40% -500000 45000 500000 x 30 5319000 150000 45000 Equity Method General Journal Debit Credit Common Stock-Shoot Additional Pald in Capital Retained Earnings 2/ Year 2 (120000+60000-30000) Investment in Shoot x 85% Noncontrolling Interest x 15% 170000 100000 150000 357000 63000 0 Problem 5 1 Year 2 12 Date 13 14 Entry 15 16 17 .18 119 120 Entry A 121 122 123 124 125 126 127 Entry! 128 129 130 Entry D 131 132 133 Entry E 134 135 136 Land Building (36000-2500) Goodwill (600000-390000) - (24000+30000+12000) Equipment (24000-4000) Investment in Shoot 214500 x 85% Noncontrolling Interest 214500 x 15% 12000 33500 144000 20000 178075 31425 Equity in Subsidiary Earnings Investment in Shoot (80000 - 6500) X 85% 62475 62475 Investment in Shoot Dividends Paldx85% 34000 34000 6500 Depreciation Expense Building (30000/12) Equipment 24000/6) 2500 4000 83 Problem 4 84 Year 1 85 Date 86 87 Entry 88 Equity Method General Journal Debit Credit 89 Common Stock-Shoot Additional Paid in Capital Retained Earings 1/ Year 1 Investment in Shoot x 85% Noncontrolling Interest x 15% 170000 100000 120000 331500 58500 12000 30000 144000 24000 90 91 92 93 Entry A 94 95 96 97 98 99 100 Entry 101 102 103 Entry D 104 105 106 Entry E 107 108 109 Land (122000-110000) Building (280000-250000) Goodwill (600000-390000) - (24000+30000+12000) Equipment (184000 - 160000) Investment in Shoot 210000 x 85% Noncontrolling Interest 210000 x 15% Equity in Subsidiary Earings Investment in Shoot (60000 - 6500) X 85% 178500 31500 45475 45475 Investment in Shoot Dividends Paid x 85% 25500 25500 6500 Depreciation Expense Building (30000/12) Equipment 24000/6) 2500 4000 Problem 2 Pliable Company holds 75% of Stiff Company stock Pliable has transferred inventory to Stiff Company as follows: Year 2018 2019 2020 2021 Percent of Transferred Sales Inventory Cost to Price to Held at Pliable Stiff Year end $203,000 $355,000 30% $208,000 $312,000 45% $120,000 $150,000 40% $300,000 $500,000 30% The following balances were included in the individual financial statements of each company for the year ended 12/31/2021: Pliable Stiff Sales $ 7,800,000 3,600,000 Cost of goods sold $ 3,490,000 2,320,000 Merch. inventory $ 610,000 380,000 a. What will be reported as consolidated sales in the year 2021? b. What will be reported as consolidated inventory at 12/31/2021? c. What will be reported as consolidated cost of goods sold for 20212 d. Were the intra-entity sales of inventory items upstream or downstream? Problems 4 and 5 Plant Company acquired 85% $510,000 of the common stock of Shoot Company January 1, year one, for The consideration given was proportional to Shoot's fair value. On that date, Shoot had the following trial balance account debit credit Additional paid in capital $100,000 Building (12-year life) $250,000 Common stock 170,000 Current assets 170,000 Equipment (6-yr life) 160,000 Land 110,000 Liabilities (due in 4 years) 300,000 Retained earnings 1/year 1 120,000 Totals $690,000 $690,000 $60.000 $30,000 $80,000 $40,000 During year one, Shoot reported net income of During year one, Shoot paid dividends of During year two, Shoot reported net income of During year two, Shoot paid dividends of On January 1 year one, fair values were: Land $122,000 Building $280,000 Equipment $184,000 There was no impairment of any goodwill arising from the acquisition Please indicate clearly which method you choose for Plant to use to account for its acquisition of Shoot Company Problem 4. Use the data for the Plant Company acquisition of the Shoot Company to prepare the consolidation worksheet entries for December 31 of year one. For clarity, use the entry labels like S, A, I and so on Problem 5. Use the data for the Plant Company acquisition of the Shoot Company to prepare the consolidation worksheet entries for December 31 of year two Problem 2 I don't see any corrections to this problem in this file. You need to recalculate the unrealized gain in the beginning and ending inventories. For the unrealized gain in the beginning and ending inventories and your calculations are not clear because each step is not labeled for the reader. First, you want to find the gross margin of the year's transfers and then find the gross margin percentage. In 2021, the gross margin is (500,000 - 300.000) and the percentage would be found by dividing this by 500,000. Then, separately. 30% of the year's sales is in ending inventory. The gross margin percentage of the portion of sales in ending inventory would be the unrealized gain If you are not able to do the calculation, then present the calculation of the unrealized gains with each step clearly labeled so the reader can provide some assistance, Problem 5 This problem also does not show any improvement from last time. In problem 4, you show the unamortized fair value of the building as 30,000 but in problems the amount is increased instead of decreased when it should have been decreased the same way as the unamortized Vair value of the equipment. 30 Problem 2 31 a. Consolidated sales in year 2021 - 57800000 + $3600000-500000 32 Consolidated sales in year 2021 - $7800000 $3600000 = 11400000 33 Consolidated sales in year 2021-$11400000-500000 - 10900000 34 35 B. Consolidated inventory at 12/31/2021 36 Consolidated Inventory - 610000+ 380000 - 120000 37 Consolidated inventory 610000 + 380000 = 990000 38 Consolidated inventory 990000 - 120000 870000 39 Unrealized marginin ending inventory 40 Purchase from Plable by Suff during the year 41 Remaining with Stuff as inventory 42 Profit margin of pliable 4) Unrealized marginin ending inventory 44 45 46 Consolidated cost of goods sold $3,490,000 2,320,000 5810000 47 Cost of goods sold A Less Gain in 49 Less: TI 50 Add: Gain in ending inventory 51 Total 500000 500000 x 30% 150000 100/500000 150000 30% 150000 30% 45000 200000 x 40 x 40/200 5810000 16000 200000/500000 - 40% -500000 45000 500000 x 30 5319000 150000 45000 Equity Method General Journal Debit Credit Common Stock-Shoot Additional Pald in Capital Retained Earnings 2/ Year 2 (120000+60000-30000) Investment in Shoot x 85% Noncontrolling Interest x 15% 170000 100000 150000 357000 63000 0 Problem 5 1 Year 2 12 Date 13 14 Entry 15 16 17 .18 119 120 Entry A 121 122 123 124 125 126 127 Entry! 128 129 130 Entry D 131 132 133 Entry E 134 135 136 Land Building (36000-2500) Goodwill (600000-390000) - (24000+30000+12000) Equipment (24000-4000) Investment in Shoot 214500 x 85% Noncontrolling Interest 214500 x 15% 12000 33500 144000 20000 178075 31425 Equity in Subsidiary Earnings Investment in Shoot (80000 - 6500) X 85% 62475 62475 Investment in Shoot Dividends Paldx85% 34000 34000 6500 Depreciation Expense Building (30000/12) Equipment 24000/6) 2500 4000 83 Problem 4 84 Year 1 85 Date 86 87 Entry 88 Equity Method General Journal Debit Credit 89 Common Stock-Shoot Additional Paid in Capital Retained Earings 1/ Year 1 Investment in Shoot x 85% Noncontrolling Interest x 15% 170000 100000 120000 331500 58500 12000 30000 144000 24000 90 91 92 93 Entry A 94 95 96 97 98 99 100 Entry 101 102 103 Entry D 104 105 106 Entry E 107 108 109 Land (122000-110000) Building (280000-250000) Goodwill (600000-390000) - (24000+30000+12000) Equipment (184000 - 160000) Investment in Shoot 210000 x 85% Noncontrolling Interest 210000 x 15% Equity in Subsidiary Earings Investment in Shoot (60000 - 6500) X 85% 178500 31500 45475 45475 Investment in Shoot Dividends Paid x 85% 25500 25500 6500 Depreciation Expense Building (30000/12) Equipment 24000/6) 2500 4000 Problem 2 Pliable Company holds 75% of Stiff Company stock Pliable has transferred inventory to Stiff Company as follows: Year 2018 2019 2020 2021 Percent of Transferred Sales Inventory Cost to Price to Held at Pliable Stiff Year end $203,000 $355,000 30% $208,000 $312,000 45% $120,000 $150,000 40% $300,000 $500,000 30% The following balances were included in the individual financial statements of each company for the year ended 12/31/2021: Pliable Stiff Sales $ 7,800,000 3,600,000 Cost of goods sold $ 3,490,000 2,320,000 Merch. inventory $ 610,000 380,000 a. What will be reported as consolidated sales in the year 2021? b. What will be reported as consolidated inventory at 12/31/2021? c. What will be reported as consolidated cost of goods sold for 20212 d. Were the intra-entity sales of inventory items upstream or downstream? Problems 4 and 5 Plant Company acquired 85% $510,000 of the common stock of Shoot Company January 1, year one, for The consideration given was proportional to Shoot's fair value. On that date, Shoot had the following trial balance account debit credit Additional paid in capital $100,000 Building (12-year life) $250,000 Common stock 170,000 Current assets 170,000 Equipment (6-yr life) 160,000 Land 110,000 Liabilities (due in 4 years) 300,000 Retained earnings 1/year 1 120,000 Totals $690,000 $690,000 $60.000 $30,000 $80,000 $40,000 During year one, Shoot reported net income of During year one, Shoot paid dividends of During year two, Shoot reported net income of During year two, Shoot paid dividends of On January 1 year one, fair values were: Land $122,000 Building $280,000 Equipment $184,000 There was no impairment of any goodwill arising from the acquisition Please indicate clearly which method you choose for Plant to use to account for its acquisition of Shoot Company Problem 4. Use the data for the Plant Company acquisition of the Shoot Company to prepare the consolidation worksheet entries for December 31 of year one. For clarity, use the entry labels like S, A, I and so on Problem 5. Use the data for the Plant Company acquisition of the Shoot Company to prepare the consolidation worksheet entries for December 31 of year two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts