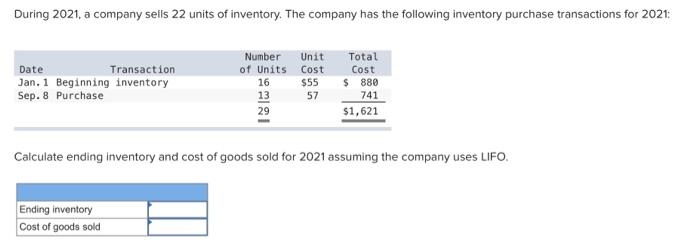

Question: please help Question 1: Question 2: During 2021, a company sells 22 units of inventory. The company has the following inventory purchase transactions for 2021:

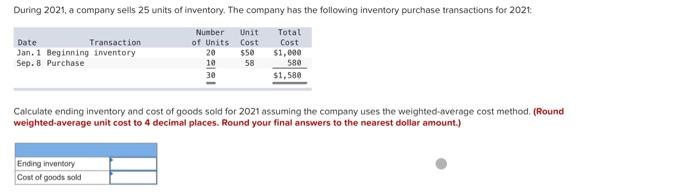

During 2021, a company sells 22 units of inventory. The company has the following inventory purchase transactions for 2021: Date Transaction Jan. 1 Beginning inventory Sep. 8 Purchase Number Unit of Units Cost 16 $55 13 57 29 Total Cost $ 880 741 $1,621 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses LIFO. Ending inventory Cost of goods sold During 2021, a company sells 25 units of inventory. The company has the following inventory purchase transactions for 2021 Number Unit Total Date Transaction of Units Cost Cost Jan. 1 Beginning inventory 20 $50 $1,000 Sep.8 Purchase 10 58 580 30 $1,580 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses the weighted-average cost method. (Round weighted-average unit cost to 4 decimal places. Round your final answers to the nearest dollar amount.) Ending inventory Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts