Question: Please HELP! Question 12 5 pts For the year ended 12/31/2014, Shrek Inc's pretax financial statement income was $500,000. The only difference between book and

Please HELP!

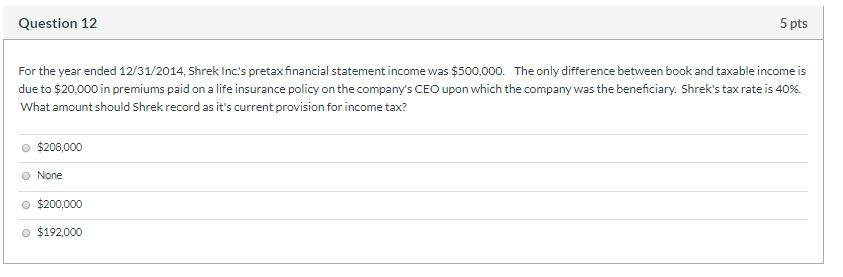

Question 12 5 pts For the year ended 12/31/2014, Shrek Inc's pretax financial statement income was $500,000. The only difference between book and taxable income is due to $20,000 in premiums paid on a life insurance policy on the company's CEO upon which the company was the beneficiary. Shrek's tax rate is 40% What amount should Shrek record as it's current provision for income tax? $208,000 None $200,000 $192,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts