Question: please help & provide explanation. thank you! Selected financial data for Bahama Bay and Caribbean Key are as follows: (s in millions) Total assets Total

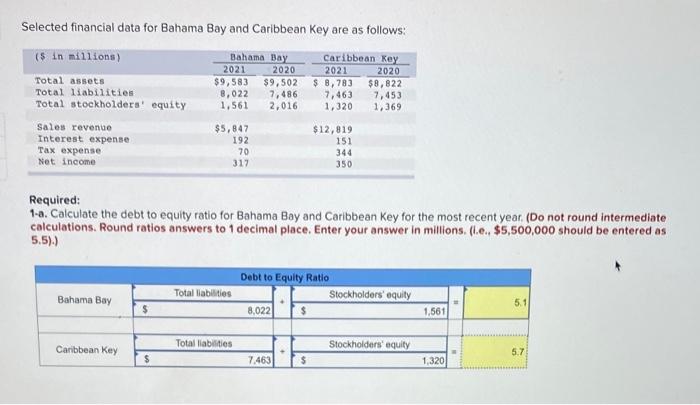

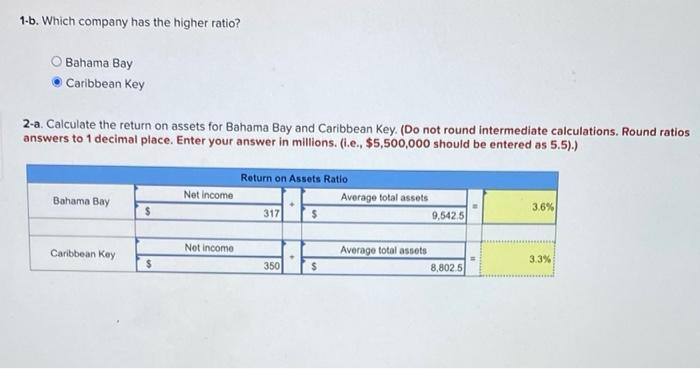

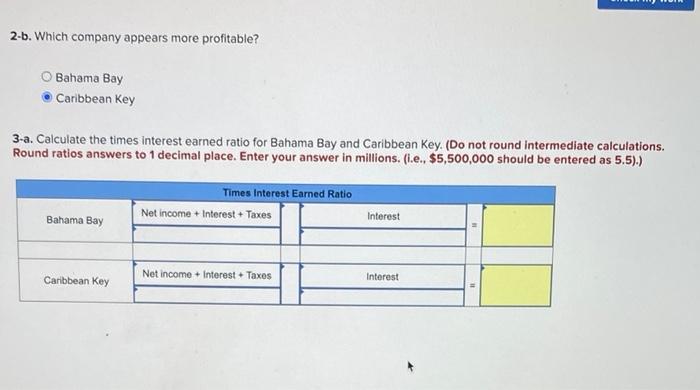

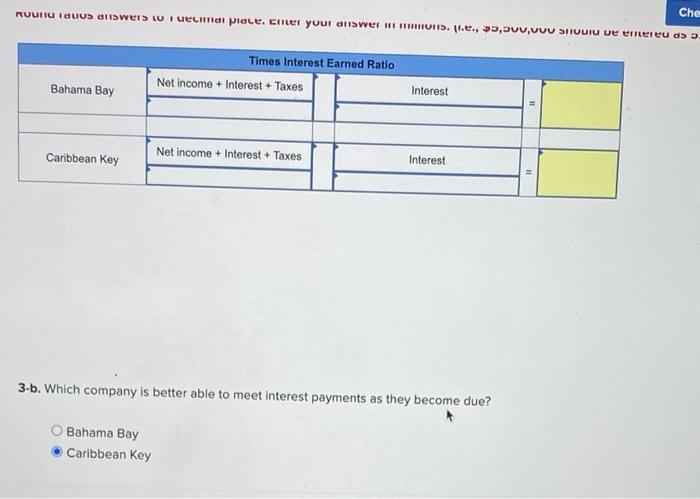

Selected financial data for Bahama Bay and Caribbean Key are as follows: (s in millions) Total assets Total liabilities Total stockholders' equity Bahama Bay 2021 2020 $9,583 $9,502 8,022 7,486 1,561 2,016 Caribbean Key 2021 2020 $ 8,783 $8,822 7,463 7,453 1,320 1,369 Sales revenue Interest expense Tax expense Net income $5,847 192 70 317 $12,819 151 344 350 Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year (Do not round intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (.e. $5,500,000 should be entered as 5.5).) Total liabilities Bahama Bay Debt to Equity Ratio Stockholders' equity 8,022 $ 5.1 $ 1.561 Total liabilities Caribbean Key Stockholders equity 5.7 $ 7.463 $ 1,320 1-b. Which company has the higher ratio? Bahama Bay Caribbean Key 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key. (Do not round intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (.e., $5,500,000 should be entered as 5.5).) Bahama Bay Return on Assets Ratio Net Income Average total assets 317 's 9,5425 $ 3.6% Caribbean Key Not income Average total assets 8,8025 3.3% $ 350 2-b. Which company appears more profitable? Bahama Bay Caribbean Key 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key. (Do not round Intermediate calculations. Round ratios answers to 1 decimal place. Enter your answer in millions. (i.e., $5,500,000 should be entered as 5.5).) Times Interest Earned Ratio Net income + Interest + Taxes Bahama Bay Interest Net income + Interest - Taxes Caribbean Key Interest RUUNU Iduus answers to Vendi piace. Cher your answer ONS..., 3,5vu,VOU SHUIU ve emereu as 3 Che Times Interest Earned Ratio Bahama Bay Net income + Interest + Taxes Interest Caribbean Key Net income + Interest + Taxes Interest 3-b. Which company is better able to meet interest payments as they become due? Bahama Bay Caribbean Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts