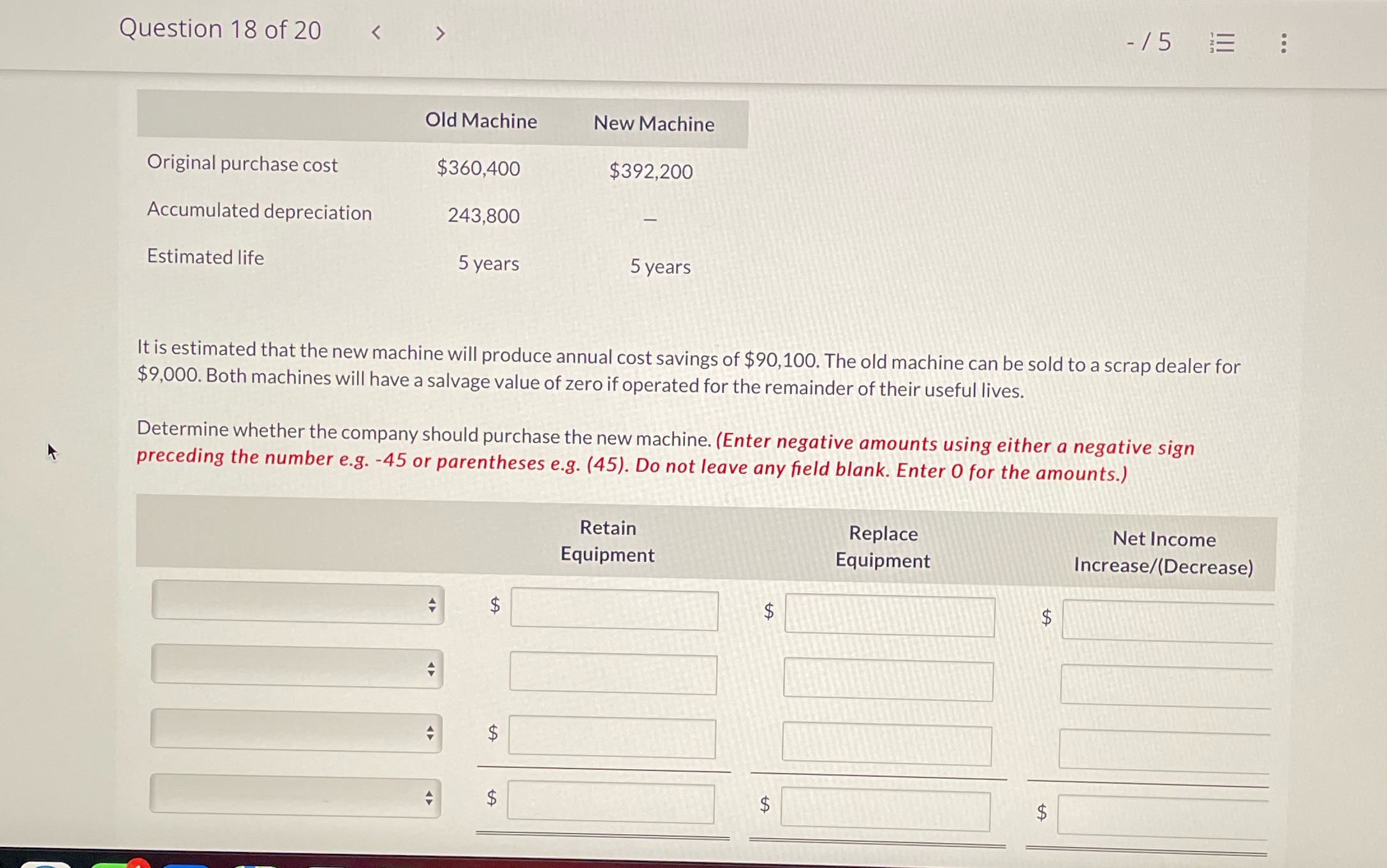

Question: Please help :) Question 18 of 20 > 15 E ... Old Machine New Machine Original purchase cost $360,400 $392,200 Accumulated depreciation 243,800 Estimated life

Please help :)

Question 18 of 20 > 15 E ... Old Machine New Machine Original purchase cost $360,400 $392,200 Accumulated depreciation 243,800 Estimated life 5 years 5 years It is estimated that the new machine will produce annual cost savings of $90,100. The old machine can be sold to a scrap dealer for $9,000. Both machines will have a salvage value of zero if operated for the remainder of their useful lives. Determine whether the company should purchase the new machine. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any field blank. Enter 0 for the amounts.) Retain Replace Net Income Equipment Equipment Increase/(Decrease) $ $ to $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts