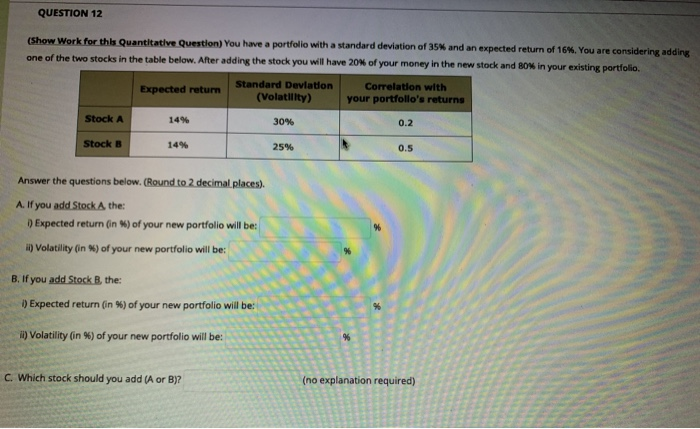

Question: please help QUESTION 12 (Show Work for this Quantitative Question) You have a portfolio with a standard deviation of 35% and an expected return of

QUESTION 12 (Show Work for this Quantitative Question) You have a portfolio with a standard deviation of 35% and an expected return of 16%. You are considering adding one of the two stocks in the table below. After adding the stock you will have 20% of your money in the new stock and 80% in your existing portfolio Standard Deviation Correlation with Expected retum (Volatility) your portfollo's returns Stock A 14% 30% 0.2 Stock B 14% 25% 0.5 Answer the questions below. (Round to 2 decimal places). A. If you add Stock Athe: 1) Expected return (in %) of your new portfolio will be: 1) Volatility (in %) of your new portfolio will be B. If you add Stock B, the: 1) Expected return (in %) of your new portfolio will be: ) Volatility (in %) of your new portfolio will be: % C. Which stock should you add (A or B)? (no explanation required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts