Question: Please help! Question 1 (10 points) SanitEyes, Inc. is a small producer of pharmaceutical products designed to treat commonly occuring eye disorders caused by allergies

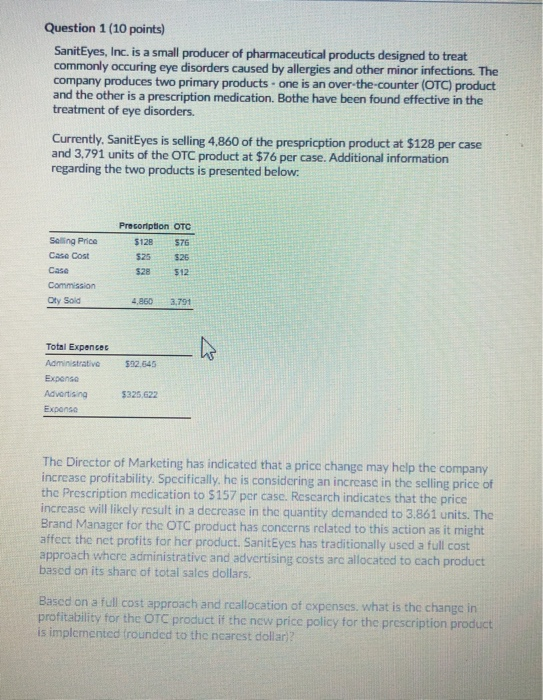

Question 1 (10 points) SanitEyes, Inc. is a small producer of pharmaceutical products designed to treat commonly occuring eye disorders caused by allergies and other minor infections. The company produces two primary products - one is an over-the-counter (OTC) product and the other is a prescription medication. Bothe have been found effective in the treatment of eye disorders. Currently, SanitEyes is selling 4,860 of the prespricption product at $128 per case and 3,791 units of the OTC product at $76 per case. Additional information regarding the two products is presented below: Presorption OTC ng Pro Case Cost Case Commission Oty Sold 4 DO 3.791 532.545 Total Expenses Administrative Expense Advertising Expense $325.622 The Director of Marketing has indicated that a price change may help the company increase profitability. Specifically, he is considering an increase in the selling price of the Prescription medication to $157 per case. Research indicates that the price increase will likely result in a decrease in the quantity demanded to 3.861 units. The Brand Manager for the OTC product has concerns related to this action as it might affect the net profits for her product. SanitEyes has traditionally used a full cost approach where administrative and advertising costs are allocated to cach product based on its share of total sales dollars. Based on a full cost approach and reallocation of expenses. What is the change in profitability for the OTC product if the new price policy for the prescription product is implemented frounded to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts