Question: Please help question 1-5 Part |. Hedging a complex portfolio. Questions 1-5. You have a complex portfolio whose value is related to the S&P index;

Please help question 1-5

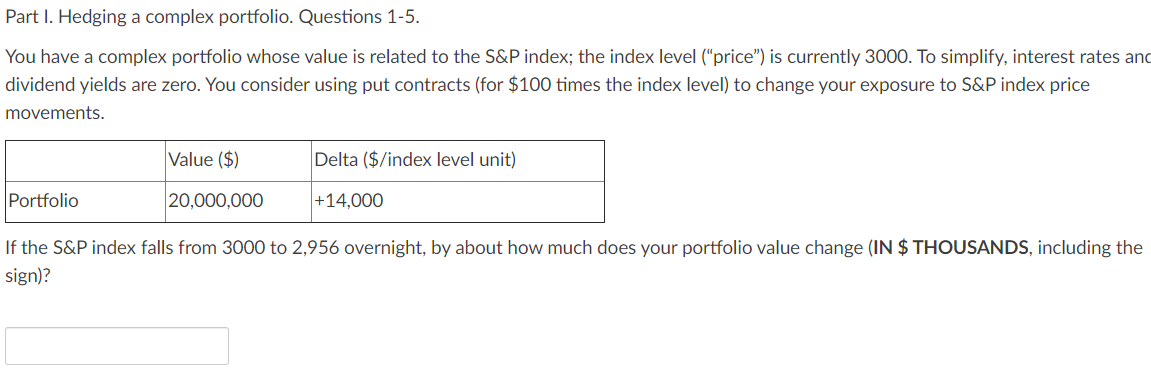

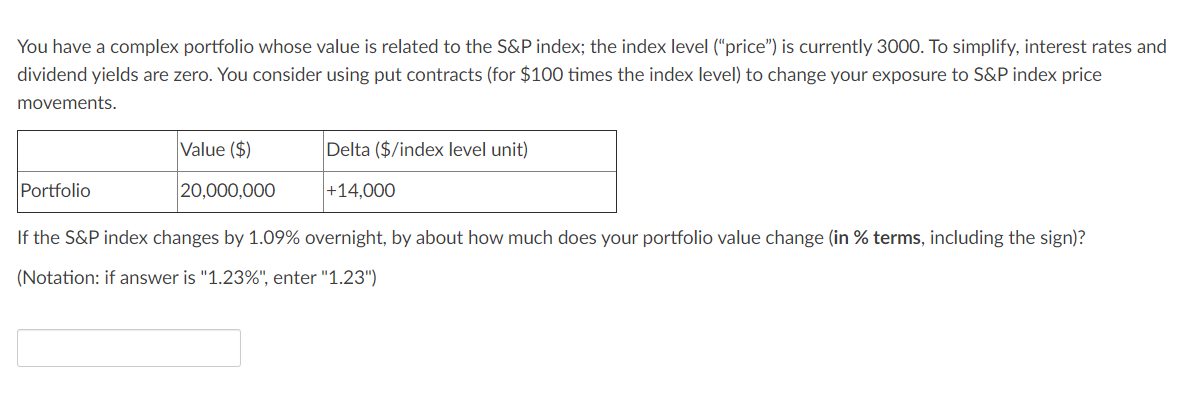

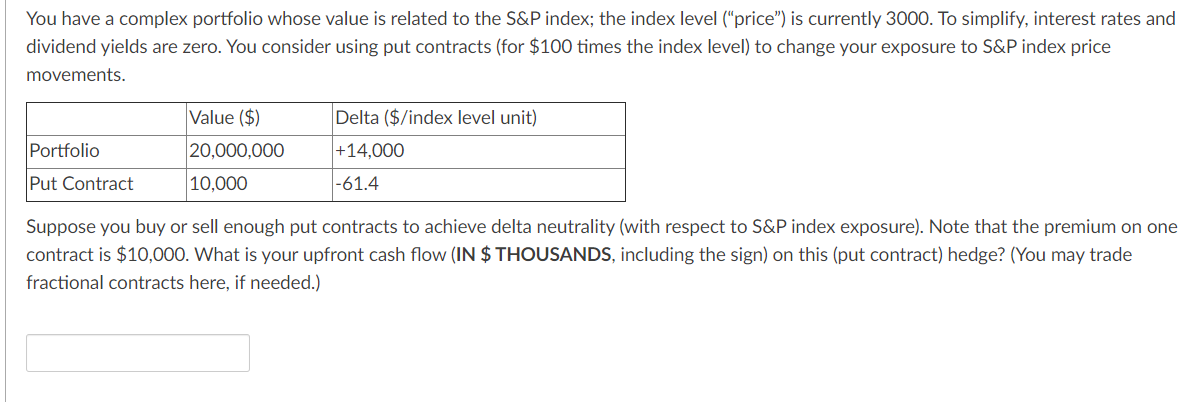

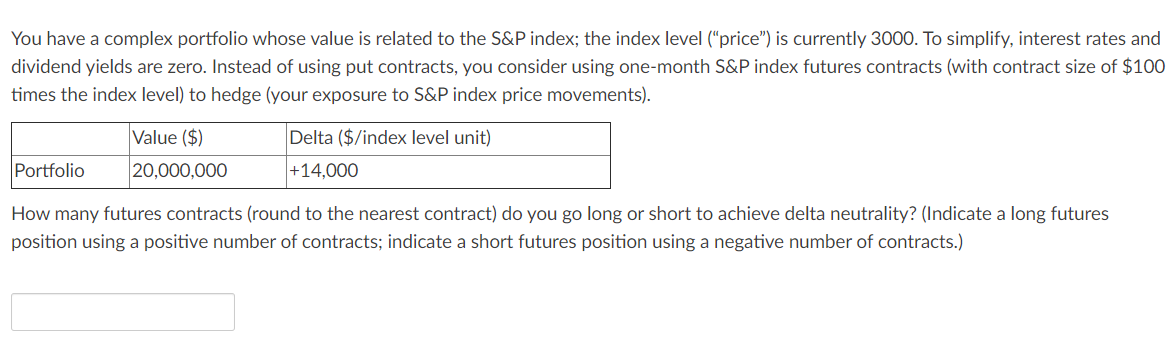

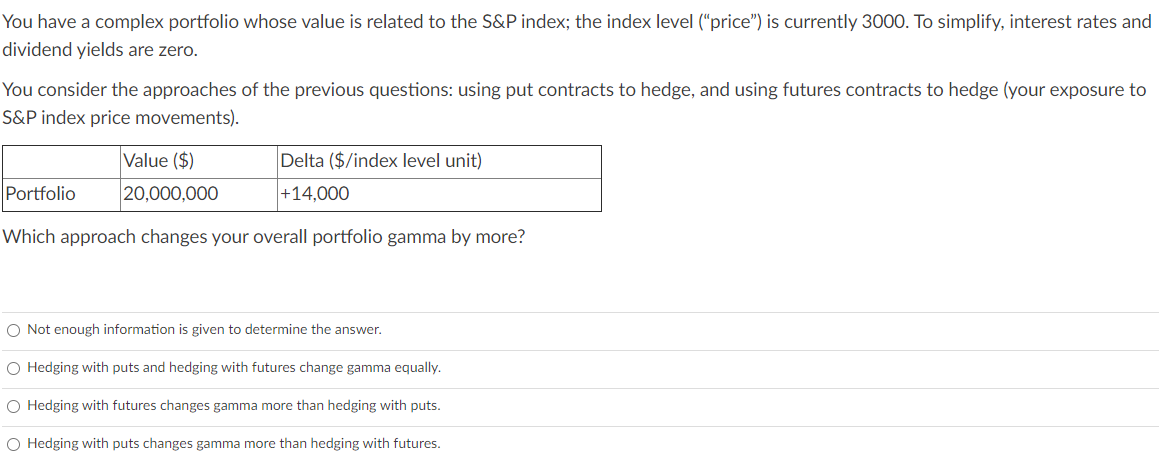

Part |. Hedging a complex portfolio. Questions 1-5. You have a complex portfolio whose value is related to the S&P index; the index level (\"price\") is currently 3000. To simplify. interest rates anc dividend yields are zero. You consider using put contracts (for $100 times the index level] to change your exposure to S&P index price movements. Value [$1 Delta [$Xindex level unit] Portfolio 20,000,000 + 14,000 If the S&P index falls from 3000 to 2,956 overnight, by about how much does your portfolio value change (IN $ THOUSANDS, including the sign)? You have a complex portfolio whose value is related to the S&P index; the index level (\"price\") is currently 3000. To simplify. interest rates and dividend yields are zero. You consider using put contracts (for $100 times the index level] to change your exposure to S&P index price movements. Value [25) Delta [$Xindex level unit) Portfolio 20,000,000 + 14,000 If the S&P index changes by 1.09% overnight, by about how much does your portfolio value change (in % terms, including the sign)? (Notation: if answer is \"1.23%", enter "1.23") You have a complex portfolio whose value is related to the S&P index; the index level (\"price\"] is currently 3000. To simplify. interest rates and dividend yields are zero. You consider using put contracts (for $100 times the index level] to change your exposure to S&P index price movements. Value [35] Delta [$z'index level unit] Portfolio 20,000,000 +14,000 Put Contract 10,000 -61.4 Suppose you buy or sell enough put contracts to achieve delta neutrality (with respect to S&P index exposure). Note that the premium on one contract is $10,000. What is your upfront cash ow {IN $THOUSANDS. including the sign] on this (put contract] hedge? (You may trade fractional contracts here, if needed.) You have a complex portfolio whose value is related to the S&P index; the index level (\"price\") is currently 3000. To simplify. interest rates and dividend yields are zero. Instead of using put contracts, you consider using one-month S&P index futures contracts (with contract size of $100 times the index level} to hedge (your exposure to S&P index price movements). Value ($1 Delta (ii/index level unit] Portfolio 20,000,000 +14,000 How many futures contracts (round to the nearest contract] do you go long or short to achieve delta neutrality? (Indicate a long futures position using a positive number of contracts; indicate a short futures position using a negative number of contracts.) You have a complex portfolio whose value is related to the S&P index; the index level (\"price\") is currently 3000. To simplify. interest rates and dividend yields are zero. You consider the approaches of the previous questions: using put contracts to hedge, and using futures contracts to hedge (your exposure to S&P index price movements]. Value ($1 Delta ($/index level unit] Portfolio 20,000,000 + 14,000 Which approach changes your overall portfolio gamma by more? 0 Not enough information is given to determine the answer. 0 Hedging with puts and hedging with futures change gamma equally. O Hedging with futures changes gamma more than hedging with puts. O Hedging with puts changes gamma more than hedging with futures