Question: Please help!! Problem 3 (40%) Boeing is the world's largest aerospace and defense firm. With headquarters in Chicago, the firm operates in four segments, commercial

Please help!!

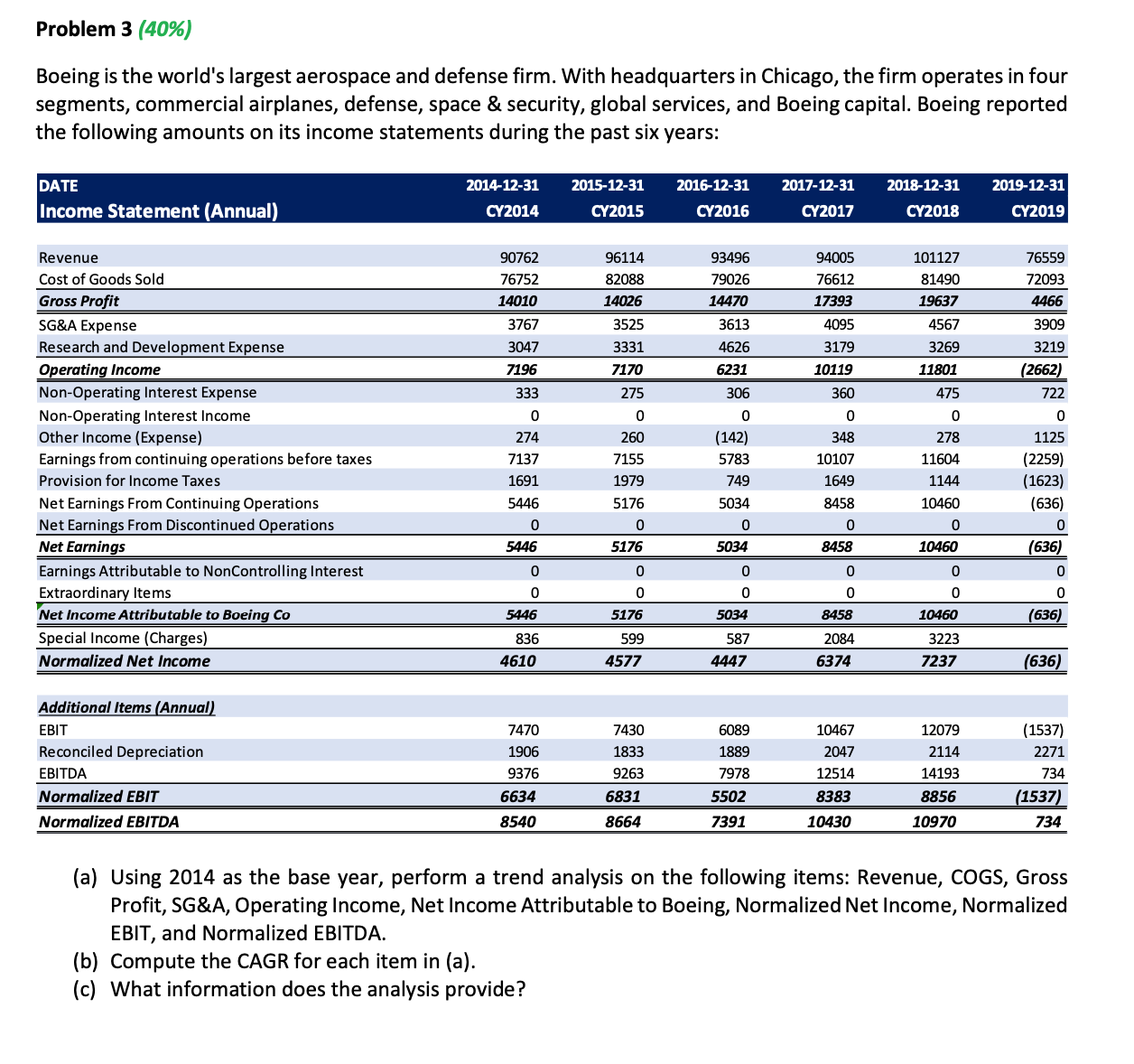

Problem 3 (40%) Boeing is the world's largest aerospace and defense firm. With headquarters in Chicago, the firm operates in four segments, commercial airplanes, defense, space & security, global services, and Boeing capital. Boeing reported the following amounts on its income statements during the past six years: 2015-12-31 2016-12-31 2017-12-31 2019-12-31 DATE 2014-12-31 2018-12-31 CY2014 CY2015 CY2016 CY2017 CY2018 CY2019 Income Statement (Annual) 90762 96114 93496 94005 101127 76559 Revenue Cost of Goods Sold 6752 82088 79026 76612 81490 72093 4010 14026 14470 7393 19637 4466 Gross Profit 3613 4095 SG&A Expense 3767 3525 4567 3909 Research and Development Expense 3047 3331 4626 179 3269 3219 7196 5231 11801 2662) Operating Income 7170 10119 333 275 306 360 175 722 Non-Operating Interest Expense 0 Non-Operating Interest Income 274 260 142) 348 278 1125 Other Income (Expense) Earnings from continuing operations before taxes 7137 7155 5783 10107 11604 (2259) 1649 1144 1623) Provision for Income Taxes 1691 1979 749 Net Earnings From Continuing Operations 5446 5176 5034 8458 10460 (636) Net Earnings From Discontinued Operations 5446 5176 5034 8458 10460 636) Net Earnings Earnings Attributable to NonControlling Interest 0 0 0 Extraordinary Items Net Income Attributable to Boeing Co 5446 5176 5034 8458 10460 636) 836 599 587 2084 3223 Special Income (Charges 1610 4577 1447 6374 7237 636) Normalized Net Income Additional Items (Annual) EBIT 7470 7430 6089 10467 12079 (1537) Reconciled Depreciation 1906 1833 1889 2047 2114 2271 9376 7978 12514 14193 734 EBITDA 9263 Normalized EBIT 6634 6831 5502 8383 8856 1537) 540 8664 7391 10430 1097 734 Normalized EBITDA (a) Using 2014 as the base year, perform a trend analysis on the following items: Revenue, COGS, Gross Profit, SG&A, Operating Income, Net Income Attributable to Boeing, Normalized Net Income, Normalized EBIT, and Normalized EBITDA (b) Compute the CAGR for each item in (a). (c) What information does the analysis provide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts