Question: please help Problem 2. Michael, Inc. is an investment advisory firm that uses an asset allocation model that recommends the portion of each client's portfolio

please help

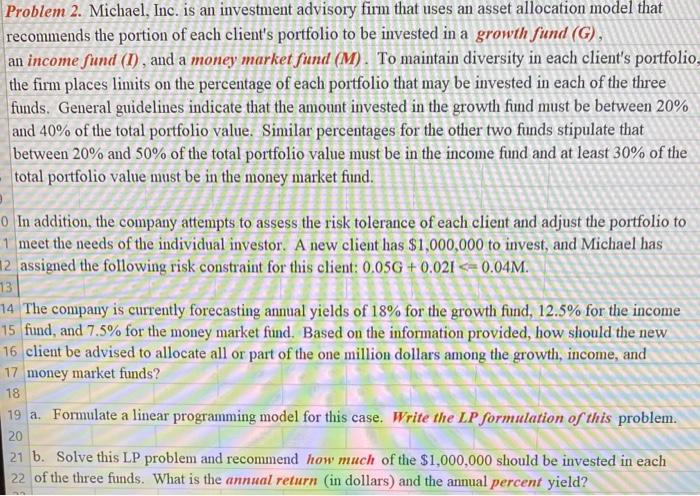

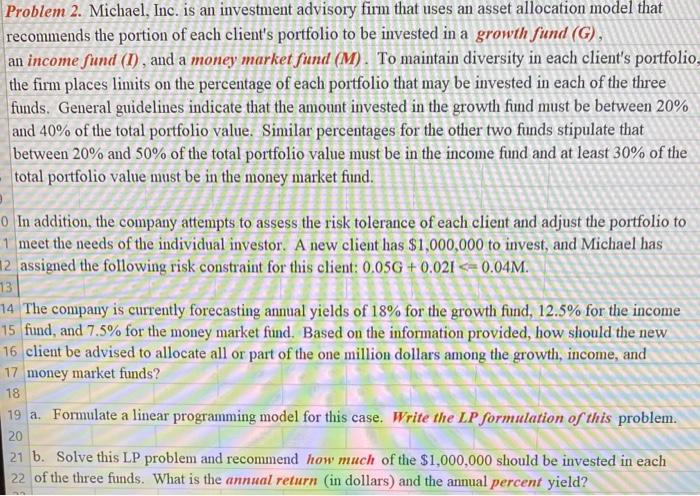

Problem 2. Michael, Inc. is an investment advisory firm that uses an asset allocation model that recommends the portion of each client's portfolio to be invested in a growth fund (G), an income fund (I), and a money market fund (M). To maintain diversity in each client's portfolio, the firm places limits on the percentage of each portfolio that may be invested in each of the three funds. General guidelines indicate that the amount invested in the growth fund must be between 20% and 40% of the total portfolio value. Similar percentages for the other two funds stipulate that between 20% and 50% of the total portfolio value must be in the income fund and at least 30% of the total portfolio value must be in the money market fund. 0 In addition, the company attempts to assess the risk tolerance of each client and adjust the portfolio to 1 meet the needs of the individual investor. A new client has $1,000,000 to invest, and Michael has assigned the following risk constraint for this client: 0.05G+0.02I

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock