Question: Please help : Problem 7 (10 Points) (a) Cinema Paradiso Company purchased equipment on January 1, 2013 for $110,000 and estimated a $10,000 salvage value

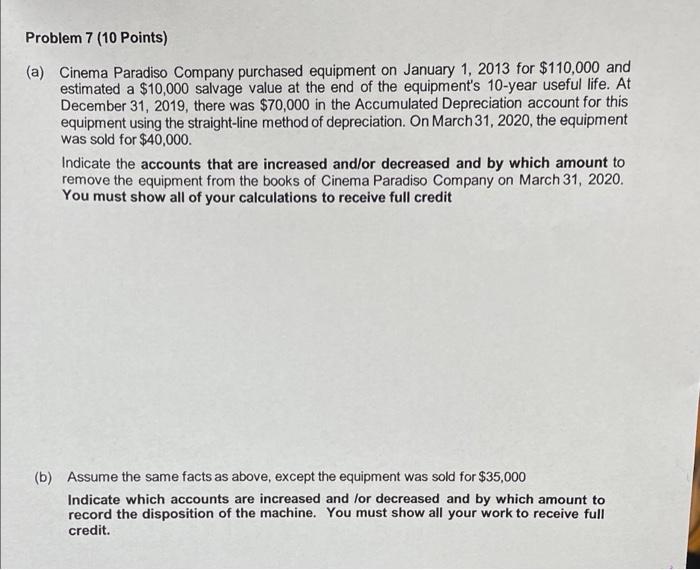

Problem 7 (10 Points) (a) Cinema Paradiso Company purchased equipment on January 1, 2013 for $110,000 and estimated a $10,000 salvage value at the end of the equipment's 10-year useful life. At December 31, 2019, there was $70,000 in the Accumulated Depreciation account for this equipment using the straight-line method of depreciation. On March 31, 2020, the equipment was sold for $40,000. Indicate the accounts that are increased and/or decreased and by which amount to remove the equipment from the books of Cinema Paradiso Company on March 31, 2020. You must show all of your calculations to receive full credit (b) Assume the same facts as above, except the equipment was sold for $35,000 Indicate which accounts are increased and lor decreased and by which amount to record the disposition of the machine. You must show all your work to receive full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts