Question: Please help!!! Question 1 (10 points) Jordan Enterprises has outstanding a 7.50% coupon bond with a remaining maturity of 20 years. The face value of

Please help!!!

Please help!!!

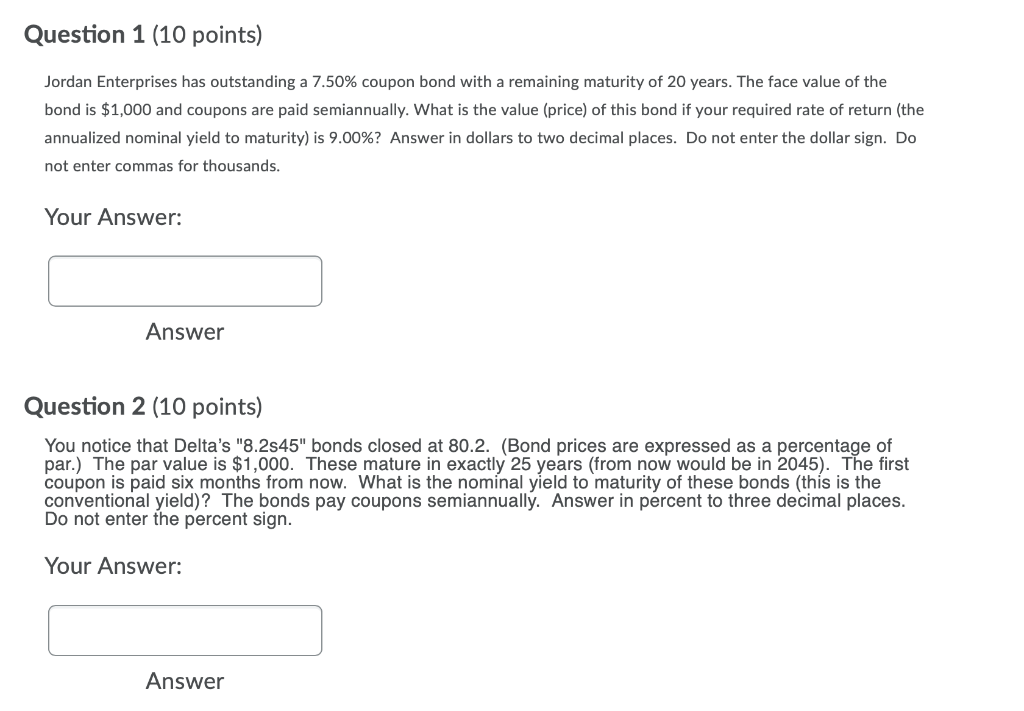

Question 1 (10 points) Jordan Enterprises has outstanding a 7.50% coupon bond with a remaining maturity of 20 years. The face value of the bond is $1,000 and coupons are paid semiannually. What is the value (price) of this bond if your required rate of return (the annualized nominal yield to maturity) is 9.00%? Answer in dollars to two decimal places. Do not enter the dollar sign. Do not enter commas for thousands. Your Answer: Answer Question 2 (10 points) You notice that Delta's "8.2545" bonds closed at 80.2. (Bond prices are expressed as a percentage of par.) The par value is $1,000. These mature in exactly 25 years (from now uld be in 2045). The first coupon is paid six months from now. What is the nominal yield to maturity of these bonds (this is the conventional yield)? The bonds pay coupons semiannually. Answer in percent to three decimal places. Do not enter the percent sign. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts