Question: Please help. Problem 8-48 (b) (LO. 2, 4) On April 30, 2018, Floyd purchased and placed in service a new $30,000 car. The car was

Please help.

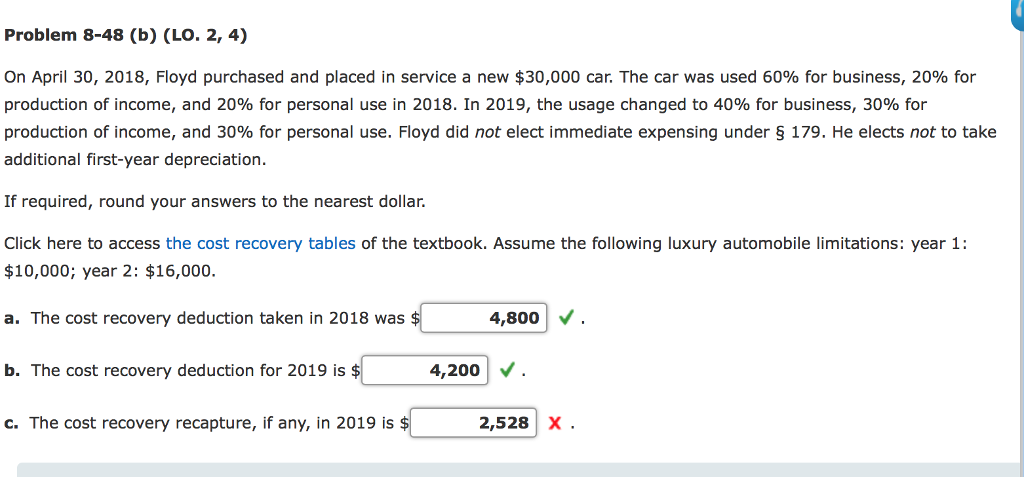

Problem 8-48 (b) (LO. 2, 4) On April 30, 2018, Floyd purchased and placed in service a new $30,000 car. The car was used 60% for business, 2096 for production of income, and 20% for personal use in 2018, In 2019, the usage changed to 40% for business, 30% for production of income, and 30% for personal use. Floyd did not elect immediate expensing under 179. He elects not to take additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,000; year 2: $16,000. 4,800 a. The cost recovery deduction taken in 2018 was b. The cost recovery deduction for 2019 is$ c. The cost recovery recapture, if any, in 2019 is 4,200 V . 2,528 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts