Question: please help QUESTION 1 Sasol Ltd is financing an oil depot with R140 000 of equity, being 25% of capital required. Bankers have approved a

please help

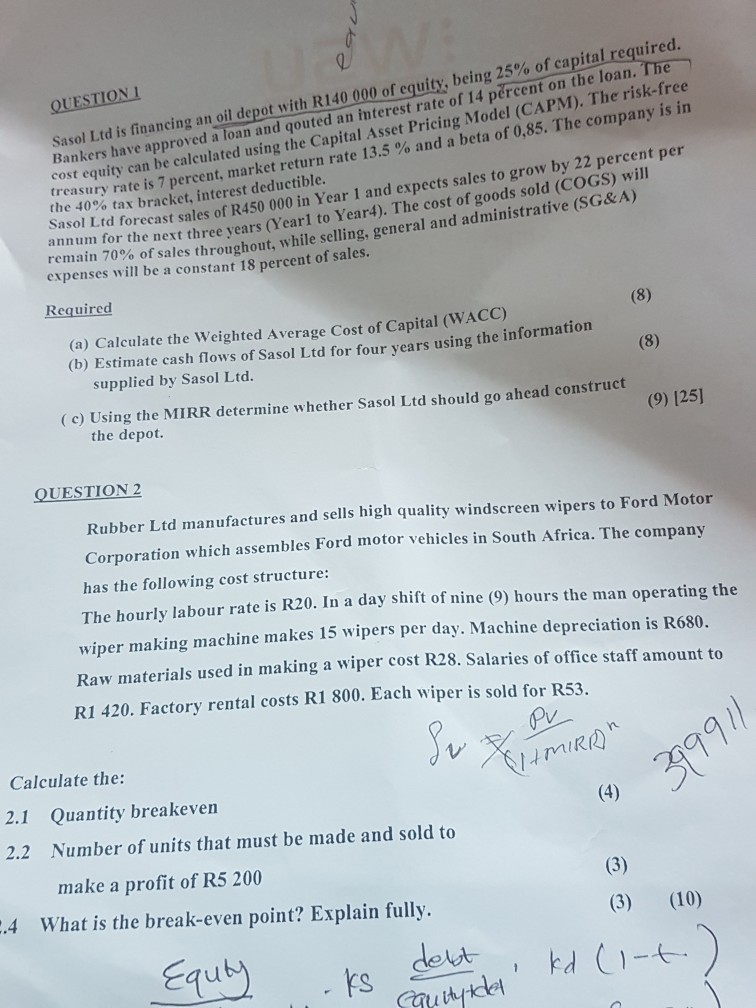

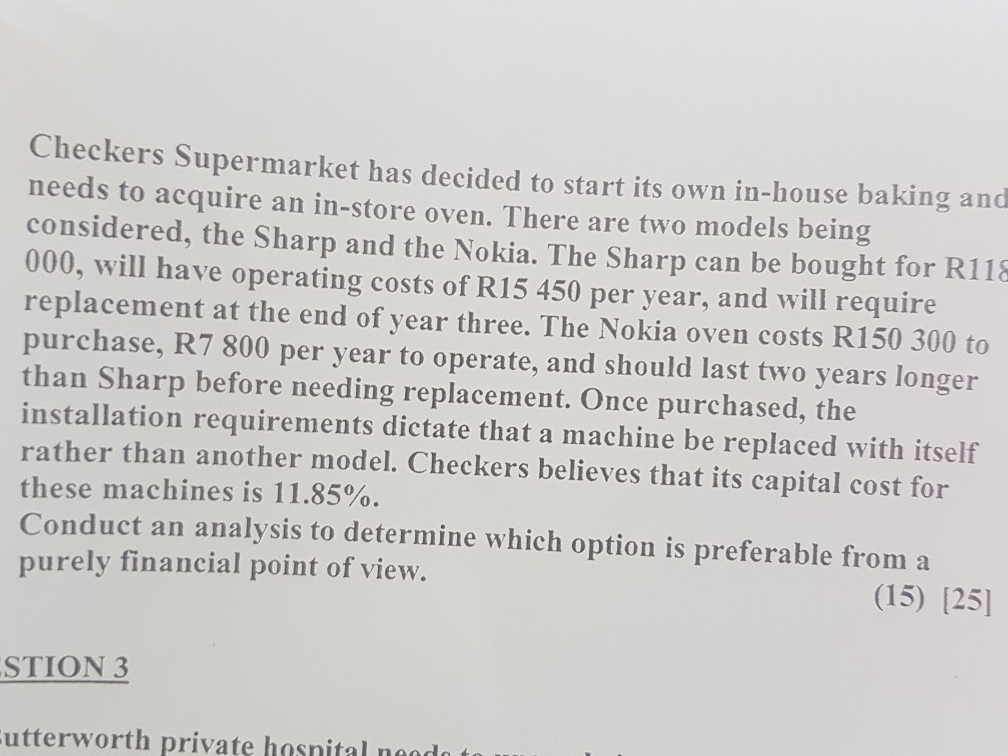

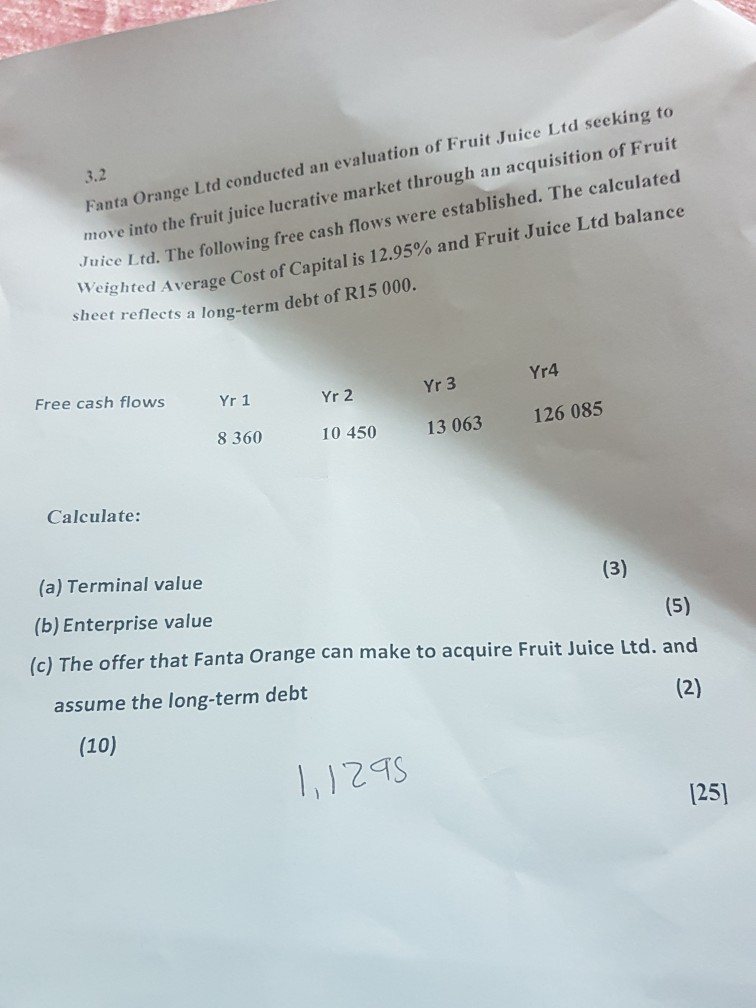

QUESTION 1 Sasol Ltd is financing an oil depot with R140 000 of equity, being 25% of capital required. Bankers have approved a loan and qouted an interest rate of 14 percent on the loan. The cost equity can be calculated using the Capital Asset Pricing Model (CAPM). The risk-free treasury rate is 7 percent, market return rate 13.5 % and a beta of 0,85. The company is in the 40% tax bracket, interest deductible. Ltd forecast sales of R450 000 in Year 1 and expects sales to grow by 22 percent per the next three years (Year1 to Year4). The cost of goods sold (COGS) will es throughout, while selling, general and administrative (SG&A) annum for the next three years expenses will be a constant 18 percent of sales. (8) Required (a) Calculate the Weighted Average Cost of Capital (WACC) (b) Estimate cash flows of Sasol Ltd for four years using the incon supplied by Sasol Ltd. (9) 125] (c) Using the MIRR determine whether Sasol Ltd should go ahead construct the depot. QUESTION 2 Rubber Ltd manufactures and sells high quality windscreen wipers to Ford Motor Corporation which assembles Ford motor vehicles in South Africa. The company has the following cost structure: The hourly labour rate is R20. In a day shift of nine (9) hours the man operating the wiper making machine makes 15 wipers per day. Machine depreciation is R680. Raw materials used in making a wiper cost R28. Salaries of office staff amount to R1 420. Factory rental costs R1 800. Each wiper is sold for R53. NIMIRROR 29991/ (1) Calculate the: 2.1 Quantity breakeven 2.2 Number of units that must be made and sold to make a profit of R5 200 5.4 What is the break-even point? Explain fully. (3) (10) Equty . Is dest kd (1+). quityidet Checkers Supermarket has decided to start its own in-house baking and needs to acquire an in-store oven. There are two models being considered, the Sharp and the Nokia. The Sharp can be bought for Rild 000, will have operating costs of R15 450 per year, and will require replacement at the end of year three. The Nokia oven costs R150 300 to purchase, R7 800 per year to operate, and should last two years longer than Sharp before needing replacement. Once purchased, the installation requirements dictate that a machine be replaced with itself rather than another model. Checkers believes that its capital cost for these machines is 11.85%. Conduct an analysis to determine which option is preferable from a purely financial point of view. (15) [25] STION 3 Outbroto 3.2 Fanta Orange Ltd conducted an evaluation of Fruit Juice Ltd seeking to move into the fruit juice lucrative market through an acquisition of Fruit nice Ltd. The following free cash flows were established. The calculated ghted Average Cost of Capital is 12.95% and Fruit Juice Ltd balance eflects a long-term debt of R15 000. sheet reflects a long-term Yr4 Free cash flows Yr 3 Yr 2 Yr 1 126 085 10 450 13 063 8 360 Calculate: (3) (a) Terminal value (5) (b) Enterprise value (c) The offer that Fanta Orange can make to acquire Fruit Juice Ltd. and (2) assume the long-term debt (10) 1125 [25]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts