Question: please help QUESTION 1 Which statement is true regarding gain contingencies? O GAAP does not permit the recording of gain contingencies until the transaction has

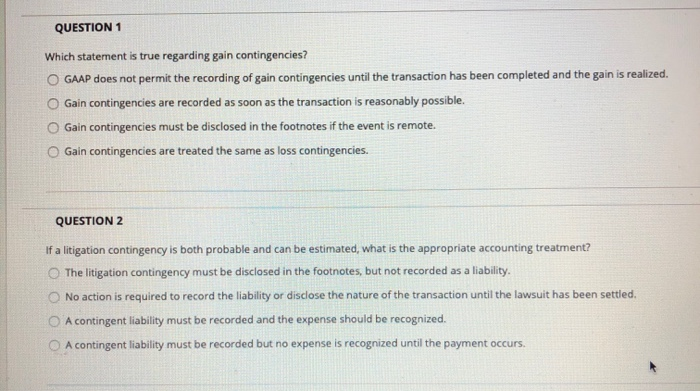

QUESTION 1 Which statement is true regarding gain contingencies? O GAAP does not permit the recording of gain contingencies until the transaction has been completed and the gain is realized. O Gain contingencies are recorded as soon as the transaction is reasonably possible. O Gain contingencies must be disclosed in the footnotes if the event is remote. Gain contingencies are treated the same as loss contingencies. QUESTION 2 If a litigation contingency is both probable and can be estimated, what is the appropriate accounting treatment? The litigation contingency must be disclosed in the footnotes, but not recorded as a liability No action is required to record the liability or disclose the nature of the transaction until the lawsuit has been settled. A contingent liability must be recorded and the expense should be recognized. A contingent liability must be recorded but no expense is recognized until the payment occurs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts