Question: Please help! :( Problem 22-12 Your answer is partially correct. Try again. On January 3, 2019, Buffalo Company purchased for $503,000 cash a 10% interest

Please help! :(

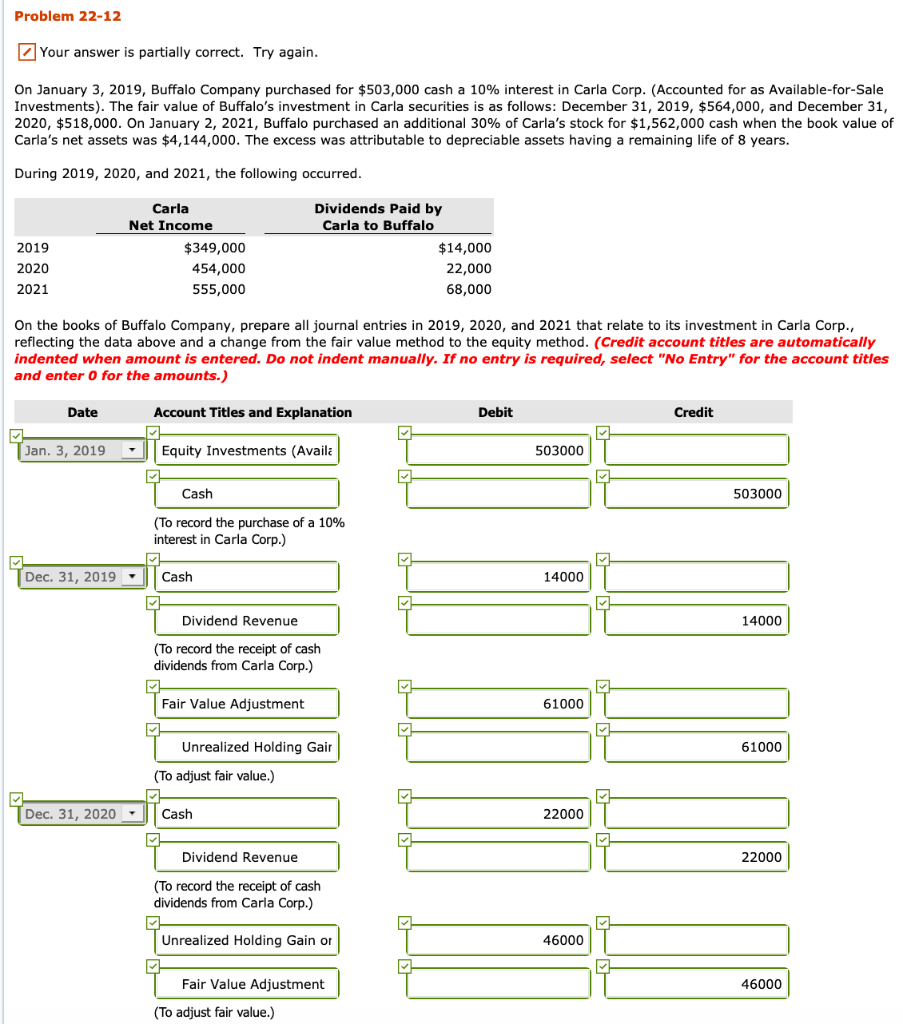

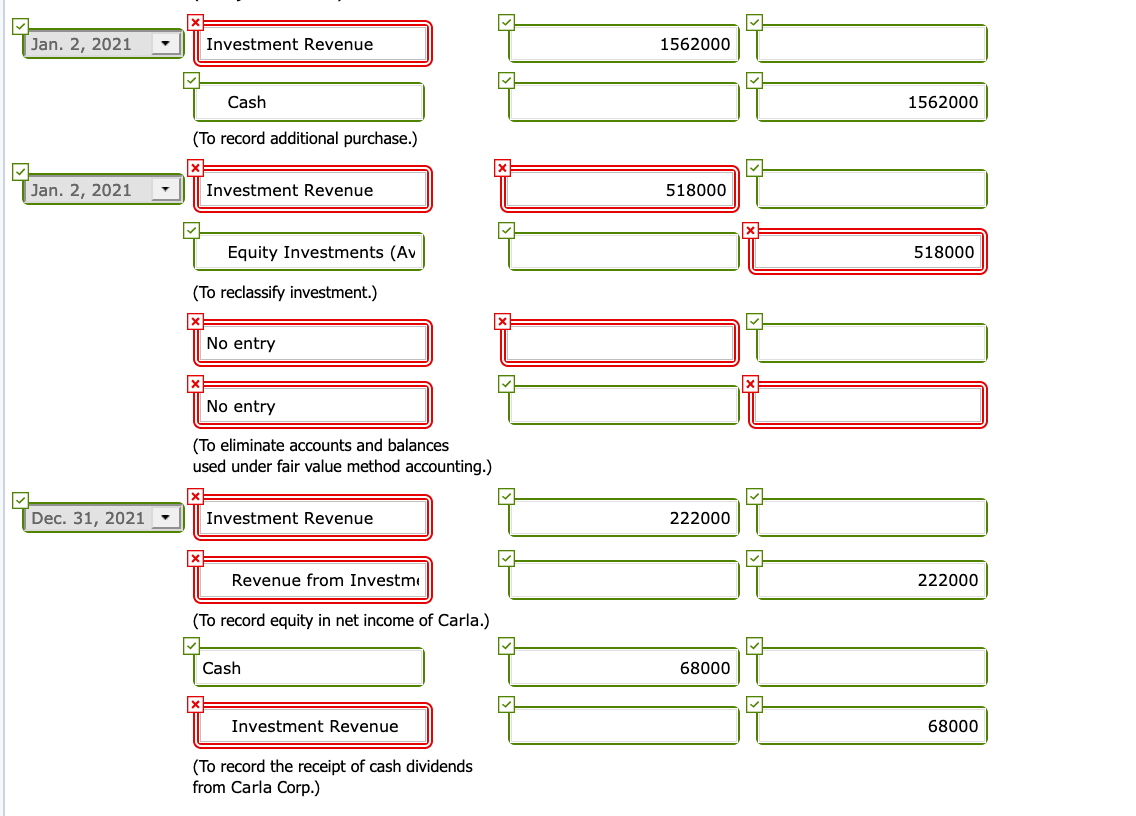

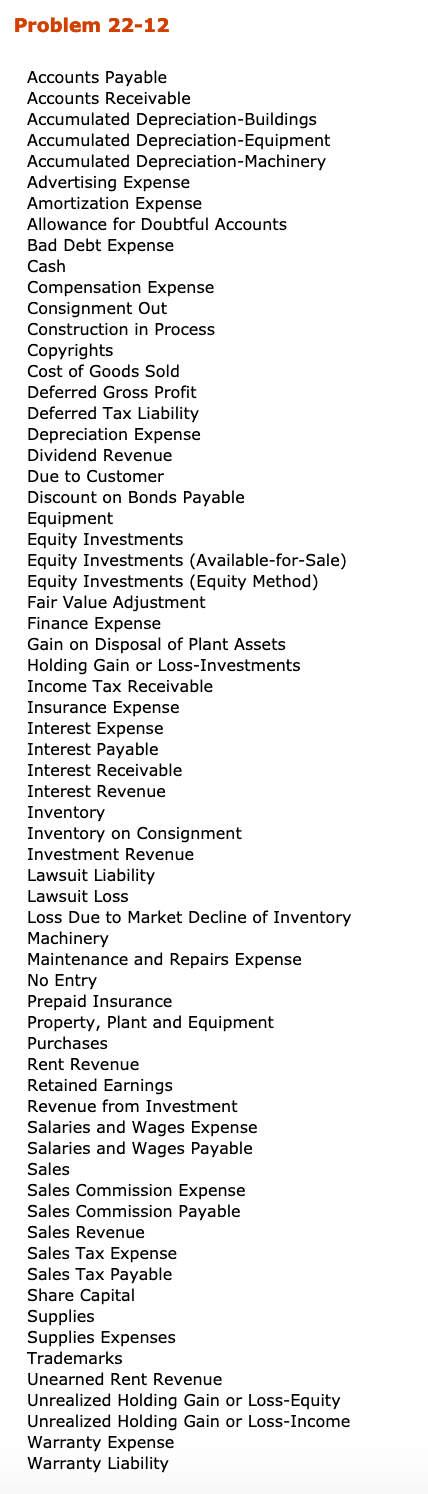

Problem 22-12 Your answer is partially correct. Try again. On January 3, 2019, Buffalo Company purchased for $503,000 cash a 10% interest in Carla Corp. (Accounted for as Available-for-Sale Investments). The fair value of Buffalo's investment in Carla securities is as follows: December 31, 2019, $564,000, and December 31, 2020, $518,000. On January 2, 2021, Buffalo purchased an additional 30% of Carla's stock for $1,562,000 cash when the book value of Carla's net assets was $4,144,000. The excess was attributable to depreciable assets having a remaining life of 8 years. During 2019, 2020, and 2021, the following occurred. 2019 2020 2021 Carla Net Income $349,000 454,000 555,000 Dividends Paid by Carla to Buffalo $14,000 22,000 68,000 On the books of Buffalo Company, prepare all journal entries in 2019, 2020, and 2021 that relate to its investment in Carla Corp. reflecting the data above and a change from the fair value method to the equity method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit [Jan. 3, 2019 Equity Investments (Availa 503000 S03000 TT Cash 503000 (To record the purchase of a 10% interest in Carla Corp.) Dec. 31, 2019 - Cash 14000 Dividend Revenue 14000 (To record the receipt of cash dividends from Carla Corp.) Fair Value Adjustment 61000 61000 Unrealized Holding Gair (To adjust fair value.) Dec. 31, 2020 - T Cash T. 22000 Dividend Revenue 22000 (To record the receipt of cash dividends from Carla Corp.) Unrealized Holding Gain or 46000 Fair Value Adjustment 46000 (To adjust fair value.) Jan. 2, 2021 Investment Revenue 1562000 1562000 Cash (To record additional purchase.) Jan. 2, 2021 Investment Revenue 518000 Equity Investments (AV 518000 (To reclassify investment.) T No entry No entry (To eliminate accounts and balances used under fair value method accounting.) Dec. 31, 2021 - Investment Revenue 222000 Revenue from Investm 222000 (To record equity in net income of Carla.) Cash 68000 Investment Revenue 68000 (To record the receipt of cash dividends from Carla Corp.) Problem 22-12 Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation Equipment Accumulated Depreciation-Machinery Advertising Expense Amortization Expense Allowance for Doubtful Accounts Bad Debt Expense Cash Compensation Expense Consignment Out Construction in Process Copyrights Cost of Goods Sold Deferred Gross Profit Deferred Tax Liability Depreciation Expense Dividend Revenue Due to Customer Discount on Bonds Payable Equipment Equity Investments Equity Investments (Available-for-Sale) Equity Investments (Equity Method) Fair Value Adjustment Finance Expense Gain on Disposal of Plant Assets Holding Gain or Loss-Investments Income Tax Receivable Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Inventory on Consignment Investment Revenue Lawsuit Liability Lawsuit Loss Loss Due to Market Decline of Inventory Machinery Maintenance and Repairs Expense No Entry Prepaid Insurance Property, plant and Equipment Purchases Rent Revenue Retained Earnings Revenue from Investment Salaries and Wages Expense Salaries and Wages Payable Sales Sales Commission Expense Sales Commission Payable Sales Revenue Sales Tax Expense Sales Tax Payable Share Capital Supplies Supplies Expenses Trademarks Unearned Rent Revenue Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income Warranty Expense Warranty Liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts