Question: please help Question 2 (20 marks) Consider the 2017 Annual Reports for Scotia Group Jamaica (SGD Limited and National Commercial Bank (NCB) Financial Group Limited.

please help

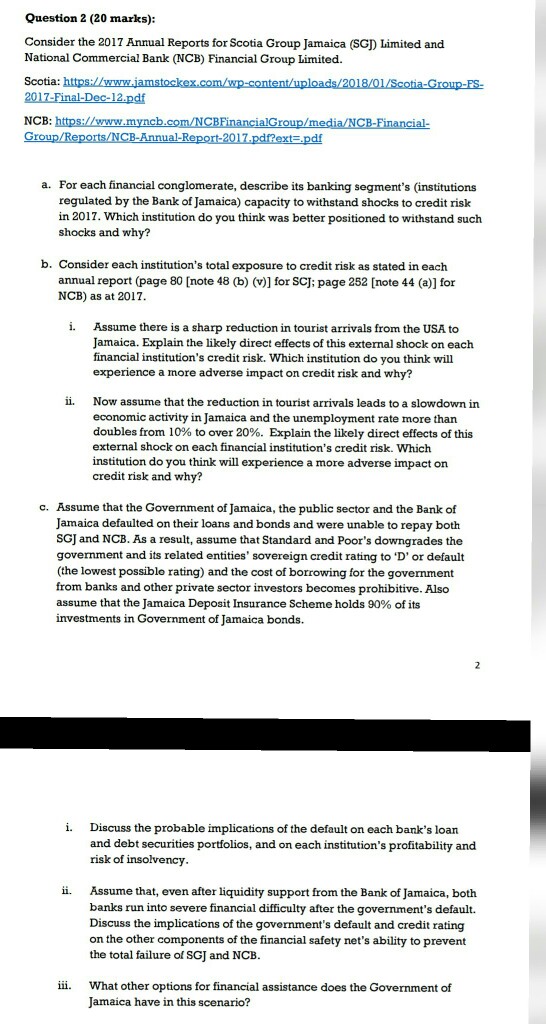

Question 2 (20 marks) Consider the 2017 Annual Reports for Scotia Group Jamaica (SGD Limited and National Commercial Bank (NCB) Financial Group Limited. Scotia: NCB: a. For each financial conglomerate, describe its banking segment's (institutions regulated by the Bank of Jamaica) capacity to withstand shocks to credit risk in 2017. Which institution do you think was better positioned to withstand such shocks and why? b. Consider each institution's total exposure to credit risk as stated in each annual report (page 80 [note 48 (b) (v)] for SCJ: page 252 [note 44 (a)] for NCB) as at 2017 i. Assume there is a sharp reduction in tourist arrivals from the USA to Jamaica. Explain the likely direct effects of this external shock on each financial institution's credit risk. Which institution do you think will experience a nore adverse impact on credit risk and why? Now assume that the reduction in tourist arrivals leads to a slowdown in economic activity in Jamaica and the unemployment rate more than doubles from 10% to over 20%. Explain the likely direct effects of this external shock on each financial institution's credit risk. Which institution do you think will experience a more adverse impact on credit risk and why? ii. c. Assume that the Government of Jamaica, the public sector and the Bank of Jamaica defaulted on their loans and bonds and were unable to repay both SGJ and NCB. As a result, assume that Standard and Poor's downgrades the government and its related entities' sovereign credit rating to D' or default (the lowest possiblo rating) and the cost of borrowing for the government from banks and other private sector investors becomes prohibitive. Also assume that the Jamaica Deposit Insurance Scheme holds 90% of its investments in Government of Jamaica bonds. i. Discuss the probable implications of the default on each bank's loan and debt securities portfolios, and on each institution's profitability and risk of insolvency i. Assume that, even after liquidity support from the Bank of Jamaica, both banks run into severe financial difficulty after the government's default. Discuss the implications of the government's default and credit rating on the other components of the financial safety net's ability to prevent the total failure osGJ and NCB ii. What other options for financial assistance does the Government of Jamaica have in this scenario? Question 2 (20 marks) Consider the 2017 Annual Reports for Scotia Group Jamaica (SGD Limited and National Commercial Bank (NCB) Financial Group Limited. Scotia: NCB: a. For each financial conglomerate, describe its banking segment's (institutions regulated by the Bank of Jamaica) capacity to withstand shocks to credit risk in 2017. Which institution do you think was better positioned to withstand such shocks and why? b. Consider each institution's total exposure to credit risk as stated in each annual report (page 80 [note 48 (b) (v)] for SCJ: page 252 [note 44 (a)] for NCB) as at 2017 i. Assume there is a sharp reduction in tourist arrivals from the USA to Jamaica. Explain the likely direct effects of this external shock on each financial institution's credit risk. Which institution do you think will experience a nore adverse impact on credit risk and why? Now assume that the reduction in tourist arrivals leads to a slowdown in economic activity in Jamaica and the unemployment rate more than doubles from 10% to over 20%. Explain the likely direct effects of this external shock on each financial institution's credit risk. Which institution do you think will experience a more adverse impact on credit risk and why? ii. c. Assume that the Government of Jamaica, the public sector and the Bank of Jamaica defaulted on their loans and bonds and were unable to repay both SGJ and NCB. As a result, assume that Standard and Poor's downgrades the government and its related entities' sovereign credit rating to D' or default (the lowest possiblo rating) and the cost of borrowing for the government from banks and other private sector investors becomes prohibitive. Also assume that the Jamaica Deposit Insurance Scheme holds 90% of its investments in Government of Jamaica bonds. i. Discuss the probable implications of the default on each bank's loan and debt securities portfolios, and on each institution's profitability and risk of insolvency i. Assume that, even after liquidity support from the Bank of Jamaica, both banks run into severe financial difficulty after the government's default. Discuss the implications of the government's default and credit rating on the other components of the financial safety net's ability to prevent the total failure osGJ and NCB ii. What other options for financial assistance does the Government of Jamaica have in this scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts